It’s a great time to be a home seller, according to the July Fannie Mae Home Purchase Sentiment Index. Home buyers, though, are expressing some concerns.

The

Fannie Mae index decreased 2.3 points in July to 74.2, moderating slightly after

two consecutive months of advances. Three of the six index components decreased month over month, with consumers reporting a significantly more pessimistic view of homebuying conditions but a more optimistic view of home selling conditions. Year over year, the index is down 19.5 points.

“Following a partial recovery of the [index] in the previous two months, consumer sentiment toward housing took a slight step back in July amid a rise in coronavirus infections across many parts of the country, including the south and southwest,” said Doug Duncan, Fannie Mae senior vice president and chief economist. “Supply constraints appear to be applying upward pressure to consumers’ home price expectations, which in turn has contributed to both a sharp reversal in optimism about whether it is a good time to buy a home and further improvement in home-selling sentiment.

Duncan added, “The July survey was conducted as legislators considered the extension of several provisions in the CARES Act to support household incomes during the pandemic. Not surprisingly – more than any other respondent groups – renters, 18-to-34-year olds, and households earning less than $100,000 think it’s a bad time to buy a home, which we believe suggests a less favorable outlook for first-time homebuying activity. In the months ahead, we continue to expect consumer sentiment to be closely linked to the country’s progress in containing the spread of the virus.”

Home Purchase Sentiment Index – Component Highlights

Fannie Mae’s Home Purchase Sentiment Index (HPSI) decreased in July by 2.3 points to 74.2. The HPSI is down 19.5 points compared to the same time last year. Read the full research report for additional information.

-

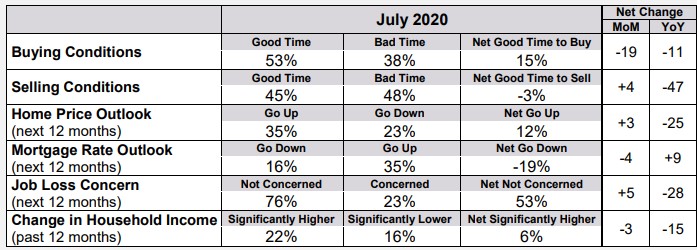

Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home decreased from 61% to 53%, while the percentage who say it is a bad time to buy increased from 27% to 38%. As a result, the net share of Americans who say it is a good time to buy decreased 19 percentage points.

-

Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home increased from 41% to 45%, while the percentage who say it’s a bad time to sell remained unchanged at 48%. As a result, the net share of those who say it is a good time to sell increased 4 percentage points.

-

Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months increased this month from 34% to 35%, while the percentage who said home prices will go down decreased from 25% to 23%. The share who think home prices will stay the same increased from 31% to 34%. As a result, the net share of Americans who say home prices will go up increased 3 percentage points.

-

Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months decreased this month from 17% to 16%, while the percentage who expect mortgage rates to go up increased from 32% to 35%. The share who think mortgage rates will stay the same remained unchanged at 42%. As a result, the net share of Americans who say mortgage rates will go down over the next 12 months decreased 4 percentage points.

-

Job Concerns: The percentage of respondents who say they are not concerned about losing their job in the next 12 months increased from 74% to 76%, while the percentage who say they are concerned decreased from 26% to 23%. As a result, the net share of Americans who say they are not concerned about losing their job increased 5 percentage points.

-

Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago decreased from 25% to 22%, while the percentage who say their household income is significantly lower remained unchanged at 16%. The percentage who say their household income is about the same increased from 58% to 62%. As a result, the net share of those who say their household income is significantly higher than it was 12 months ago decreased 3 percentage points.