Mortgage Rates Increase Following Two Weeks Without Change

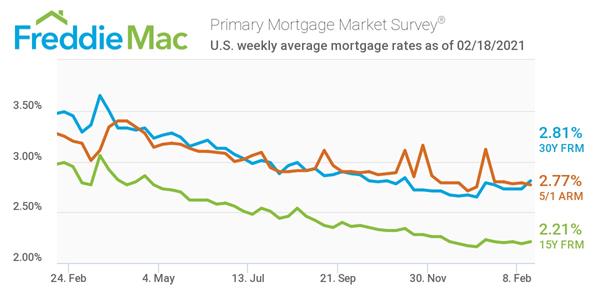

Freddie Mac's Primary Mortgage Market Survey reported the 30-year fixed-rate mortgage averaged 2.81%, the first bit of movement after two weeks of stagnant rates and the highest point since mid-November 2020.

"Economic spending has improved, due to the most recent stimulus, but supply chain shortages are causing downstream inflation, leading to higher mortgage rates. While there are multiple temporary factors driving up rates, the underlying economic fundamentals point to rates remaining in the low 3% range for the year," said Sam Khater, Freddie Mac’s chief economist.

Additionally, the 15-year fixed-rate mortgage averaged 2.21% for the week ending Feb. 18, 2021, up from its previous average of 2.19%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.77%, down from its previous average of 2.79%.