Potential For Declining Rates This Summer, Following CPI Report

Norada Real Estate Investments said "rates likely to decline" after the latest CPI report.

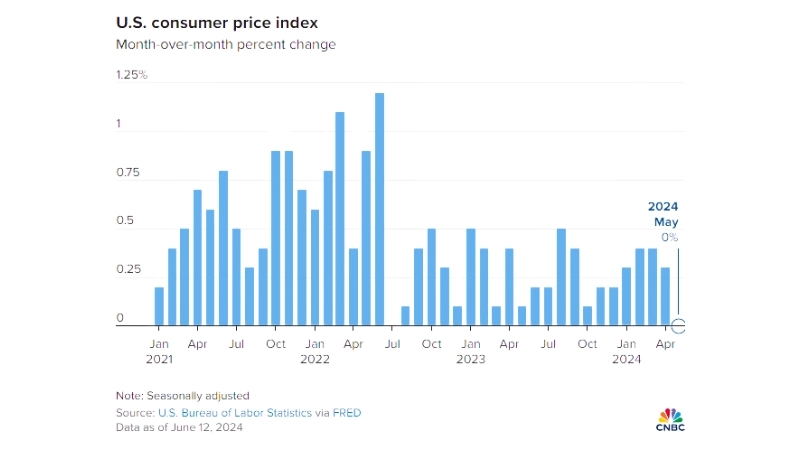

Expectations about mortgage rates are all over the place this year. Previously industry participants had eagerly predicted several rate cuts to come from The Federal Reserve in 2024, but that forecast has since been revised. After the Fed’s June 12 meeting, the industry will be lucky to see just one rate cut this year.

However, the latest Consumer Price Index (CPI) Report, released after the Fed's meeting, indicated a continued cooling of inflation. That likely triggered the sudden drop in daily average mortgage rates to their lowest level in three months.

Optimism is now rising as some, like Norada Real Estate Investments, a nationwide provider of investment property, are projecting mortgage rates to decline over the summer, preventing housing costs from rising excessively. Furthermore, the company believes this might lead to a revision of the Fed’s rate cut projection at the upcoming meeting.

A few weeks ago, rates spiked after a strong jobs report and then subsequently dropped. Redfin’s leading economist, Chen Zhao, said the latest inflation report is beneficial for homebuyers as it has already led to a decrease in mortgage rates.

While lower mortgage rates are typically seen as favorable, they could stimulate demand more than supply, potentially negating any reduction in home-price growth. A sudden drop in rates might drive prices up, which would balance out the impact on homebuyers' monthly payments. So while rates decrease, the overall effect on monthly housing costs may remain neutral if home prices increase correspondingly.

Due to recent events and the CPI report, Norada Real Estate Investments said the trajectory of mortgage rates and housing costs will depend on several factors, including future inflation data and the Fed's actions.

If mortgage rates continue to drop without a corresponding rise in home prices, homebuyers could benefit from lower monthly payments. However, if lower rates significantly boost demand without an increase in supply, home prices might climb, offsetting the advantage of reduced mortgage rates.

In all, the coming months will be critical for the housing market. While declining mortgage rates present an opportunity for lower monthly housing costs, the market dynamics of supply and demand will ultimately determine their impact.