Trade Groups Call For Federal Intervention In Housing Affordability Crisis

Policymakers urged to consider new solutions

All eyes are on policymakers to address the nation’s growing housing shortage, as industry stakeholders urge federal action.

Trade associations including the National Association of Home Builders (NAHB) and the National Association of Realtors (NAR) have called upon the White House and Congress to support affordable housing solutions. While some progress has been made, much still needs to be done.

NAHB Chairman Carl Harris called out both presidential candidates for paying little attention to the issue during last week’s debate.

“The housing affordability crisis is a top national concern and Americans will take notice why the presidential candidates said very little on how to make homeownership and renting more affordable,” Harris said in a statement put out by the NAHB. “With a nationwide shortage of roughly 1.5 million housing units, the only way to bring down rising housing costs is to put in place policies that will allow builders to increase the housing supply.”

Earlier this year, NAHB unveiled a 10-point plan to address the shortage by removing barriers that hinder new home construction. Actions recommended include ending tariffs on Canadian lumber shipments and increasing the domestic supply of timber from federally owned lands, supporting careers in the trades, and easing stringent regulations.

The latter point is perhaps the most crucial to fixing the crisis, according to Harris, a custom home builder in Wichita, Kan.

“The administration and Congress must address excessive regulations, support trades education to alleviate a severe labor shortage in the construction industry that is delaying home building projects, and oppose restrictive, mandatory building codes that significantly raise housing costs and provide little energy savings to consumers,” Harris said.

The NAR also addressed federal housing policy at the end of June, commending the U.S. Dept. of the Treasury for supporting Committee Development Financial Institutions (CDFIs) with an additional $100 million earmarked for distribution to affordable housing initiatives over the next three years.

“Executive agencies have the power to act quickly to promote homeownership,” NAR’s Chief Advocacy Officer Shannon McGahn said. “We applaud the Biden Administration’s comprehensive, multi-agency response targeting solutions at every level of government. It will take an all-of-government approach to yield results in this fight.”

NAR joined NAHB in calling for state and local governments to consider removing or reducing strict zoning regulations and regulatory barriers that prohibit development.

“Overly restrictive zoning and burdensome permitting regulations are slowing construction and preventing lower-cost housing from being built where needed,” McGahn pointed out. “City and state regulations should encourage the construction of affordable housing by supporting zoning for multi-family structures and manufactured homes.”

Both trade groups have brought their plea to the White House, lobbying for these causes on behalf of the industry professionals that make up their membership.

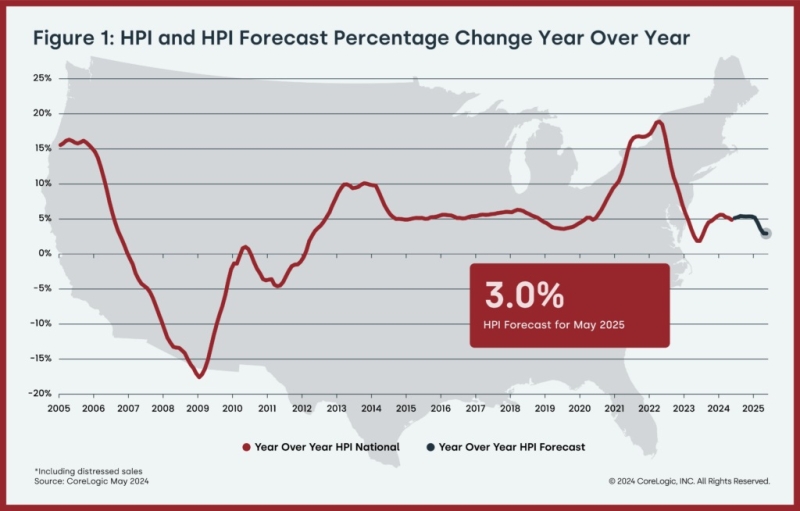

“Housing construction peaked in 2005 with over two million housing starts, but just four years later, it bottomed out at 550,000 starts.,” McGhan said. “With a historical average of 1.5 million starts per year, we are in a deficit that will take years to correct without urgent action. NAR’s own landmark research revealed a 5.5-million-unit shortage nationwide. And our country has the largest shortage of homes in the middle-income price range, creating what’s called the ‘missing middle.’”

Sales of single-family homes dropped to their lowest level in six months this May, just as single-family building permits dropped to their lowest level in close to a year, Census data revealed. By June builder sentiment had fallen to its lowest level since December 2023.