Application Payment Index Points To Declining Home Affordability

MBA releases February PAPI.

The latest indicator of declining homebuyer affordability in the U.S. emerged with the Mortgage Bankers Association’s (MBA) Purchase Applications Payment Index (PAPI), released Thursday.

The national median payment applied for by purchase applicants increased to $2,184 in February from $2,134 in January according to the PAPI, which measures how monthly mortgage payments vary across time relative to income, compiled with data from MBA’s Weekly Applications Survey (WAS).

“Homebuyer affordability conditions declined further in February as recent economic data on jobs and inflation continue to keep mortgage rates elevated to around seven percent,” said MBA’s Associate Vice President, Housing Economics, and Executive Director, Research Institute for Housing America Edward Seiler. “Challenging affordability conditions and low housing supply are keeping some prospective homebuyers on the sidelines this spring. The eventual, expected decline in rates in the coming months will hopefully spur new activity in the housing market.”

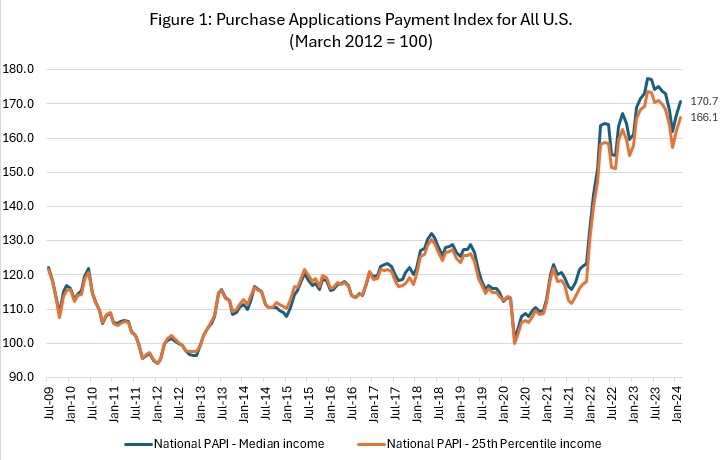

The national PAPI increased 2.4% to 170.7 in February from 166.8 in January. An increase occurs when the mortgage payment-to-income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI happens when there are decreases in applications, rates or earnings and indicates homebuyer affordability improving.

Notable takeaways:

- The PAPI is up 1.1% on an annual basis, due to earnings rising 4.8% year over year and payments increasing 6% in the same time frame.

- The national median mortgage payment rose by $50 in February to $2,184, up $123 from one year ago – a 6% increase.

- The national median mortgage payment for FHA loan applicants was $1,872 in February, up from $1,830 in January and up $165 YOY.

- The national median mortgage payment for conventional loan applicants was $2,194, up from $2,147 in January and up $77 YOY.

- The top five states with the highest PAPI and thus, the lowest homebuyer affordability, were: Idaho, Nevada, Arizona, Florida and Utah.

- The top five states with the lowest PAPI and higher affordability were: Louisiana, Connecticut, Vermont, New York, and Alaska.