ATTOM: Drop In Refinancing Prolongs 2Q Mortgage Lending Slump

Refinance lending fall 36% quarterly as total loans decreased another 13%.

- Lenders issued $807.8 billion worth of mortgages in the second quarter of 2022, down quarterly by 11% and annually by 3%.

- Only 941,000 residential loans were rolled over into new mortgages in the second quarter, down 36% from the first quarter and down 60% from last year.

- For the first time since early 2019, refinance activity in the second quarter did not represent the largest chunk of mortgages, dropping to 39% of all loans.

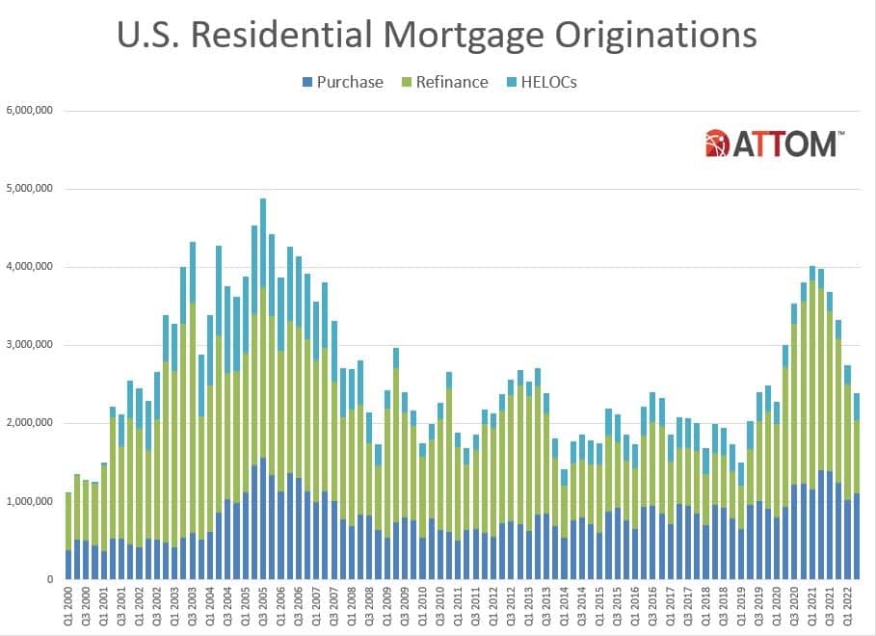

Fewer mortgages were originated in the second quarter of 2022, the fifth quarterly decline in a row, according to a report released today by ATTOM, the nationwide property data firm.

Just 2.39 million mortgages, secured by residential property, were originated in the second quarter, a 13% drop from the first quarter, according to ATTOM's second-quarter 2022 U.S. Residential Property Mortgage Origination Report.

The total also is down 40% from the second quarter of 2021, the biggest annual drop since 2014, ATTOM said.

Lenders issued $807.8 billion worth of mortgages in the second quarter of 2022, down quarterly by 11% and annually by 3%, the report states. The annual decrease in the dollar volume of loans was the largest in eight years, ATTOM said.

“Mortgage rates that have virtually doubled over the past year have decimated the refinance market and are starting to take a toll on purchase lending as well,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “The combination of much higher mortgage rates and rising home prices has made the notion of homebuying simply unaffordable for many prospective buyers, which threatens to drive loan volume down even further as we exit the spring and summer months.”

The downturn in total activity resulted from just 941,000 residential loans being rolled over into new mortgages during the second quarter, which was down 36% from the first quarter of 2022 and down 60% from last year.

Refinance lending decreased for the fifth straight quarter, hitting a point that was just one-third of what it was in early 2021. The dollar volume of refinance loans was down 35% from the prior quarter and 56% annually, to $310.1 billion.

For the first time since early 2019, refinance activity in the second quarter did not represent the largest chunk of mortgages, dropping to 39% of all loans. That was off from 53% in the first quarter and from a recent peak of 66% in early 2021.

Purchase-loan activity increased slightly as the 2022 Spring home-buying season kicked into gear. The number of purchase loans rose 8% quarterly to 1.1 million, representing 46% of all borrowing. The total, however, was unusually small for the April-through-June period, and resulted in purchase mortgages being down 21% annually.

The dollar volume of loans taken out to buy residential properties rose to $431.4 billion, up 15% from the first quarter but still down 12% from last year’s second quarter.

Home Equity Lines of Credit (HELOCs) shot up 35% quarterly and 44% annually, to 341,704.

“Borrowers looking to tap into their equity should know that HELOC activity has been particularly strong among credit unions and community banks, along with a small but growing number of depository banks,” Sharga said. “While non-bank mortgage lenders may begin to more aggressively originate home equity loans, it’s not likely they’ll be active participants in the HELOC market.”

HELOCs comprised 14.3% of all second-quarter 2022 loans, doubling the 6% level from a year earlier.

Residential loans backed by the U.S. Department of Veterans Affairs (VA) accounted for 5.1% of all residential property loans originated in the second quarter of 2022, down slightly from 5.6% in the previous quarter and 6.8% a year earlier.

Down payments, however, increased, with the median down payment on single-family homes and condos rising to $35,000. That's up 34.7% from $25,980 in the previous quarter and up 34.6% from $26,000 in the second quarter of 2021.

Among homes purchased with financing in the second quarter, the median loan amount was $320,000, up 8.1% from the prior quarter and up 12.3% from the same period in 2021.The typical down payment in the second quarter of this year represented 9.1% of the purchase price, a significant jump up from 7.4% in the prior quarter and 7.5% a year earlier.