Black Knight: Nearly 60% Of Borrowers Used Rate Buydowns

Housing prices, mortgage rates continue to decline but affordability still an issue.

- Black Knight said 57% of borrowers locked in a lower rate by paying at least a half point.

- 44% paid at least a full point, and nearly a quarter paid two points or more.

- Home prices declined for the sixth-straight month in December.

Home prices declined for the sixth-straight month in December, dropping annual home-price growth down to 5%, its slowest rate since June 2022, according to a new report from Black Knight.

The real estate data company on Monday issued its monthly Mortgage Monitor Report for December 2022, stating that despite the drop in prices and mortgage rates, affordability remains a key issue in the market.

Based on the company's recent Optimal Blue rate-lock data, nearly 6 in 10 home buyers in January paid at least a half-point to permanently lock in a lower mortgage rate. Black Knight said 57% of borrowers locked in a lower rate by paying at least a half point, while 44% paid at least a full point, and nearly a quarter paid two points or more.

Such rate buydowns peaked in September-October 2022, when as many as 7 in 10 (71%) borrowers paid points on permanent buydowns, and 4 of 10 (43%) paid two points or more, Black Knight said.

Overall, borrowers paid an average of 1.25 points, down from a peak of 2.03 points last fall, at an average cost of $4,300 per borrower for the week ending Jan. 21, 2023, vs. $6,900 for the week ending Oct. 1, 2022, Black Knight said.

For context, before the pandemic and the resulting housing-market boom, average points paid in 2018-20 were closer to 0.5, with a corresponding cost of around $1,500, Black Knight said.

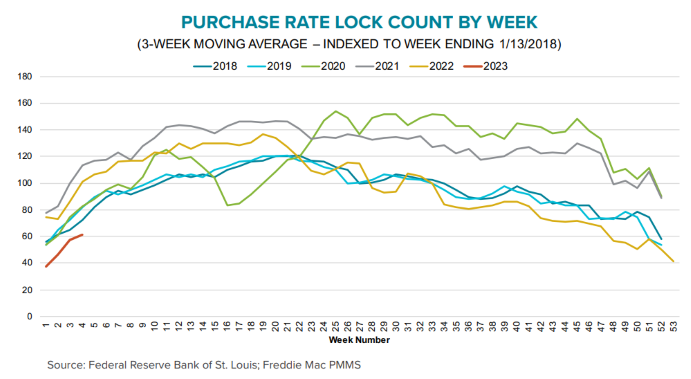

In the first week of January, the purchase lock index was at 37.5; by the fourth week, the index had risen to 61.3% — a 64% increase over the course of the month.

Purchase borrowers — who paid an average of 1.16 points in the week ending Jan. 21, 2023 – now make up 81% of new rate locks. Cash-out refi borrowers (about a 14% share) paid nearly twice that, for an average of 2.06 points

Additionally, at least 3% of purchase borrowers received temporary buydowns, with 1/0s, 2/1s and 3/2/1s the most prominent market offerings, setting up some degree of potential for payment shocks down the road, the company said.

“Based on our Optimal Blue rate lock data, we can see definite signs of a January uptick in purchase lending on lower rates and somewhat lower home prices,” said Ben Graboske, president of Black Knight Data & Analytics. “Indeed, locks on purchase mortgages soared 64% from the first through the fourth week in January. On the surface, it may seem the market has been stirred by a full point decline in interest rates and home prices coming off their peaks — but it’s not that simple.”

Graboske said that, while the Black Knight Home Price Index in December showed home values post their sixth-consecutive monthly decline, and prices at the national level are now 5.3% off their June 2022 peaks, “affordability still has a stranglehold on much of the market, with the monthly mortgage payment on the average-priced home more than 40% higher than it was this time last year.”

He added that it’s also important to keep January’s surge in purchase activity in perspective.

“While up, purchase locks were still running roughly 13% below pre-pandemic levels for the last full week of the month,” he said.

The response to the challenging housing market, he said, “is greater reliance on permanent rate buydowns by borrowers. There have been murmurs and stories around temporary buydowns, but those remain a relatively small share of originations in general.”

Other highlights:

- Home prices have pulled back by 6% or more from peak in 14 (28%) of the 50 largest markets.

- Four markets — San Francisco (-13%), San Jose (-12.7%), Seattle (-11.3%), and Phoenix (-10.5%) have seen declines greater than 10%

- While down from a peak of 38.4% in October, at 34.8% the national payment-to-income ratio remains above peak levels seen in 2006 prior to the Great Financial Crisis.

- It now takes nearly $600 (+41%) more to make the monthly mortgage payment on the average priced home using a 20% down 30-year rate mortgage than at the same time last year.