Blockbuster Jobs Report Staves Off Recession But Delays Rate Cuts

Hot May jobs report signals further delays in rate cuts, according to the MCT June Indices report

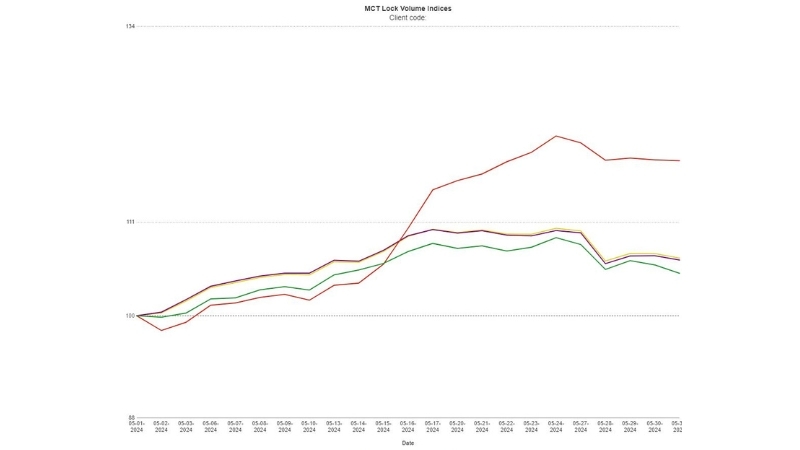

Mortgage rate lock volume grew by nearly 7% over the course of one month, according to a report from Mortgage Capital Trading, Inc. (MCT), suggesting further delays to prospective Federal Reserve rate cuts.

As mortgage lock volume edges upward during the Spring home buying season – up 6.78% in May compared to the previous month – the mortgage industry continues to monitor economic indicators that will factor into the Federal Reserve’s decision on how long to hold rates.

Early May economic indicators presented a mixed bag, according to the MCT June Indices report. While April’s Consumer Price Index (CPI) aligned with predictions, the May Nonfarm Payroll report far exceeded forecasts with 272,000 jobs added in May.

Nonfarm payroll data far outpaced economists’ expectations for 180,000 jobs and an unemployment rate of 3.9%. Yet, the Federal Reserve is in the midst of a battle to bring down inflation, and is looking for a slow-but-steady cool down in the labor market. Markets hoped for a “Goldilocks” report that was not too hot that it would push the Federal Reserve to hold off on a rate cut, nor too cold that it showed plummeting employment levels. But, the data released last Friday disappointed.

Although a booming labor market does help to stave off a recession, it also means the Federal Reserve is not in any rush to cut interest rates. The central bank meets this week for its June policy meeting.

The combination of the May Nonfarm Payroll and upcoming CPI report leads MCT researchers to believe the Federal Reserve will hold rates elevated longer as they seek more consistent economic indicators pointing toward their goal of two percent inflation.

“The next couple of months will be key from a data standpoint as the Federal Reserve looks for a trend of inflation heading towards the goal of two percent. Considering the Nonfarm Payroll number that just came out, setting a trend is going to take more time,” said Senior Director and Head of Trading at MCT, Andrew Rhodes. “We’re looking ahead to the May CPI print to see how the Fed is going to interpret both data points. Even with CPI coming in around expectation, the jobs number could likely push the Fed to further delay their rate cuts.”