Home Flipping Activity, Profits Rise During Q1 2024

The flipping rate rose for the second straight quarter while investment returns reached 30% nationwide.

- One in every 12 home sales nationwide was a flip between January and March 2024.

ATTOM's first-quarter 2024 U.S. Home Flipping Report, released today, presents some good news for home flippers.

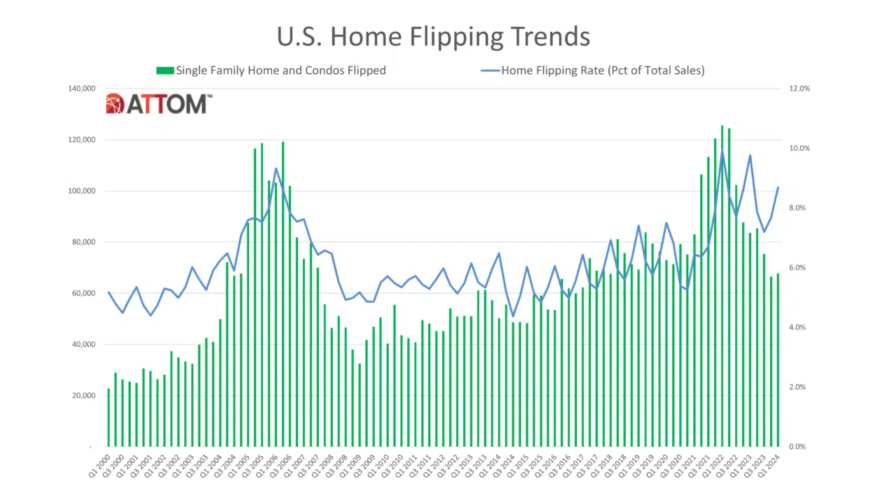

The first quarter of this year saw 67,817 single-family homes and condominiums flipped. Those transactions represented 8.7%, or one of every 12 home sales nationwide, during the months running from January through March of 2024.

The latest portion was up from 7.7% of all home sales in the U.S. during the fourth quarter of 2023 – the second straight quarterly gain. However, the portion was still down from 9.8% in the first quarter of last year.

As flipping rates went up, fortunes kept improving for investors. The latest data showed that home flippers typically earned a 30.2% gross profit nationwide before expenses on homes sold during the first quarter of this year, marking the third time in four quarters that margins increased following six years of mostly uninterrupted declines.

While Q1 2024's profit margin remained about 25 percentage points below the peaks hit in 2016, it was up from both the fourth quarter of 2023 and up over 5% year-over-year.

Gross profits on typical flips around the country increased to $72,375, which remained down from 2022's high of about $80,000. But it was up from $65,000 in the fourth quarter of 2023 and was about $10,000 above last year's low point.

"The latest numbers show that investors still face an uphill climb to clear significant profits after expenses," said Rob Barber, CEO for ATTOM. They, like others, also face tenuous times amid a housing market boom that's cooled down over the past year. But we now have a year's worth of a trend showing that things have started to turn around for the flipping industry, with clear signs of increasing interest flowing into the market."

ATTOM's latest data observed a typical nationwide resale price on flipped homes of $312,375, a 4.1% improvement over the fourth quarter of 2023. The increase outpaced the 2.1% rise in median prices that recent home flippers were commonly seeing when they were buying their properties.

Home flips as a portion of all home sales increased from the fourth quarter of 2023 to the first quarter of 2024 in over 77% of metro areas. Among those metros, the largest flipping rates during the first quarter of 2024 were in Warner Robins, Georgia (flips comprised 18.7% of all home sales); Macon, Georgia (17.1%), and Fayetteville, North Carolina (15.8%).

The report also denoted some trends in home flipping compared to last year's data:

- Nationwide, 63.8% of homes flipped in the first quarter of 2024 had been purchased by investors with cash. That's virtually the same compared to Q4 2023's 63.7%.

- Of the 67,817 homes flipped in Q1 2024, 11.2% were sold to buyers using loans backed by the FHA, marking the second straight quarterly increase.

- Home flips accounted for at least 10% of all home sales in 284, or 31.5%, of the 902 counties around the U.S. with at least 10 flips in the first quarter of 2024.

- Profit margins went up from the fourth quarter of last year to the first quarter of this year in 89 of the 173 metro areas analyzed.

More data from the report can be found here.