Borrowers Forget The True Cost Of Homeownership

Not all costs are fixed for a fixed mortgage — insurance, maintenance, property taxes, and utilities.

- New Redfin report shows the median down payment is up 24% from last year.

- The true cost of homeownership includes, on average, $17,958 of additional expenses each year.

- 88% of homeowners say the true cost of owning a home is more expensive than they expected, according to a survey of 1,000 homeowners.

- 67% of homeowners have regrets about their home purchase, according to the same survey.

First-time homebuyers may easily forget there are home expenses outside of principal and interest payments on their mortgage that can go up and down with inflation, including maintenance, improvements, utilities, property taxes, and insurance. In other words, the true cost of homeownership, which according to new research from The Real Estate Witch, an online real estate publication, includes $17,958 of additional expenses each year.

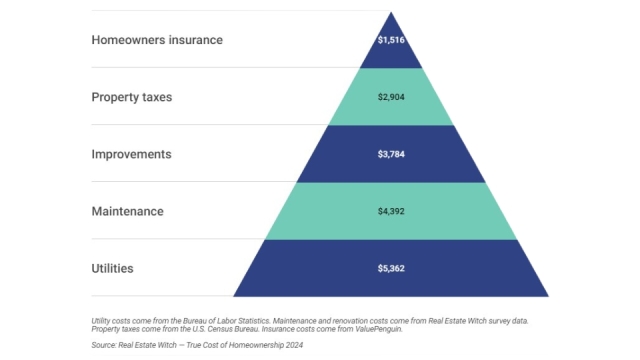

Broken down into expense items, the average homeowner spends $4,392 on maintenance and repairs, $3,784 on renovations and improvements, $5,362 on utilities, $2,904 on property taxes, $1,516 on homeowners insurance. Over a 30-year fixed conventional mortgage, this translates to a staggering $538,740 in additional expenses beyond the mortgage — enough to buy a second house.

Although borrowers don’t have control over additional home expenses going up or down, they do have more control over how much they contribute for a down payment. However, a new Redfin report shows the median down payment is up 24% from last year’s $44,850 to this year’s $55,640. Plus, more borrowers are trying to put down a higher amount to save on monthly costs, which could free up more money to spend on housing expenses. But, that has the potential to wipe out any savings they already have.

“Homebuyers are doing whatever they can to pull together a large down payment in order to lower their monthly payments moving forward,” said Rachel Riva, a Redfin real estate agent in Miami. “The smallest down payment I’ve seen recently is 25%. I had one client who put down 40%.”

So it comes as no surprise that 88% say the true cost of owning a home is more expensive than they expected, and 67% have regrets about their home purchase. In fact, 26% of homeowners think they overpaid for their home, including 46% of 2023 and 2024 buyers, who faced both high home prices and high interest rates. That is according to a survey of 1,000 homeowners.

Furthermore, homeowners are paying top dollar for projects that need more than a little bit of sweat equity. On average, homeowners spend a daunting 588 hours each year working on home upkeep and improvements — about 11.3 hours weekly, or 24.5 days a year. That means every 15 years, the typical homeowner loses a year of their life (365 days) to home upkeep and improvements.

Overall, one in five homeowners (19%) struggle to afford maintenance so much that they cannot afford a $500 emergency repair without going into credit card debt. And 20% have resorted to taking on more debt to afford the expense of homeownership.

In all, heightened inflation for housing expenses is killing the American dream for one in four homeowners (28%) who say they've considered going back to renting.