Building Materials Remain Top Challenge for Builders

NAHB/Wells Fargo Housing Market Index finds cost, availability of materials top concerns for single-family home builders.

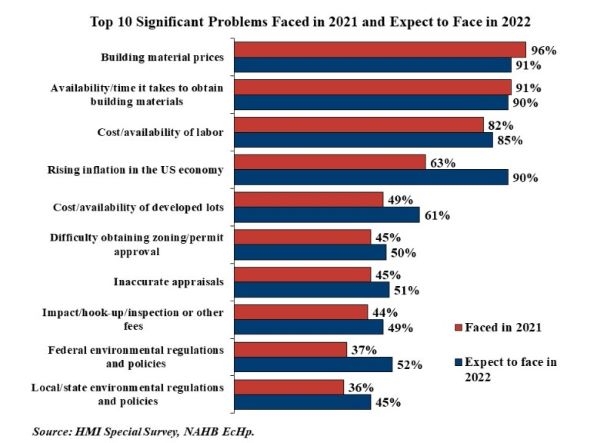

Prices for building materials were a significant issue for 96% of builders last year, and 91% of builders surveyed expect it to continue being a problem in 2022, according to the National Association of Home Builders/Wells Fargo Housing Market Index.

According to the survey, the availability and/or time it takes to obtain building materials was also a predominant issue for a large majority (91%) of builders, and 90% expect it will remain an issue this year. The high incidence of builders reporting building material problems is not surprising, given recent increases in material prices, NAHB said.

The cost and/or availability of labor was the third-most cited issue by builders, with 82% saying it was a problem in 2021 and 85% saying they expect it to remain a key issue in 2022. The fourth most-cited issue was inflation, with 63% saying it was a significant problem last year and 90% saying they expect it remain a key issue this year.

The largest portion of builders reporting building materials prices as a “significant problem” is not surprising, given that it has been trending up for the past decade. Based on the HMI survey, the price of building materials was cited as a significant issue by just 33% of builders in 2011, rising to 96% in both 2020 and 2021.

Meanwhile, the cost and availability of labor was reported as a significant problem by only 13% of builders in 2011. The share increased to 82% in both 2017 and 2018; 87% in 2019, and 65% in 2020, 82% last year, and 85% expecting it to remain this year. The large number of unfilled job openings in the construction industry is an indicator of this issue.

NAHB has conducted its monthly survey of single-family builder members for more than 30 years, in order to generate the NAHB/Wells Fargo Housing Market Index. The HMI survey asks builders to rate market conditions for the sale of new homes at the present time and what they expect over the next 6 months, as well as the traffic of prospective buyers. The results are combined into a single composite index that measures the overall strength of the market for new single-family housing.

The survey questionnaire was sent electronically to a panel of approximately 2,900 builder members. A total of 380 builders responded to the survey, for a response rate of 13%.

You can read the full survey report at https://nahbnow.com.