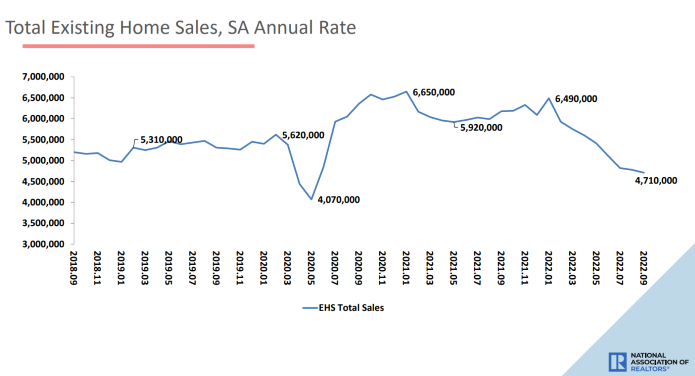

Existing-Home Sales Fall For 8th Straight Month

National Association of Realtors says inventory also fell.

- Existing-home sales fell for the eighth consecutive month to a seasonally adjusted annual rate of 4.71 million.

- The median existing-home sales price increased to $384,800, up 8.4% from one year ago.

- Inventory of unsold existing homes declined for the second straight month to 1.25 million by the end of September, the equivalent of 3.2 months' supply.

Sales of existing homes slipped again in September for the eighth straight month, according to a report from the National Association of Realtors (NAR).

Three of the four major U.S. regions also posted month-over-month declines in sales. On a year-over-year basis, sales fell in all four regions.

Total existing-home sales — completed transactions that include single-family homes, townhomes, condominiums, and co-ops — dipped 1.5% from August to a seasonally adjusted annual rate of 4.71 million in September, NAR said. Year-over-year, sales fell nearly 24%, down from 6.18 million in September 2021.

"The housing sector continues to undergo an adjustment due to the continuous rise in interest rates, which eclipsed 6% for 30-year fixed mortgages in September and are now approaching 7%," said NAR Chief Economist Lawrence Yun. "Expensive regions of the country are especially feeling the pinch and seeing larger declines in sales."

Total housing inventory at the end of September was 1.25 million units, down 2.3% from August and down 0.8% from a year earlier, NAR said. Unsold inventory remained at a 3.2-month supply at the current sales pace. That's unchanged from August but up from 2.4 months in September last year.

"Despite weaker sales, multiple offers are still occurring with more than a quarter of homes selling above list price due to limited inventory," Yun said. "The current lack of supply underscores the vast contrast with the previous major market downturn from 2008 to 2010, when inventory levels were four times higher than they are today."

The median existing-home price for all housing types in September was $384,800, an 8.4% jump from September 2021 ($355,100), as prices climbed in all regions. It was the 127th consecutive month for year-over-year increases, the longest-running streak on record.

It was also, however, the third straight month that the median sales price faded after reaching a record high of $413,800 in June, reflecting the usual seasonal trend of prices trailing off after peaking in early summer.

Properties typically remained on the market for 19 days in September, up from 16 days in August and 17 days in September 2021, NAR said. Of the homes sold in September 2022, 70% were on the market for less than a month.

Other highlights of the report:

- First-time buyers were responsible for 29% of sales in September, unchanged from August but slightly higher than 28% from September 2021.

- All-cash sales accounted for 22% of transactions in September, down from 24% in August and 23% in September 2021.

- Individual investors or second-home buyers, who make up many cash sales, purchased 15% of homes in September, down from 16% in August, but up from 13% in September 2021.

- Distressed sales, including foreclosures and short sales, represented 2% of sales in September, up just slightly from 1% in August 2022 and September 2021.

- According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage was 6.11% in September, up from 5.22% in August. The average commitment rate across all of 2021 was 2.96%.

Realtor.com's Market Trends Report in September shows that the largest year-over-year median list-price growth occurred in Miami (+28.3%); Memphis, Tenn. (+27.3%); and Milwaukee (+27.0%). Phoenix reported the highest increase in the share of homes that had their prices reduced compared to last year (+32.3 percentage points), followed by Austin (+27.4 percentage points) and Las Vegas (+20 percentage points).

Single-Family & Condo/Co-op Sales

Single-family home sales declined to a seasonally adjusted annual rate of 4.22 million in September, down 0.9% from 4.26 million in August and down 23% from a year earlier. The median existing single-family home price was $391,000 in September, up 8.1% from September 2021.

Existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 490,000 units in September, down 5.8% from August and 30% from one year ago. The median existing condo price was $331,700 in September, an annual increase of 9.8%.

Regional Breakdown

- Existing-home sales in the Northeast fell 1.6% from August to an annual rate of 610,000 in September, down 18.7% from September 2021. The median price in the Northeast was $418,500, up 8.3% from a year earlier.

- Existing-home sales in the Midwest slid 1.7% from the previous month to an annual rate of 1.14 million in September, falling 19.7% from September 2021. The median price in the Midwest was $281,500, up 6.9% from the prior year.

- In the South, existing-home sales fell 1.9% in September from August to an annual rate of 2.08 million, a decline of 23.8% from this time last year. The median price in the South was $351,700, up 11.8% from September 2021.

- Existing-home sales in the West were identical to last month at an annual rate of 880,000 in September, but down 31.3% from one year ago. The median price was $595,400, a 7.1% increase from September 2021.

The National Association of Realtors represents more than 1.5 million members in all aspects of the residential and commercial real estate industries.