MLOs know the Fed has been purchasing approximately 50 percent of the Agency production for several months now, so the announcement of the tapering that began in mid-November could be cause for concern.

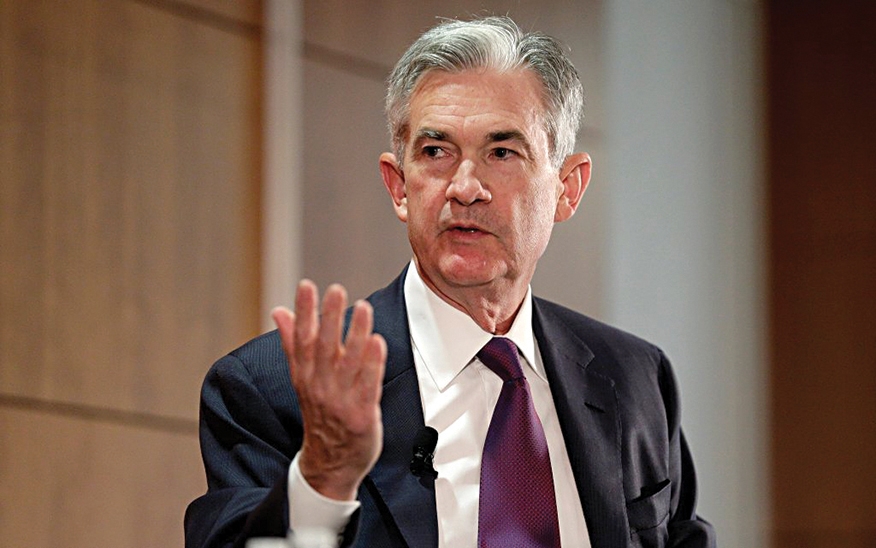

The Fed left rates (the Federal Funds Rate and the Discount Rate) unchanged at the meeting, as expected, but finally announced plans to stop buying mortgage and treasury bonds by mid-2022. “With COVID case counts receding further, and progress on vaccinations, economic growth should pick up this quarter, resulting in strong growth for the year as a whole,” Powell said.

What’s What?

So, we have the “chicken and the egg” issue: Will this move increase mortgage interest rates, or were the economic conditions that drove the FOMC’s decision already pushing rates higher? The Fed has been buying these securities at low rates, keeping mortgage rates at historic lows. It’s quite possible that rates will continue to inch up, increasing the urgency for homeowners considering refinancing — but that is because economic conditions warrant it, not because the Fed is driving it.

MLOs will watch as the Fed begins reducing the pace of its $120 billion in monthly purchases of bonds and MBS. Taking your “foot off the gas” is not the same as “putting your foot on the brake.” It is not increasing rates, though many believe this may occur next summer. Pandemic-related supply-and-demand imbalances, supply-chain disruptions, and the ongoing effects of COVID are the key drivers of higher inflation today, keeping it well above the Fed’s 2 percent inflation goal.

The Fed has been very clear it wants to finish tapering bond purchases by the middle of 2022. In fact, late in November, Powell told Congress the FOMC will consider accelerating the tapering during its December meeting due to concern over inflation, which saw prices spike 6.2% in October. Historically, the Fed has not made an active policy of buying securities, so ending them is viewed as a return to normalcy. The Fed has also said there will be no rate hikes until it is finished tapering, and the tapering itself is expected to be done in a systematic and predictable manner: a little bit each month, unless there are changes in the economic outlook.

Maximum Hope

The FOMC is smart to “keep its knees bent” if inflation or inflation expectations rise further, and the Fed may well finish bond-buying sooner, opening the door to rate hikes sooner. For example, if inflation picks up its pace, or employment continues to improve unexpectedly dramatically. The opposite is true, of course.