FHA Endorsed Mortgages Declined 17% In Q1 2023

Decrease was due to a decline in both purchase and refinancing activity, driven by the rise of interest rates.

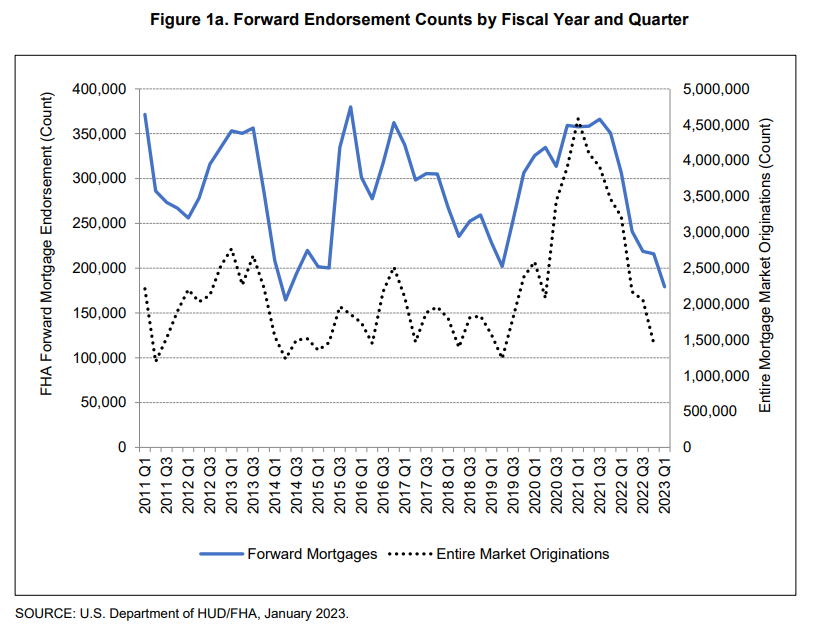

During its first quarter of fiscal year (FY) 2023, which ended Dec. 31, 2022, the Federal Housing Administration (FHA) endorsed 179,152 forward mortgages for insurance, down 17.07% from the previous quarter.

That’s according to a quarterly report released recently by the FHA and the U.S. Department of Housing and Urban Development (HUD). The report reviews the status of the Mutual Mortgage Insurance Fund (MMIF), the federal fund that acts as the insurer of mortgages guaranteed by FHA. The fund supports both FHA mortgages used to buy homes and home equity conversion mortgages (HECMS). The report is required by the National Housing Act, as amended by the FHA Modernization Act of 2008.

According to the report, the decrease in endorsed mortgages in the first quarter was due to a decline in both purchase and refinancing activity, primarily driven by the rise of interest rates.

During the quarter, the dollar volume of purchase endorsements fell 16.35% or $7.88 billion, from the previous quarter, while refinance endorsements — conventional to FHA, FHA to FHA — of $8.78 billion in the quarter were down $2.51 billion, or 22.22%, from the previous quarter.

The dollar volume of all forward mortgage endorsements of $49.07 billion decreased 17.47%, the report states.

FHA purchase activity by loan count was down 16.26% from the previous quarter, from 168,250 mortgages to 140,889 mortgages. FHA-to-FHA refinance endorsements decreased by 27.96% from the previous quarter, from 25,661 to 18,486, mostly due to the recent rise in interest rates, the report states.

Conventional-to-FHA refinance mortgages also decreased, but to a lesser extent, falling 10.61% from 22,125 to 19,777 mortgages, according to the report.

Cash-out refinance mortgages made up 94% of all refinance mortgage endorsements for the quarter, up from 61%in FY 2022 and 19% in FY 2021, the report states.

HECM endorsement volume, which was $4.75 billion for the first quarter of FY 2023, decreased 34.03% from the previous quarter. The FHA said the decline in HECM endorsements is likely due to the increase in interest rates, which reduced the amount of equity a homeowner could draw via a HECM loan.

HECM endorsement counts during the first quarter totaled 9,555, a decrease of 31.11% from the previous quarter.

Other key highlights:

- Through the first quarter of FY 2023, FHA served 115,576 first-time homebuyers, representing 82% of FHA’s forward purchase mortgage endorsements.

- FHA also served 42,511 households of color with purchase mortgages, and

- 9,555 seniors were able to access their home equity using FHA’s HECM program.

During the same period, FHA said, it maintained its strong focus on assisting homeowners facing hardships through the COVID-19 National Emergency. For homeowners who fell behind on their mortgage payments since the start of the pandemic, FHA has continued to deliver expanded flexibilities and forbearance options.

The agency said it continues to engage with mortgage servicers, consumer advocates, and housing counselors to assist in ensuring that homeowners in need are aware of the loss-mitigation tools available to them.

A number of FHA borrowers continued to face COVID-19 related hardships in the first quarter of FY 2023. Seriously delinquent mortgages (those past due 90 or more days) are still elevated from the pre-pandemic period, although the portfolio experienced a decline in delinquencies from 7.28% at the end of the same quarter of FY 2021 to 4.91% at the end of this quarter.

In addition, early payment defaults (defaults within six months of endorsement) declined from a peak of approximately 9% in early 2020 to around 2% through the current quarter. This is still above average relative to historical results and continues to vacillate at elevated levels.

The FHA said it will continue to focus extensive efforts on helping struggling homeowners to obtain financial relief needed to achieve long-term homeownership sustainability. This quarterly report also provides detailed information on the composition and credit quality of new insurance in force, and on FHA’s financial position.

You can read the full report here.