Home Insurance Pricing Up 19% In 2023

Guaranteed Rate's study attributes the rise to climate risks and other factors.

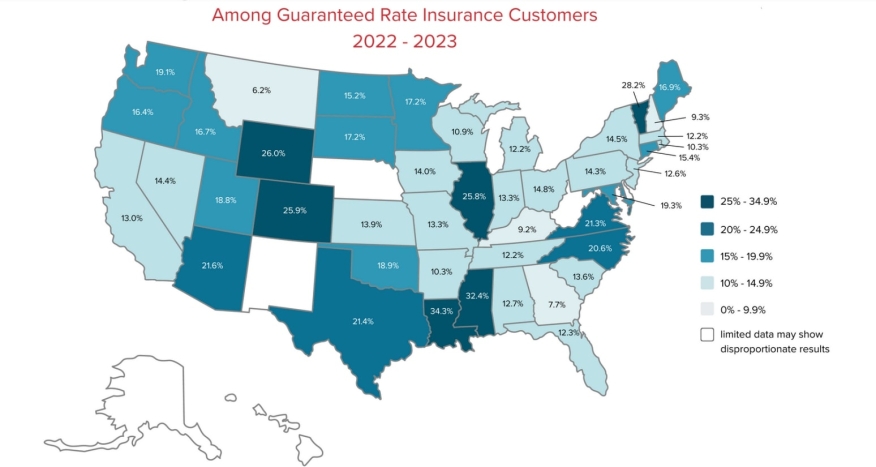

Affordability challenges persist for aspiring homeowners as a new study from Guaranteed Rate Insurance, owned by retail lender Guaranteed Rate, shows home insurance prices increased 19% in 2023 and 55% since 2019.

Although the company forecasts some improvement in the homeowners insurance market in 2024, the study highlights a persistent trend of increasing premiums and deductibles, as well as carrier restrictions. The study also forecasts the likely need for homeowners to purchase additional products, such as private flood insurance, which grew 163% year-over-year both in high risk and low risk zones.

The study points to a variety of factors contributing to these increases, such as increasingly frequent and stronger storms causing more damage in 2023, as well as shifts in population distribution, particularly towards areas prone to natural disasters. Unpriced climate risks, such as increasingly frequent and costly extreme weather events, pose myriad threats to the housing finance ecosystem for borrowers, lenders, servicers, and investors.

However, federal housing agencies have begun pivoting to understand and address these risks.

An increase in natural disasters led to particularly steep rate hikes in Florida, Texas, and California, resulting in limited options for homeowners in those states. The homeowners insurance market in Florida has been deteriorating for nearly three years.

Jeff Wingate, Executive Vice President and Head of Insurance at Guaranteed Rate said, “These real-time insights allow us to work with our clients proactively, as we have a comprehensive understanding of market trends and an array of strategies available to lower costs, reduce risk and ensure our clients have proper coverage."

The study includes Guaranteed Rate’s guidance for homeowners struggling to adapt to rapidly rising premiums. Specific recommendations include:

- Compare insurance rates

- Increase deductibles

- Bundle Home & Auto

- Ensure proper coverage limits

- Assess roof condition

- Reduce risk through smart technology

- Consider purchasing private flood insurance

- Proactively protect property

- Monitor credit rating

- Estimate insurance costs prior to purchasing a new home