Home Price Moderation Varies Significantly By Market

First American says growth in home prices has slowed in all 50 states.

- As affordability declines, potential homebuyers are pulling back from the market, reducing competition for homes and prompting annual house price appreciation to moderate.

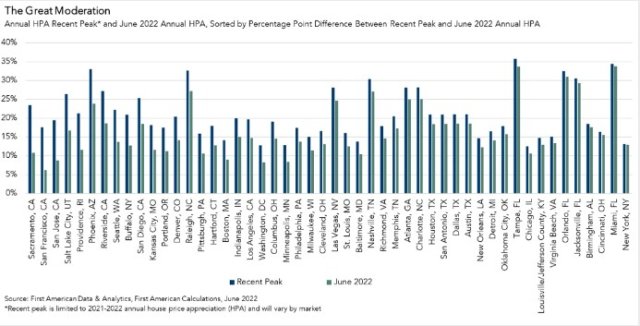

- While house price growth has slowed in all top 50 markets we track, the pace of moderation varies significantly by market.

- The market with the strongest deceleration was Sacramento, CA, where annual price appreciation peaked in July 2021 at 23.5% and slowed to 10.8%.

- The market with the smallest gap was New York, which did not accelerate as fast as in other markets and was well below the national peak.

The decline in housing affordability is reducing competition for homes, prompting annual house-price appreciation to moderate — but at rates that vary significantly by market, according to a new report.

First American Financial Corp. has released its June 2022 First American Real House Price Index (RHPI), measuring the price changes of single-family properties throughout the U.S. adjusted for impact of income and interest rate changes on consumer house-buying power over time at national, state, and metropolitan levels.

“In June 2022, the Real House Price Index (RHPI) jumped up by 53.3% on an annual basis, setting a new record for the fifth month in a row for the fastest year-over-year growth in the more than 30-year history of the series,” said Mark Fleming, chief economist at First American.

According to Fleming, the rapid annual decline in affordability was driven by an 18.5% annual increase in nominal house prices and a 2.5-percentage-point increase in the 30-year, fixed-rate mortgage compared with a year ago. Even though household income increased 4.7% since June 2021, it was not enough to offset the affordability loss from higher mortgage rates and fast-rising prices.

As affordability declines, potential homebuyers are pulling back from the market. That reduces competition for homes and has caused the annual house-price appreciation to moderate. Annual house-price growth peaked in March at nearly 21%, but has since decelerated to a still-robust 18.5% in June.

However, the modest price deceleration is not a national phenomenon, Fleming said. “While house-price growth has slowed in all top 50 markets we track, the pace of moderation varies significantly by market.”

Price Moderation By Market

Although all 50 states are pulling back from their respective peaks in home prices, some markets are decelerating faster than others. The chart above shows annual price appreciation at the 2021-22 peak for each respective market, and the pace of growth in June 2022. Markets are rank-ordered from the largest to the smallest percentage point difference between the recent peak for that market and the corresponding June 2022 house price appreciation rate.

The market with the strongest deceleration was Sacramento, Calif., where annual price appreciation peaked in July 2021 at 23.5% and slowed to 10.8%. The market with the smallest gap was New York, which did not accelerate as fast as in other markets and was well below the national peak, reaching only 13% in May 2021, and it remains at nearly the same pace in June.

The market with the slowest annual pace of price appreciation in June was San Francisco at 6.2%, down significantly from its July 2021 pace of 17.5%. Conversely, the market with the fastest pace of appreciation in June was Miami at nearly 33.8%, nearly the same pace as its peak of 34.4% in May 2022.

“The record-breaking house-price appreciation nationwide and across markets in 2021 and early 2022 was due to a supply and demand imbalance — too much demand, too little supply,” Fleming said. “There remains a structural and long-term national supply shortage in the housing market, but in some cities the pullback in demand is strong and inventory is rising faster, resulting in a greater moderation of house price growth.”

The five states with the greatest year-over-year increase in the RHPI are: Florida (+75.6%), South Carolina (+63.7%), Georgia (+61.6%), North Carolina (+61.5%), and Arizona (+60.2%).

There were no states with a year-over-year decrease in the RHPI.

June 2022 Real House Price Index Highlights

- Between June 2021 and June 2022, real house prices increased 53.3%. Between May 2022 and June 2022, real house prices increased just 3.7%.

- Consumer house-buying power (how much one can buy based on changes in income and interest rate) fell 2.8% between May 2022 and June 2022, and decreased 22.7% year-over-year.

- Median household income has increased 4.7% since June 2021 and 72.5% since January 2000.