Home Prices Decline, But Monthly Payments Soar

Black Knight finds home prices are on the decline, but soaring interest rates create record-breaking P&I payments.

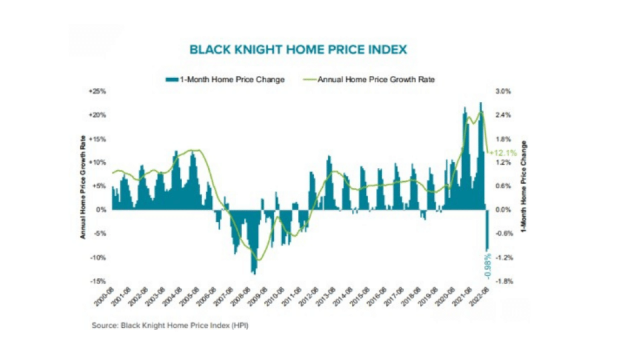

- July and August’s month-over-month declines mark the sharpest contractions seen in more than 13 years.

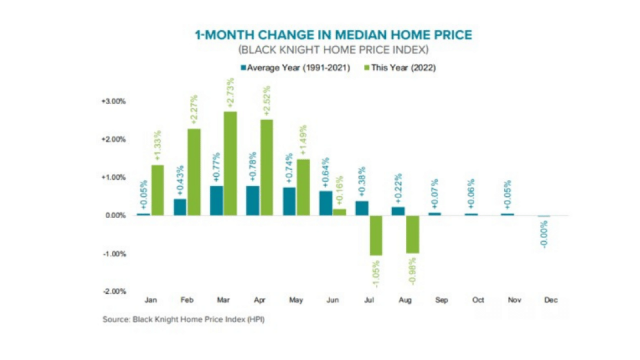

- The median home price is now 2% off its June peak after July’s revised 1.05% monthly decline and August’s 0.98% decline.

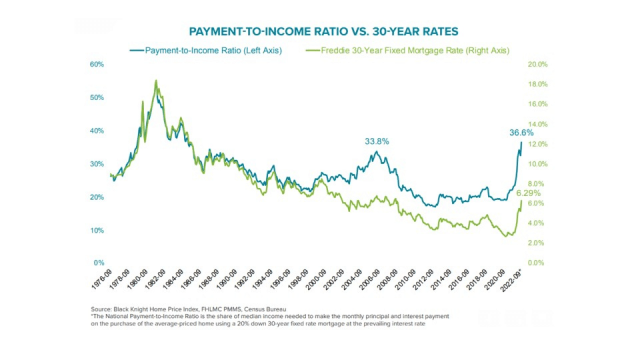

- Interest rates have pushed home affordability to its worst point in 38 years.

- Monthly P&I payment on a median home is up $930 from the same time last year, a 73% increase.

All eyes are on the housing market as home prices begin to decline.

The most recent data from the Black Knight Home Price Index shows that home prices fell for the second consecutive month in August. Black Knight President Ben Graboske explains that July and August’s month-over-month declines mark the sharpest contractions seen in more than 13 years.

The median home price is now 2% off its June peak after July’s revised 1.05% monthly decline and August’s 0.98% decline. Together, these figures represent two straight months of significant pullbacks after more than two years of record-breaking growth.

The only months with materially higher single-month price declines than we’ve seen in July and August were in the winter of 2008, Graboske said, following the Lehman Brothers bankruptcy and subsequent financial crisis.

"Historically low inventory — along with record low interest rates — was one of the key drivers behind U.S. home prices seeing essentially a decade's worth of appreciation in just two-and-a-half years,” Graboske said. “Inventory levels had been improving though, with our Collateral Analytics data showing both overall inventory and months of supply rising sharply from May through July. We'd climbed from 1.7 months of for-sale inventory to 3.1 months before improvement stalled in August as sellers appeared to take a step back from the market.”

Inventory is growing at 1/10th the rate it had been before the pandemic, with the market down by 600,000 listings. Graboske said it will be worth watching inventory levels closely in coming months for any sign of a shift in seller sentiment. Prospective sellers are not only coming to grips with falling demand and declining prices due to sharply higher interest rates, they also have a growing disincentive to give up their own historically low-rate mortgages in this environment.

Graboske suspects some may be waiting out the market to see if demand and prices return in the spring.

Although prices have pulled back from recent historic peaks, housing remains historically unaffordable. Even though prices improved slightly in July and early August, interest rates have pushed home affordability to its worst point in 38 years, surpassing June’s record-setting 34.3% payment-to-income ratio.

With rates at 6.7% as of Sept. 29, 38.2% of the median household income is needed to make the principal and interest (P&I) payment on the median-priced home purchase, the largest share since December 1984, when mortgages were at 13.2%.

Monthly P&I payment on a median home is up $930 from the same time last year, marking a 73% increase. The situation is widespread across the nation with 84 out of 100 largest U.S. markets now at more than three-decade lows in terms of home affordability.