Housing Market Continues To Improve For Buyers: Realtor.com

In January, inventories rose and price-growth leveled off as mortgage rates continued to decline.

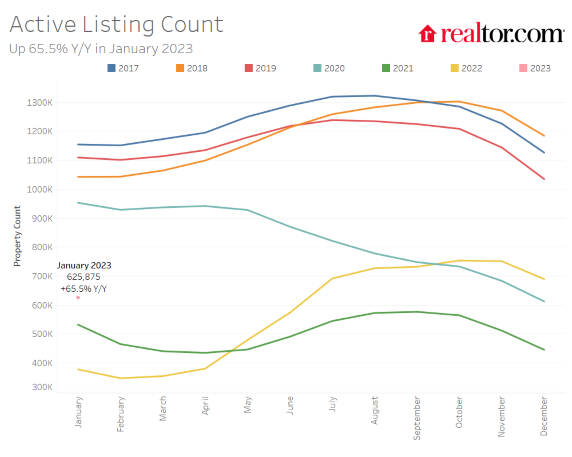

- The active inventory of homes for sale grew 65.5% year-over-year in, but is still 43.2% lower than before the pandemic.

- Both pending listings (-31.9%) and newly listed homes (-5.4%) declined year-over-year.

- The share of homes with price reductions more than doubled year over year, to 15.3%.

Buyers regained the upper hand in the housing market in January, as mortgage rates fell to their lowest level in months and inventory rose, according to a report from Realtor.com.

The company’s Monthly Housing Trends Report, released Thursday, said growth in the typical asking price on homes for sale continued to slow last month, while the annual decline in new listings also moderated to single digits.

New listings remain an important indicator of home selling interest, and a sustained improvement would suggest more sellers are returning to the market in the coming months, Realtor.com said.

The report also noted that 56% of listing views went to out-of-metro homes, with affordable metros in the Midwest and Northeast gaining in popularity.

"Home buying in January remained relatively sluggish as sales slowed, inventories rose, and price growth leveled off," said Danielle Hale, chief economist for Realtor.com. “These trends reinforce that while buyers are gaining an advantage in the market, they are still being deterred by high home prices and financing costs.”

Hale said that even as inventories climb and prices moderate, “homeowners have equity and advantages in the market but need to set their expectations accordingly.”

For renters hoping to become homeowners this year, Realtor.com said its Best Markets for First-Time Homebuyers has identified pockets of affordability across the country, especially in the Northeast, where they might be able to better overcome affordability challenges and find a better deal.

Affordable Metros

The Realtor.com Q4 Cross-Market Demand Report, also released Thursday, highlighted regional variations in home-buying activity. It showed that, in the face of higher affordability challenges, more homebuyers are on the move this year.

Across the top 100 metros in the fourth quarter, 55.5% of listing views on Realtor.com went to properties outside of the shoppers' metro area, compared to 55% during the third quarter and 53.4% in the same quarter last year. Regionally, shoppers in the West (63%) and Northeast (57%) were mostly likely to search out-of-market last quarter, the report said.

Markets in the Midwest and Northeast that can offer shoppers more affordable deals gained the most popularity from out-of-market shoppers last quarter, including Pittsburgh; Buffalo, N.Y.; Syracuse, N.Y.; Albany, N.Y.; and Cleveland. Markets that saw the greatest decline in out-of-market home shoppers were Austin, Texas; Seattle; Knoxville, Tenn.; Albuquerque, N.M.; and Ogden, Utah.

High financial costs likely made Phoenix and Los Angeles less desirable destinations for both local and out-of-metro home shoppers last quarter compared to a year earlier, which Realtor.com said aligns with its 2023 Housing Forecast, which predicted large year-over-year sales declines in those two metro areas.

More Homes To Choose From

Nationally, the number of active listings in January continued to climb, suggesting that reduced competition and more time to make buying decisions weren't enough to spur buyer demand in the face of high mortgage rates and home prices.

Pending listings, or homes under contract with a buyer, continued to drop, as did the number of newly listed homes. The decline in new listings is the smallest since last July.

Other highlights:

- In January, the active inventory of homes for sale grew 65.5% year-over-year in, but it is still 43.2% lower than it was before the pandemic (January 2017-19 average).

- Both pending listings, or homes under contract with a buyer (-31.9%), and newly listed homes (-5.4%) declined year-over-year. The decline in new listings is much lower than last month's 21% decrease and November's 17.2% decrease, and is the smallest decline since last July's 6.8% decrease.

- Among the 50 largest U.S. metros, 49 posted yearly active inventory gains in January, led by Nashville (+303.5%), Austin (+260.4), and Raleigh, N.C. (+254.8%). The only metro to see inventory decline on a year-over-year basis was Hartford, Conn. (-8%).

- On average across the 50 largest metros, only the South saw year-over-year new listings increase in January (+5.4%); 12 metros saw the number of newly listed homes increase compared to last year, up from only two markets in December, and all were located in the South: Raleigh, N.C. (+49.0%), Nashville (+45.3%), and Austin (+24.9%) saw the greatest increases.

Buyers Have More Time

In January, the U.S. median listing price remained unchanged from December. Growth in the typical asking price (+8.1% year over year) also remained little changed from last month, after six months of decelerating price growth, suggesting a potential slowdown in the normalization of prices that could continue as we head further into 2023, Realtor.com said.

As the number of homes for sale continues to rise, sellers were more than twice as likely as last year to reduce the asking price. Homes also spent more time on market than last year, with homes in western metros spending 12 days more on the market compared to pre-pandemic times. In all other regions, homes are still selling more quickly than 2017–19, on average.

- The U.S. median listing price was $400,000 in January, up 8.1% year-over-year, only a slight change from the December growth rate.

- The share of homes with price reductions more than doubled year over year, increasing from 6% in January 2022 to 15.3% this year. This is generally higher than it was before the pandemic, but is still slightly lower than 2019 levels (15.6%).

- The typical home spent 75 days on the market in January, 13 days longer than last year, but 16 days faster than 2017–19, on average.

- Across the 50 largest U.S. metros, 45 saw an increase in time on market compared to the same time last year, with the greatest increases seen in Raleigh (+41 days), Las Vegas, and Denver (+40 days, respectively). Only three markets saw shrinking time on market, including Richmond, Va. (-20 days), Milwaukee (-8 days), and Buffalo (-3 days).