Housing Starts Plunged 8% In June

Decline a surprise following report of growth in builder confidence.

- Housing starts in June were at a seasonally adjusted annual rate of 1.43 million, down 8% from May.

- Single-family starts fell 7% from May, while multifamily units fell 11.6%.

Construction on new homes plunged in June from a month earlier, defying expectations and the growing confidence of home builders.

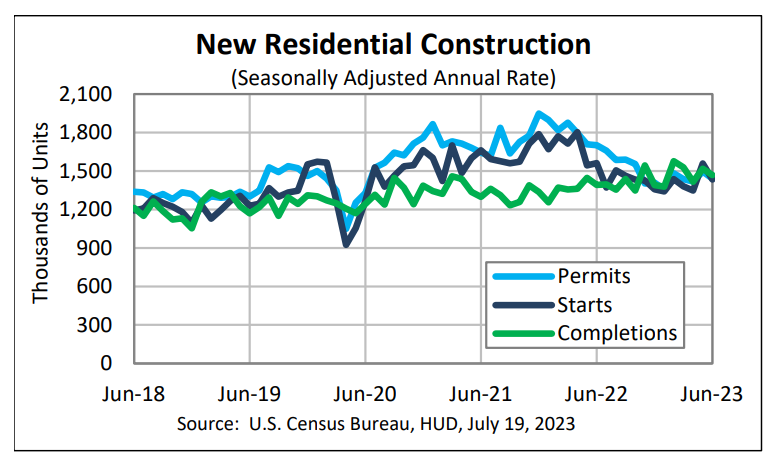

According to a joint report released Wednesday by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, privately owned housing starts in June were at a seasonally adjusted annual rate of 1.43 million, 8% below the revised May estimate of 1.56 million and 8.1% below the June 2022 rate.

The results were below analyst expectations for 1.46 million starts.

Single‐family housing starts in June were at a rate of 935,000, 7% below the revised May figure of 1.01 million and 7.4% below a year earlier. June’s decline in starts from a month earlier broke a string of four consecutive monthly increases in single-family housing starts.

The June rate for starts on buildings with five or more units was 482,000, down 11.6% from the revised May estimate of 545,000, and down 11.2% from a year earlier.

Authorizations of building permits also fell in June. Privately owned housing units authorized by building permits during the month were at a seasonally adjusted annual rate of 1.44 million, down 3.7% from the revised May rate of 1.5 million and is 15.3% below a year earlier.

Single‐family permit authorizations in June were at a rate of 922,000, an increase of 2.2% from the revised May figure of 902,000, but down 2.7% from a year earlier..

Authorizations for buildings with five or more units were at a rate of 467,000 in June, down 13.5% from the revised May figure of 540,000, and 33.1% below the level a year earlier.

The number of new houses completed in June also fell. Privately owned housing completions were at a seasonally adjusted annual rate of 1.47 million, 3.3% below the revised May estimate of 1.52 million, but 5.5%$ above the same point last year.

Single‐family completions in June were at a rate of 986,000, 2.8% below the revised May rate of 1.01 million, and 2.3% below the rate at the same point last year.

The June completion rate for buildings with five units or more was 476,000, down 2.5% from the revised May rate of 488,000, but 26.3% more than the 377,000 rate in June 2022.

The results were a surprise, especially following this week’s report that home builder confidence grew for the seventh consecutive month.

“New residential construction surprised on the downside, with activity pulling back in July and reflecting headwinds, despite recovering builder confidence” said George Ratiu, chief economist at Keeping Current Matters, a real estate insights and analytics company.

The National Association of Home Builders said Tuesday that its NAHB/Wells Fargo Housing Market Index (HMI) for July increased one point to 56, the seventh straight increase and the highest level since June 2022.

The NAHB said builder confidence in the market for newly built single-family homes improved because the low inventory of existing homes is keeping demand for new homes solid.

“The July index value was boosted by improvements in the current sales pace and traffic of potential buyers,” Ratiu said. “However, mounting cost pressures and rising mortgage rates are leading to a slowdown in construction activity.”

Looking ahead to the second half of 2023, Ratiu said, “We can expect a more moderate stream of new homes. For homebuilders, construction costs remain under pressure, as slowing Canadian lumber shipments are pushing prices higher. With massive timber losses due to wildfires in Canada this season weighing on markets, the price of lumber has risen from $428 in mid-May to $580 per thousand board feet this week.”

First American Financial Corp. Deputy Chief Economist Odeta Kushi said that while the overall index for builder sentiment rose in July, the increase was slower than in previous months, a sign of moderating and cautious optimism.

“Of the index’s three components, current sales conditions and buyer traffic increased, while sales expectations fell,” Kushi said.

“Builders are benefitting from the lack of resale inventory, but higher mortgage rates pose a threat,” she said. “Reduced affordability alongside ongoing supply-side challenges and tighter lending standards for acquisition, development, and construction (AD&C) loans could throttle builder momentum.”

Still, she said, there is pent-up demand in the housing market, and builders are working to fill the demand for inventory.

“Note the steady increase in single-family housing permits, a leading indicator of future housing starts,” Kushi said. “There is a significant shortage in the U.S. housing market, and existing-home supply is insufficient to meet the demand. As a result, builders are stepping up.”