Housing Starts Rebound In April

Increase 2.2% from March, but number of units under construction not enough to fill inventory void.

- Housing starts in April were at a seasonally adjusted annual rate of 1.4 million.

- Starts for buildings with five or more units rose 5.2%, while single-family starts rose 1.6%.

- The nationwide housing shortage is estimated at between 3.5 million to 5.5 million units.

- A total 1.68 million units were under construction in April.

Construction of new homes rebounded in April after declining in March, led by a strong improvement in building multifamily units, but there are not nearly enough homes under construction to ease the shortage of inventory.

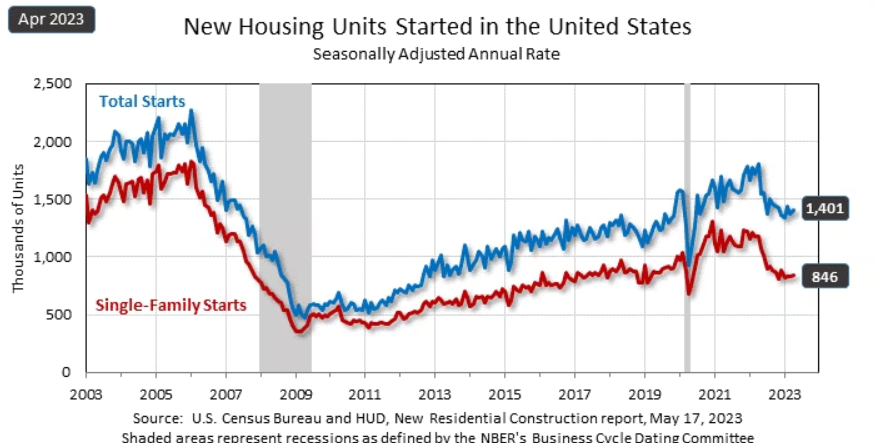

According to a report released jointly by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, privately owned housing starts in April were at a seasonally adjusted annual rate of 1.4 million, up 2.2% from the revised March estimate of 1.37 million. April’s estimate, however, was still 22.3% below the rate of 1.8 million a year earlier.

Overall housing starts have held within a range of 1.35 million and 1.48 million since November 2022.

Starts for buildings with five or more units in April were estimated at 542,000, up 5.2% from the revised estimate of 515,000 in March, but 11.7% below the 614,000 rate a year earlier.

Single‐family housing starts in April also increased, rising 1.6% to an estimated rate of 846,000, from the revised March figure of 833,000. The rate was still 28.1% below the rate of 1.18 million a year earlier.

The increase in construction reflects the improvement in builder confidence reported Tuesday by the National Association of Home Builders (NAHB). According to the latest NAHB/Wells Fargo Housing Market Index (HMI) survey, builder confidence in the market for newly built single-family homes rose five points to 50 in May, the fifth straight monthly increase and the first time that sentiment levels have reached the midpoint mark of 50 since July 2022.

The NAHB said construction of new homes is increasing because many homeowners with loans well below current mortgage rates are choosing to stay put, keeping the supply of existing homes near historic lows and causing potential home buyers to turn their attention to new construction.

Completions, Permits Fall

While construction began on more new homes in April, fewer were being completed.

According to the report, privately owned housing completions in April were at a seasonally adjusted annual rate of 1,36 million, down 10.4% from the revised March estimate of 1.5 million but 1% above the April 2022 rate of 1.36 million.

Single‐family housing completions in April were at a rate of 971,000, down 6.5% from the revised March rate of 1.04 million and 5.2% below the rate of 1.02 million a year earlier.

The April rate for buildings with five or more units was 400,000, a drop of 17.4% from the 484,000. April’s rate, however, was 24.2% higher than the rate of 322,000 a year earlier.

The number of building permits authorized in April also fell. According to the report, privately owned housing units authorized by building permits were at a seasonally adjusted annual rate of 1.42 million, down 1.5% from the revised March rate of 1.44 million and 21.1% below the April 2022 rate of 1.8 million.

While overall permits were down, single‐family authorizations in April increased 3.1% to a rate of 855,000 from the revised March figure of 829,000.

Authorizations of units in buildings with five units or more were at a rate of 502,000 in April, down 9.7% from the revised rate of 556,000 in March and 23% below the rate of 652,000 a year earlier.

Housing Market 'Supply-Starved'

First American Financial Corp. Deputy Chief Economist Odeta Kushi said the modest improvement in housing starts is a sign that builders are cautiously trying to fill the void in the “supply-starved” housing market.

“Focusing on single-family construction, the month-over-month data showed a modest improvement in single-family homebuilding,” Kushi said. “Permits, a leading indicator of future starts, are up 3.1% month over month, and single-family starts were up 1.6% month over month, so more groundbreaking on new homes. Single-family completions were down 6.5% on a monthly basis, meaning less new housing supply added to the overall housing stock.”

She said the inventory of existing homes remains limited. “As a result, prospective buyers may turn to the new-home market. If finding an existing-home is difficult, a new home at the right price is a good substitute.”

Kushi noted that while new homes have historically made up about 11% of total inventory, the share has increased to nearly 30% in recent months.

“Builders want to ensure that if they build it, someone will buy it,” she said. “Despite ongoing affordability constraints, builders are finding that there is demand on the sidelines. As long as existing-home supply remains constrained, new-home construction can fill the void.”

Kushi added that a total 1.68 million units were under construction in April. “The number of single-family homes under construction has retreated from the 2022 peak, while multi-family hit another record high this month. More supply should put some downward pressure on prices.”

Estimates of the nationwide housing shortage vary, but range between 3.5 million to 5.5 million housing units, she said.

“This implies that even if all units under construction came to market tomorrow, we’d still be underbuilt by millions of units,” Kushi said. “As such, new supply of housing is more likely to ease than erase the national housing shortage, although this will vary by location.”