“Despite a national cooling in residential real estate, we’re finding that the luxury real estate market is still in a league of its own,” Pacaso CEO and Co-Founder Austin Allison said. “High-net-worth buyers are not as reliant on financing, so they might be less deterred by rising rates, and we hear a lot from our buyers that they don’t want to wait for perfect market conditions — they are ready to enjoy the benefits of a second home now.”

However, the luxury second-home market isn’t going at warp speed as it was in 2020 and 2021. In the third quarter of last year, Picasso laid off about 30% of its workforce citing declining prices for luxury second homes and an unstable economy in which a “global recession now seems likely” as reasons for the move.

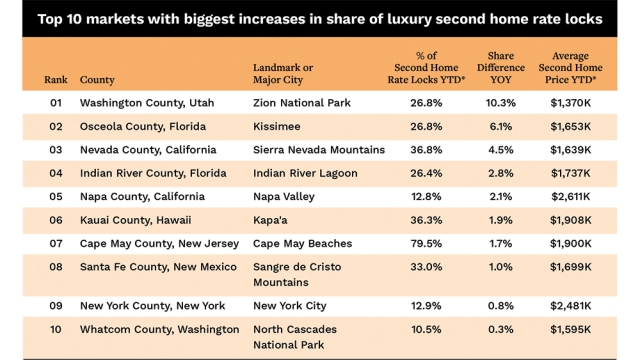

But there are a few places still bucking that trend and one of them is Osceola County.

A previous report from the company about attitudes of second home buyers found that two-thirds of them want the commute to be four hours or less to their second home and 87% want to drive it. For loan originators that means your potential client might be closer than you think.