Mortgage Credit Availability Dipped In December

MBA says credit tightening due to mortgage rates remaining high YOY.

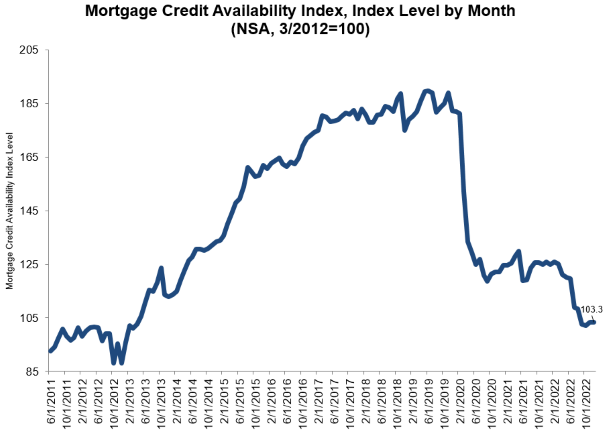

- MBA’s Mortgage Credit Availability Index (MCAI) fell 0.1% to 103.3 in December, indicating tightening credit.

- Both the Conventional MCAI and Government MCAI also decreased by 0.1%.

- MBA economist says the doubling of mortgage rates over the past year caused credit availability to shrink 18% YOY.

Mortgage credit tightened slightly in December as mortgage rates remained high, the Mortgage Bankers Association (MBA) said Tuesday.

According to the MBA’s Mortgage Credit Availability Index (MCAI), which analyzes data from ICE Mortgage Technology, the MCAI fell 0.1% to 103.3 in December. A decline in the index indicates that lending standards are tightening, while increases indicate loosening credit. The index was benchmarked to 100 in March 2012.

Both the Conventional MCAI and Government MCAI also decreased by 0.1%, the MBA said. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 0.2%, while the Conforming MCAI was unchanged.

“Mortgage credit availability was mostly unchanged in December as mortgage rates remained significantly higher than the prior two years and both refinance and purchase activity slowed dramatically,” said Joel Kan, MBA’s vice president and deputy chief economist.

Kan said the doubling of mortgage rates over the past year “caused credit availability to shrink 18% during the same period. This pivot in the market resulted in lenders exiting certain origination channels to manage their operational costs or stop lending altogether, which was a main driver in the decrease in credit supply.”

In addition, he said, “investors stopped offering many streamlined refinance programs as rates increased and the refinance market shrank. The segment of the market which showed the sharpest decline in credit availability was FHA and VA lending — which saw a 23% decline over 12 months.”

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI, and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of the loan programs they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loans.

The Conforming and Jumbo indices have the same base levels as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted base levels in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). The metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time.