Mortgage Credit Availability Increased In November

The Mortgage Credit Availability Index increased, indicating loosening credit.

- The Mortgage Credit Availability Index (MCAI) rose by 1.4% to 103.4 in November.

Mortgage credit availability increased in November according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

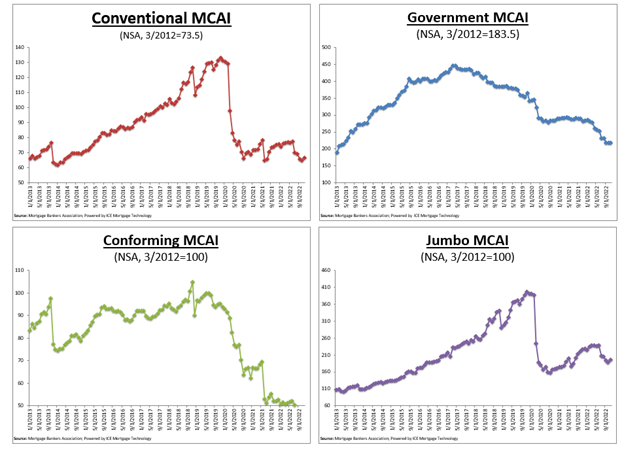

The MCAI rose by 1.4% to 103.4 in November. A decline in the MCAI indicates that lending standards are tightening, while increases in the index indicate loosening credit.

The Conventional MCAI increased 2.8%, while the Government MCAI remained unchanged.

Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 3.9%, and the Conforming MCAI rose by 1%.

“Credit availability increased slightly in November, the first increase in nine months as lenders continued to navigate a challenging environment brought on by higher rates and a much slower housing market,” said Joel Kan, MBA’s vice president and deputy chief economist. “Jumbo credit availability saw a 4% increase, as jumbo rates remained more competitive than rates on conforming loans. Lenders are seeking to capture more volume in this space. Most of last month’s increase came from more ARM loan programs being offered.”

According to the MBA, the MCAI is calculated using several factors related to borrower eligibility, such as credit score, loan type and loan-to-value ratio. These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology.