Mortgage Delinquencies Drop Again in January To Another Historic Low

Just 3.3% of all mortgages in delinquency, lowest rate in 23 years.

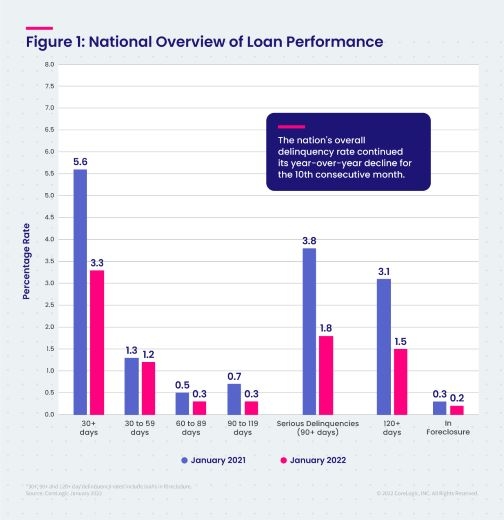

- The 3.3% level is down from 5.6% a year earlier, and the lowest since January 1999.

- January marked the 10th consecutive month of year-over-year declines.

Just 3.3% of all mortgages in the U.S. were in some stage of delinquency in January, the lowest overall rate in 23 years, according to a report from CoreLogic.

The 3.3% of mortgages at least 30 days past due, including those in foreclosure, represented a 2.3 percentage point decrease from the 5.6% in delinquency in January 2021, according to CoreLogic’s monthly Loan Performance Insights Report. The 3.3% rate is the lowest since January 1999.

CoreLogic, a global property information, analytics, and data-enabled solutions provider, examines all stages of delinquency to gain a complete view of the mortgage market and loan performance health.

Rising home prices, strong job market cited

The drop in the nation’s overall mortgage delinquency rate in January marked the 10th consecutive month of year-over-year declines, the report said. CoreLogic attributed the trend to two factors: Escalating home prices and a strong job market.

U.S. home prices continue to reach new highs, posting 20% year-over-year growth in February. Meanwhile, the latest U.S. jobs report shows that the country added an average of 562,000 positions per month in the first quarter of 2022.

While the U.S. foreclosure rate declined compared to January 2021, the expiration of moratoriums in some states caused the number of foreclosures to rise from December 2021, the report states. Still, the January 2022 foreclosure rate was flat from December and is still the lowest recorded since at least 1999.

“The large rise in home prices — up 19% in January from one year earlier, according to CoreLogic indexes for the U.S. — has built home equity and is an important factor in the continuing low level of foreclosures,” said Frank Nothaft, chief economist of CoreLogic. “Nonetheless, there are many homeowners that have faced financial hardships during the pandemic and are emerging from 18 months of forbearance. The U.S. may experience an uptick in distressed sales this year as some owners struggle to remain current after forbearance and loan modification.”

In January 2022, CoreLogic said, the U.S. delinquency and transition rates and their year-over-year changes were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.2%, down from 1.3% in January 2021.

- Adverse Delinquency (60 to 89 days past due): 0.3%, down from 0.5% in January 2021.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 1.8%, down from 3.8% in January 2021 and a high of 4.3% in August 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.2%, down from 0.3% in January 2021.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.7%, unchanged from January 2021.

State and Metro Takeaways

In January, all states logged year-over-year declines in their overall delinquency rate. The states with the largest declines were: Nevada (down 3.7 percentage points), Hawaii (down 3.5 percentage points) and New Jersey (down 3.2 percentage points).

The remaining states, including the District of Columbia, registered annual delinquency rate drops between 3.1 percentage points and 1.0 percentage points, CoreLogic said.

All U.S. metro areas posted at least a small annual decrease in overall delinquency rates, including those that were previously affected in the aftermath of Hurricane Ida last fall.

The top four metros with the largest declines were: Odessa, Texas (down 6.3 percentage points); Kahului-Wailuku-Lahaina, Hawaii (down 6.1 percentage points); Laredo, Texas (down 5.9 percentage points), and Lake Charles, La. (down 5.8 percentage points).

The data in The CoreLogic LPI report represents foreclosure and delinquency activity reported through January 2022. It accounts for only first liens against a property and does not include secondary liens. The delinquency, transition, and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not subject to foreclosure and are, therefore, excluded from the analysis. CoreLogic has approximately 75% coverage of U.S. foreclosure data.