Mortgage Economic Review December 2021

The Mortgage Economic Review is a monthly summary of Key Economic Indicators, Data, and Events pertinent to Mortgage and Real Estate Professionals.

- Interest Rates: Rates drifted sideways then fell slightly. The 10-Year Treasury yield fell to 1.43% (Nov 30) from 1.58% (Nov 1).

- Housing: Home Prices still rising - up another 1.0% in October and 19% YoY.

- Labor: The Economy created 531,000 new jobs in October, the Unemployment Rate dropped to 4.6%, and Wage Growth increased 4.9% YoY.

- Inflation: Inflation jumped with CPI up 0.9% (+6.2% YoY), PPI up 0.6% (+8.6% YoY).

BY MARK PAOLETTI | SPECIAL TO NATIONAL MORTGAGE PROFESSIONAL

The Mortgage Economic Review is a monthly summary of key economic indicators, data, and events pertinent to Mortgage and Real Estate Professionals.

AT A GLANCE - Key Economic Data and Events during November 2021

- Interest Rates: Rates drifted sideways then fell slightly. The 10-Year Treasury yield fell to 1.43% (Nov 30) from 1.58% (Nov 1).

- Housing: Home Prices still rising - up another 1.0% in October and 19% YoY.

- Labor: The Economy created 531,000 new jobs in October, the Unemployment Rate dropped to 4.6%, and Wage Growth increased 4.9% YoY.

- Inflation: Inflation jumped with CPI up 0.9% (+6.2% YoY), PPI up 0.6% (+8.6% YoY).

- The Economy: US GDP grew at a 2.1% annualized rate during the 3rd Quarter of 2021.

- Consumers: Retail Sales soared 1.7% as Consumer's started Holiday Shopping early.

- Volatile Stock Markets: News of the Omicron Variant rattled investor confidence.

- Conforming Loan Limit Increase: $647,200 for a 1 unit property ($970,800 High Cost Areas)

- Omicron Variant: The new Covid variant caused worldwide concern. Some countries instituted travel bans, while health officials don't think it will cause another Pandemic.

Interest Rates and Fed Watch

Interest Rates drifted sideways after President Biden re-upped Jerome Powell as Fed Chairman for another 4-year term, which was widely expected. After the FOMC Meeting on November 3rd, the Fed announced they would start "tapering" their Bond Buying in late November, but they were not ready to raise Interest Rates. Fed Chair Powell said: "We don't think it is time to raise rates...We continue to articulate a different and more stringent test for the economic conditions that would need to be met before raising the federal funds rate". Despite the current Fed rhetoric, most Economists expect the Fed to start raising Interest Rates sometime in mid to late 2022. The last FOMC Meeting for 2021 is on December 14th and 15th.

- 10 Year Treasury Security Yield: fell to 1.43% (Nov 30) from 1.58% (Nov 1).

- 30 Year Fixed Mortgage fell to 3.10 (Nov 24) from 3.14% (Oct 29).

- 15 Year Fixed Mortgage rose to 2.42% (Nov 24) from 2.37% (Oct 29).

- 5/1 ARM Mortgage fell to 2.47% (Nov 24) from 2.56% (Oct 29).

Housing Market Data Released in November 2021

The Housing Market continued its bullish ways with strong demand and higher prices. Potential Home Buyers expect that Mortgage Rates and Rent will continue to rise next year. So why wait to buy a home - buy now while Interest Rates are low. The problem is finding a home. Inventory issues have plagued the Housing Market for years, but there is light at the end of the tunnel. There are 726,000 New Homes currently under construction - the highest since 2007. At some point, the supply of New Homes will increase to meet demand, but it may take years. The main concern is: can buyers afford a home with higher Interest Rates AND higher prices? Is there a price level where Buyers just say No? In the meantime, the S&P/Case-Shiller Home Price Index jumped another 1.0%, up 19% YoY.

- Existing Home Sales (closed deals in October) rose 0.8% to an annual rate of 6,340,000 homes, down 5.8% in the last 12 months. The median price for all types of homes is $353,900 - up 13.1% from a year ago. The median Single-Family Home price is $360,800 and $296,700 for a Condo. Homes were on the market for an average of 18 days, and 82% were on the market for less than a month. Currently, 1,250,000 homes are for sale, down 12.0% from 1,420,000 units a year ago.

- New Home Sales (signed contracts in October) rose 0.4% to a seasonally adjusted annual rate of 745,000 homes - down 23.% YoY. The median New Home price fell to $407,700 from $408,800 the prior month. The average price rose to $477,800 from $451,700 the prior month. There are 389,000 New Homes for sale, which is a 6.3 month supply.

- Pending Home Sales Index (signed contracts in October) rose 7.5% to 125.3 from 116.7 the previous month, down 1.4% YoY.

- Building Permits (issued in October) rose 4.0% to a seasonally adjusted annual rate of 1,650,000 units - up 3.4 YoY. Single-Family Permits rose 2.7% to an annual pace of 1,069,000 homes, down 6.3% YoY.

- Housing Starts (excavation began in October) fell 0.7% to an annual adjusted rate of 1,520,000, up 0.4% YoY. Single-Family Starts fell 3.9% to 1,039,000 units, down 10.3% YoY.

- Housing Completions (completed in October) were unchanged at an annual adjusted rate of 1,240,000 units - down 8.4% YoY. Single-Family Completions fell 1.7% to an annual adjusted rate of 929,000 homes - up 3.5% YoY.

- S&P/Case-Shiller 20 City Home Price Index rose 1.0% in September, up 19.1% YoY.

- FHFA Home Price Index rose 0.9% in September, now up 17.7% YoY.

Labor Market Economic Data Released in November 2021

The Economy created 531,000 new jobs in October, surpassing expectations of 450,000. Plus, September and October were revised up an additional 235,000. That's 766,000 new jobs when you include the upward revisions. In the last 3 months, 1,326,000 new jobs were created. As usual, Hospitality was the top sector adding 164,000 new jobs; Manufacturing added 60,000; Construction added 44,000; Transport/Warehousing added 54,000; while Government jobs fell 73,000 (mostly 43,000 Education jobs). The Labor Force Participation Rate has been stubbornly low for a recovery. This could be caused by several reasons, such as: retiring Baby Boomers, less of the population is in the job market, the Pandemic recovery uniqueness is distorting Labor Data, or a combination of all the above.

- The Economy created 531,000 New Jobs during October.

- The Unemployment Rate fell to 4.6% in October from 4.8% in September.

- The Labor Force Participation Rate was unchanged at 61.6%.

- The Average Hourly Wage rose 0.4% in October, now up 4.9% YoY.

- Job Openings rose slightly to 10,438,000 from 10,400,000 in September.

Inflation Economic Data Released in November 2021

Inflation roared back with a vengeance. All the Inflation Indicators CPI, PPI, PCE, and Core were up big, some at multi-decade highs. The CPI jumped 0.9% in October, up 6.2% in the last 12 months. In the past 5 months, Inflation has remained over 5.0%. The Fed has maintained Inflation would be "transitory", but Economists and Politicians are worried. Prices have increased across the board on just about everything. Those high prices really hit home when you are in the grocery store and gas station. Consumers get angry when they have to pay high prices for necessities like groceries, gas, and shelter. Politicians are worried Consumers will express that anger in the upcoming 2022 Mid-Term Elections.

- CPI rose 0.96%, up 6.2% YoY | Core CPI rose 0.6%, up 4.6% YoY

- PPI rose 0.6 %, up 8.6% YoY | Core PPI rose 0.4%, up 6.8% YoY

- PCE rose 0.6%, up 5.0% YoY | Core PCE rose 0.4%, up 4.1% YoY

GDP Economic Data Released in November 2021

The 2nd estimate of 3rd Quarter GDP showed the US Economy grew at a 2.1% annualized rate (a slight revision from last month's 2.0%) and up 4.9% in the last 12 months. The Economy continues to recover from the Pandemic at roughly a 5.0% annual Growth rate. Employment and Wage growth remains strong, but supply chain issues and Inflation pose a real threat to continued growth. The supply chain issues should be fixed by mid-2022, but Inflation is a stickier problem that will be more difficult to resolve.

- GDP Growth 3Q2021 (2nd estimate): 2.1% annualized growth rate

- US GDP Output: 3Q2021: $23.2T | 2Q2021: $22.7T | 1Q2021: $22.0T | 4Q2020: $21.5T

Consumer Economic Data Released in November 2021

The Holiday Shopping Season officially began on Black Friday, but Consumers stated a lot earlier this year. The specter of high Inflation motivated people to BUY NOW before prices go up - and while goods are still in stock. Consequently, Retails Sales jumped a whopping 1.7% during October (up 16.3% YoY). Paradoxically, the Consumer developed a very gloomy mood in the last month. Consumer Sentiment and Confidence declined due to fears of Inflation and Covid re-infection. Economists predict a good Holiday Buying Season for retailers in 2021. Despite supply chain problems, major retailers reported that they have plenty of inventory. Most Economists expect consumption to stay strong in 2022, but like Consumer Confidence, consumption can change quickly.

- Retail Sales rose 1.7% during October, now up 16.3% in the last 12 months.

- Consumer Confidence Index fell 1.9% to 109.5 from 111.6 the previous month.

- Consumer Sentiment Index (U of M ) fell to 67.4 from 71.7 the previous month.

Energy, International, and Things You May Have Missed

Oil Prices plunged as several countries imposed travel bans to curb the spread of the Covid Omicron Variant.

- West Texas Intermediate Crude fell to $67/barrel (Nov 30) from $84/barrel (Oct 29).

- North Sea Brent Crude fell to $71/barrel (Nov30) from $84/barrel (Oct 29).

- Natural Gas fell slightly to $4.58/MMBtu (Nov 30) from $5.62/MMBtu (Oct 29).

- The Atlanta Braves won the World Series defeating the Houston Astros.

- Poland and Lithuania deployed troops to their borders with Belarus to prevent thousands of Syrian and Iraq migrants from entering the EU.

- Shoplifting Mobs are becoming a real problem for retailers, especially in California.

- Russia massed 100,000 troops at the Ukrainian border, stoking fears of an invasion.

- Samsung will build a $17B chip-making plant in Taylor (Austin suburb), TX. The US does not want another chip shortage for several reasons, including national security.

The Mortgage Economic Review is a concise summary of Key Economic Data that influences the Mortgage and Real Estate Industries. It's a quick read that keeps busy Professionals updated on important Economic Information. Feel free to share this with friends and colleagues in the Mortgage and Real Estate business. To have the Mortgage Economic Review emailed to you each month, click here.

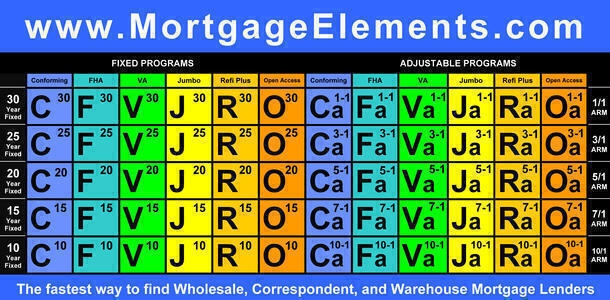

Discover new lending opportunities at MortgageElements.com, where you can explore over 300 Wholesale, Correspondent, Warehouse, Reverse, Construction, and Rehab Mortgage Lenders, from one website. Use the Mortgage Periodic Table to research Mortgage Products, view Underwriting Guidelines, and connect with Wholesale and Correspondent Account Executives - it costs nothing to use and is one of the industry's largest databases of TPO Mortgage Lenders.

Mark Paoletti, MortgageElements.com

The Mortgage Economic Review is for informational and educational purposes only and should not be construed as investment, legal, financial, or mortgage advice. The information is gathered from sources believed to be credible; some are opinion-based and editorial in nature. Mortgage Elements Inc does not guarantee or warrant its accuracy or completeness, and there is no guarantee it is without errors. This newsletter is created for use by Mortgage and Real Estate Professionals and is not an advertisement to extend credit or solicit mortgage originations. © Copyright 2021 Mark Paoletti, Mortgage Elements Inc, All Rights Reserved.