NAR: Pending Home Sales Fall For 3rd Straight Month

Index fell 2% in August from July, and is down 24.2% year over year.

- Pending home sales waned for the third consecutive month, down 2% from July.

- For the second month in a row, the only U.S. region to post a gain was the West.

- Compared to the previous year, contract signings retracted by double-digit percentages in each region.

Pending home sales fell in August for the third straight month, the National Association of Realtors (NAR) said Wednesday.

Pending sales decreased in three of the four major regions, with only the West seeing a modest gain. Year-over-year, all four regions posted double-digit declines, NAR said.

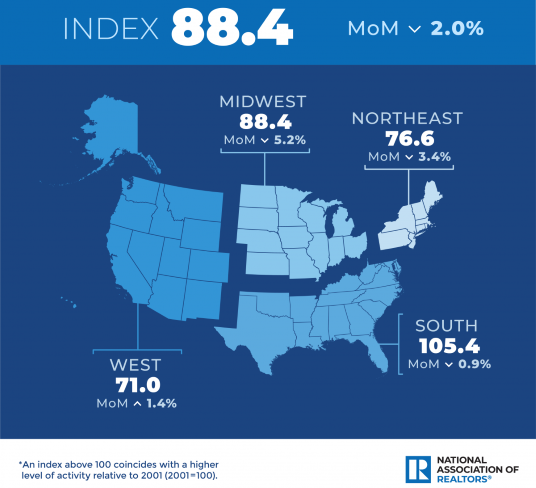

NAR’s Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, fell 2% to 88.4 in August. Year-over-year, pending transactions dwindled by 24.2%. An index of 100 is equal to the level of contract activity in 2001.

"The direction of mortgage rates — upward or downward — is the prime mover for home buying, and decade-high rates have deeply cut into contract signings," said NAR Chief Economist Lawrence Yun. "If mortgage rates moderate and the economy continues adding jobs, then homebuying should also stabilize."

Yun said he expects the economy will remain sluggish throughout the end of this year, with mortgage rates rising close to 7% in the coming months. "Only when inflation calms down will we see mortgage rates begin to steady," he said.

As a result of the current interest rate environment and weaker economic activity, NAR said it expects sales of existing homes to decline 15.2% to 5.19 million units in 2022, while it projects new home sales to fall by 20.9%.

Yun said the limited housing inventory and almost non-existent distressed property sales have supported home prices. Overall, he forecasted housing prices will rise by 9.6% in 2022.

In 2023, he said, he foresees slower price appreciation and corresponding increases in sales as the year progresses.

"Next year, the annual median home price is expected to rise by only 1.2%," he added. "Home sales will pick up in the second half of 2023, but will be down by 7.1% overall."

The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes, NAR said. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

Pending contracts are good early indicators of upcoming sales closings, but the amount of time between pending contracts and completed sales is not identical for all home sales. Variations in the length of the process from pending contract to closed sale can be caused by issues such as buyer difficulties with obtaining mortgage financing, home inspection problems, or appraisal issues.

By Region

- The Northeast PHSI decreased 3.4% from last month to 76.6, down 19\% from August 2021.

- The Midwest index fell 5.2% to 88.4 in August, a 21.1% drop from the previous year.

- The South PHSI slid 0.9% to 105.4 in August, a decline of 24.2% from a year ago.

- The West index rose by 1.4% in August to 71.0, down 31.3% from August 2021.

"Home prices are the least affordable in the West and, consequently, the region suffered deeper annual declines in contract signings due to rising interest rates when compared to other areas of the country," Yun said. "However, the recent increases of the last two months, though small, are encouraging."

NAR said the Pending Home Sales index is based on a sample that covers about 40% of multiple listing service data each month. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months, it said.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing-home sales in 2001 fell within the range of 5 million to 5.5 million, which is considered normal for the current U.S. population.

The National Association of Realtors is America's largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries.