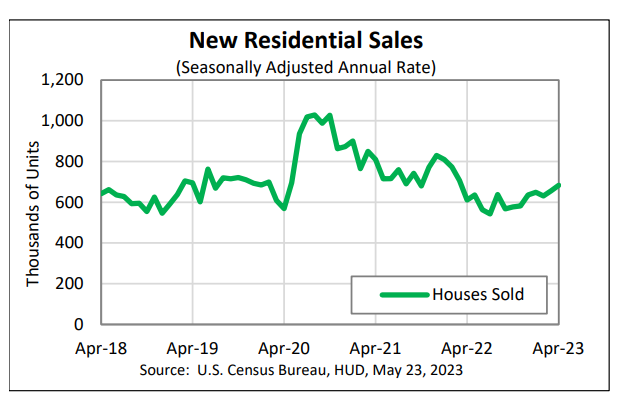

New Home Sales Reach 13-Month High

Sales of new single-family homes rose 4.1% in April from March, and are up nearly 12% YOY.

Sales of new single-family homes rose for the third straight month in April to a level not seen in more than a year, the U.S. government said Tuesday.

According to estimates released jointly by the U.S. Census Bureau and the Department of Housing and Urban Development, sales of newly constructed single-family homes were at a seasonally adjusted annual rate of 683,000, up 4.1% from the revised March rate of 656,000.

The estimate also was 11.8% higher than the April 2022 estimate of 611,000, and was the highest since March 2022. Sales have now risen year-over-year in four of the past five months.

April’s estimate beat the forecast of economists polled by Reuters, who had expected new home sales would fall to a rate of 665,000 units.

By region, sales increased month over month in the South (17.8%) and Midwest (11.8%), and fell in the West (-9.1%) and Northeast (-58.6), according to the report. Year over year, sales rose in the South (23.4%) and Midwest (20.6%), and fell in the Northeast (-46.7%) and the West (-2.8%).

The median sales price of new houses sold in April 2023 was $420,800, down 7.7% from $455,800 in March and down 8.2% from $458,200 a year earlier. The median means half of the homes sold for more and half for less.

The average sales price was $501,000, down 10.4% from $559,200 in March and down 10.9% from $562,400 a year earlier.

The seasonally adjusted estimate of new houses for sale at the end of April was 433,000, the report states. That represents a 7.6-month supply at the current sales rate, unchanged from a month earlier.

The release noted that the seasonally adjusted estimates of housing units sold, housing units for sale, and the months' supply of new housing have been revised back to January 2018.

First American Financial Corp. Deputy Chief Economist Odeta Kushi noted that prices for new homes saw the largest year-over-year decline since April 2020.

“Builders are offering incentives, including price reductions, to entice buyers,” she said.

Kushi also said the inventory of new homes as a share of total inventory reached 29% in April.

“From 2000 until the pandemic, new homes on average made up about 11% of total inventory,” she said. “When existing homes are hard to find, new homes at the right price are a good substitute.”

She added, however, that the increase in new-home sales in April was driven by sales of homes not yet started.

“A new-home sale occurs when a sales contract is signed or a deposit is accepted, but the home can be in any stage of construction — not yet started, under construction, or completed,” Kushi said. While the inventory of new homes increased month over month, the increase came “exclusively from inventory not yet started,” she said.

“The total new-home inventory consisting of completed and ready to occupy homes is now at 16.2%, which is an increase of 106% year over year, but still down from more than 20% from pre-pandemic levels,” Kushi said.

She cited higher costs for builders as an ongoing “headwind to building more entry-level homes. In April 2023, only 15% of new-home sales were priced below $300,000, which is significantly lower relative to the pre-pandemic April 2019 share of 37%.”

Kushi summed up the current housing market by stating that buyers are out there, but the limited inventory remains an obstacle.

“The historical average for inventory turnover — the total supply of homes for sale as a percentage of occupied residential inventory — is approximately 2.5%, or 250 homes for sale out of every 10,000,” she said. “In April, housing inventory was 1.2%, well below the historical norm. With existing homeowners not selling, buyers may turn to the new-home market and builders are in a unique position to do what's necessary to move inventory and bolster sales.”