Optimal Blue Introduces CompassEdge

Says the platform supports the next generation of hedging and loan trading.

Optimal Blue, a division of Black Knight Inc., on Wednesday announced the release of CompassEdge — a hedging and loan-trading platform that it says is the first of its kind in the capital markets sector.

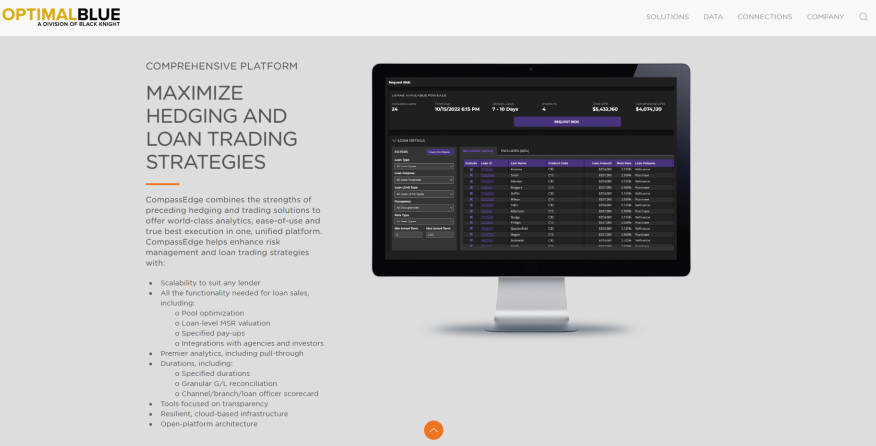

The CompassEdge platform combines the company’s CompassPoint, Optimal Blue Secondary Services, and Resitrader solutions to support the needs of originators, regardless of range, size, or type, the company said. It merges and builds upon the strengths of each preceding solution to offer “world-class analytics, ease-of-use, and true best execution in one, unified platform,” it said.

Optimal Blue President Scott Happ said the announcement “marks an unprecedented step forward for capital markets participants, as we introduce our much-anticipated CompassEdge platform. Our existing hedging and loan-trading solutions are already unrivaled in the industry, and with CompassEdge we’ve created a unified platform that’s even greater than the sum of its parts.”

He added, “With a simple login, any credentialed member of an organization can access the comprehensive hedging and trading tools, data, and analytics they need — from a single, user-friendly source.”

Describing it as a first for the industry, Optimal Blue said CompassEdge integrates pipeline risk management tools and analytics with loan sale and mortgage servicing rights (MSR) valuation functionality.

“Streamlined navigation enables users to efficiently complete a loan sale in just a few clicks,” it said in a news release. “Additionally, CompassEdge promotes greater transparency across organizations by making premier analytics accessible to any capital markets participant — from the lock desk to the C-suite — without requiring in-depth system training.”

The company said the platform’s intuitive interface and mobile functionality also make it easy for any user to access key data and tools from any location.

“Whether you’re a small originator with one secondary marketing manager, or a large originator with an extensive team, CompassEdge offers the scalability to support your goals,” Happ said.