Potential Home Sales Plunge YOY In October

First American says housing market will stabilize in 2023 once mortgage rates peak.

Rising mortgage rates and falling home affordability continued to shrink the potential for home sales in October, but there are signs the housing market may stabilize next year, according to a new report.

First American Financial Corp. released its monthly Potential Home Sales model and analysis for October on Friday. According to the report, the housing market potential fell by nearly 4% from September, and plunged 21% when compared with October of last year — a decline of 1.33 million potential existing-home sales.

The model measures what the healthy market level of home sales should be based on economic, demographic, and housing-market fundamentals.

Mark Fleming, chief economist at First American, said the steep annual decline in market potential in October was “largely a result of higher mortgage rates, which discourage both buyers and sellers from jumping into the market.”

Still, Fleming said he sees signs that the market could stabilize in 2023.

“To understand what we can expect in 2023, it’s important to examine what influences buyers and sellers, and how those influences shape market potential,” he said.

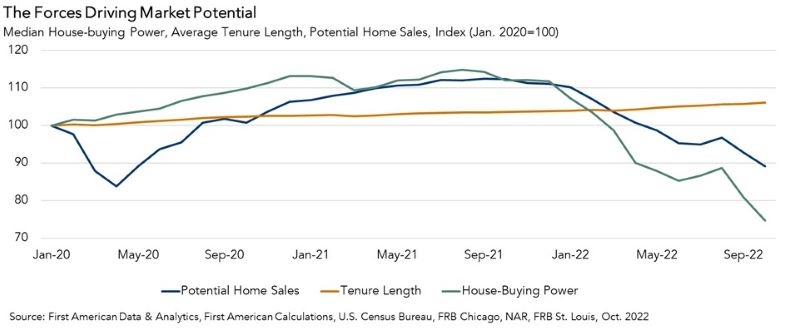

Fleming noted that, since October 2021, homebuyers have lost $162,000 in house-buying power, primarily due to higher mortgage rates.

“The 30-year, fixed mortgage rate increased from 3.1% last October to 6.9% in October of this year,” he said. “Rising household income prevented the year-over-year loss in house-buying power from being even more severe. The sharp hit to house-buying power prompted a strong pullback in housing demand in October, decreasing housing market potential by 782,000 potential home sales year over year.”

Fleming said affordability is likely to remain a drag on housing market potential until house-buying power recovers — which is unlikely in the foreseeable future — or house prices decline.

“House prices have already begun to adjust to the reality of higher mortgage rates, which will help bring more balance to the housing market heading into 2023,” he said.

Fleming noted that 93% of outstanding mortgages had rates below 6% in the second quarter of 2022, and with mortgage rates near 7%, there is a financial disincentive for homeowners to sell their homes and buy a new home at a higher mortgage rate.

“As a result, the average number of years that homeowners live in their homes has continued to increase,” he said, reaching a historic high of 10.65 years in October and growing at the fastest pace since early 2021.

“The rate ‘lock-in’ effect prevents more housing supply from reaching the market and dampens housing market potential,” Fleming said. “Homeowners staying put reduced housing market potential by 84,000 potential home sales in October compared with one year ago.”

High levels of home equity, however, could mitigate the impact of the rate lock-in effect, he said.

“Homeowners have gained record amounts of equity in their homes due to rapidly rising house prices over the course of the pandemic,” Fleming said. “For some equity-rich homeowners, moving and taking on a higher interest rate isn’t a huge deal, especially if they are moving to a more affordable place. Higher home prices compared with one year ago boosted housing market potential by 86,600 potential home sales in October, offsetting the loss in potential homes sales due to homeowners staying put.”

Given all of that, Fleming said the housing market trend to watch in 2023 is whether mortgage rates will go any higher, and if so, by how much.

“Once mortgage rates peak, housing market potential will likely stabilize,” he said. “The housing market, once adjusted to the ‘new normal’ of higher mortgage rates, will benefit from continued strong demographic-driven demand relative to an overall, long-run shortage of supply. Based on current dynamics, it appears the housing market may begin to stabilize in 2023.”

Key Highlights

For the month of October, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales decreased to a 5.13 million seasonally adjusted annualized rate (SAAR), a 3.9% month-over-month decrease.

- The market potential for existing-home sales decreased 20.7% from a year earlier, a loss of 1,334,000 SAAR sales. This represents a 47% increase from the market potential low point reached in February 1993.

- Currently, potential existing-home sales is 1,665,000 SAAR, or 24.5% below the pre-recession peak of market potential, which occurred in April 2006.