Sales Of Existing Homes Fell In August For 7th Straight Month

Median existing-home price also rose, the 126th consecutive month of year-over-year increases.

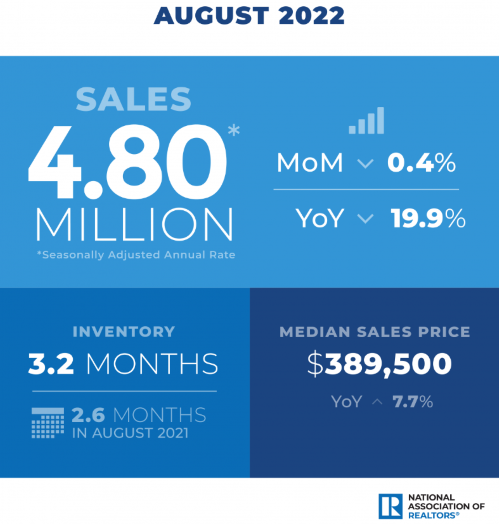

- Existing-home sales decreased for the seventh straight month to a seasonally adjusted annual rate of 4.8 million. Sales tailed off 0.4% from July and 19.9% from the previous year.

- The median existing-home sales price rose 7.7% from one year ago to $389,500.

- After five successive monthly increases, the inventory of unsold existing homes dwindled to 1.28 million by the end of August, or the equivalent of 3.2 months at the current monthly sales pace.

- Month-over-month sales varied across the four major U.S. regions.

Sales of existing homes dipped again in August, the seventh consecutive monthly decline, the National Association of Realtors (NAR) said Wednesday.

Month-over-month sales varied across the four major U.S. regions, as two recorded increases, one was unchanged, and the other posted a drop, the NAR said. On a year-over-year basis, however, sales fell in all four regions.

Total existing-home sales — completed transactions that include single-family homes, townhomes, condominiums, and co-ops — posted a slight contraction of 0.4% from July to a seasonally adjusted annual rate of 4.8 million in August. Year-over-year, sales fell 19.9% from 5.99 million in August 2021.

"The housing sector is the most sensitive to and experiences the most immediate impacts from the Federal Reserve's interest rate policy changes," said NAR Chief Economist Lawrence Yun. "The softness in home sales reflects this year's escalating mortgage rates. Nonetheless, homeowners are doing well, with near nonexistent distressed property sales and home prices still higher than a year ago."

Total housing inventory at the end of August was 1.28 million units, a decrease of 1.5% from July but unchanged from the previous year. Unsold inventory sits at a 3.2-month supply at the current sales pace — identical to July but up from 2.6 months a year earlier.

"Inventory will remain tight in the coming months, and even for the next couple of years," Yun said. "Some homeowners are unwilling to trade up or trade down after locking in historically low mortgage rates in recent years, increasing the need for more new-home construction to boost supply."

Builders began construction on 12% more homes in August, but that was led mostly by a surge in construction of multifamily units, according to a report released Tuesday by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Prices Still Rising

The median existing-home price for all housing types in August was $389,500, a 7.7% jump from August 2021 ($361,500), as prices ascended in all regions. It marks 126 consecutive months of year-over-year increases, the longest streak on record. It was the second month in a row, however, that the median sales price retracted after reaching a record high of $413,800 in June, the usual seasonal trend of prices declining after peaking in the early summer.

Properties typically remained on the market for 16 days in August, up from 14 days in July but down from 17 days a year earlier. Of the homes sold in August, 81% were on the market for less than a month.

First-time buyers were responsible for 29% of sales in August, consistent with July 2022 and August 2021.

All-cash sales accounted for 24% of transactions in August, the same share as in July but up from 22% from August 2021.

Individual investors or second-home buyers, who make up many cash sales, purchased 16% of homes in August, up from 14% in July and 15% from a year earlier.

Distressed sales — including foreclosures and short sales — represented approximately 1% of sales in August, essentially unchanged from July and from August 2021.

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage was 5.22% in August, down from 5.41% in July. The average commitment rate across all of 2021 was 2.96%.

Realtor.com's Market Trends Report in August shows that the largest year-over-year median list price growth occurred in Miami (+33.4%), Memphis, Tenn. (+25.8%), and Milwaukee, Wis. (+25%). Phoenix reported the highest increase in the share of homes that had their prices reduced compared to last year (+30.9 percentage points), followed by Austin, Texas (+24.8 percentage points), and Las Vegas (+24.4 percentage points).

Single-family & Condo/Co-op Sales

Single-family home sales decreased to a seasonally adjusted annual rate of 4.28 million in August, down 0.9% from 4.32 million in July and down 19.2% from the previous year. The median existing single-family home price was $396,300 in August, up 7.6% from August 2021.

Existing condominium and co-op sales were recorded at a seasonally adjusted annual rate of 520,000 units in August, up 4% from July but down 24.6% from last year. The median existing condo price was $333,700 in August, an annual increase of 7.8%.

"In a sense, we're seeing a return to normalcy with the homebuying process as it relates to home inspections and appraisal contingencies, as those crazy bidding wars have essentially stopped," said NAR President Leslie Rouda Smith, a Realtor from Plano, Texas, and a broker associate at Dave Perry-Miller Real Estate in Dallas.

Regional Breakdown

- Existing-home sales in the Northeast grew 1.6% from July to an annual rate of 630,000 in August, down 13.7% from the same month last year. The median price in the Northeast was $413,200, an increase of 1.5% from last year.

- Existing-home sales in the Midwest fell 3.3% from July to an annual rate of 1.16 million in August, retreating 15.9% from a year earlier. The median price in the Midwest was $287,900, up 6.6% from last year.

- At an annual rate of 2.13 million in August, existing-home sales in the South were identical to July but down 19.3% from a year ago. The median price in the South was $356,000, an increase of 12.4% from last year.

- Existing-home sales in the West expanded 1.1% from July to an annual rate of 880,000 in August, down 29% from this time last year. The median price in the West was $602,900, a 7.1% increase from last year.

The National Association of Realtors is America's largest trade association, representing more than 1.5 million members involved in all aspects of the residential and commercial real estate industries.