Student Loan Relief Could Increase Homeownership

Urban Institute says borrowers of color would most likely see the greatest benefits.

- A significant reduction or elimination of monthly student loan expenses could move households on the margins of homeownership readiness.

- The additional saving could help more borrowers for a down payment and buy higher-priced homes.

- Borrowers of color would see the greatest benefits from this credit score boost, as they are more likely to default on their student loans than white borrowers.

- Biden’s proposal would allocate an extra $10,000 in student loan forgiveness for Pell grant recipients — 88% of Black student borrowers received a Pell grant.

Student loan debt is a hindrance to homeownership for many millennials and first-time homebuyers, according to a study by the Urban Institute.

Having outsized loan balances raises borrowers’ debt-to-income (DTI) ratios, which lenders consider to be an important indicator of borrower creditworthiness in their underwriting decisions. It also prevents them from saving money for a down payment.

For borrowers who have defaulted on their student loans, the hit to their credit score could make them ineligible for a mortgage.

The Biden administration recently announced its proposal for student debt relief, including $10,000 of loan forgiveness for most borrowers and up to $20,000 of forgiveness for Pell grant receipts. This also includes a more generous income-driven repayment (IDR) plan, and an extension of the payment pause through the end of the year.

The administration also released details of its Fresh Start initiative, which would allow defaulted borrowers to return to a current status when student loan payments resume.

The Urban Institute urges the administration to make these policy changes and speed up the path to homeownership for student loan borrowers — particularly borrowers of color — by lowering DTI ratios and improving their credit histories.

Reducing DTI

The median outstanding student loan debt is about $20,000, so many borrowers would have their entire balances forgiven once the policy goes into effect. For those borrowers, monthly payments would drop from $200 to $0. Even for those with significant outstanding debt, expected monthly payments would decline.

DTIs are calculated as significant monthly expenses, including any student loan payments, divided by gross monthly income. A significant reduction or elimination of monthly student loan expenses could move households on the margins of homeownership readiness into a DTI ratio at or below 45%, the standard limit used by Fannie Mae in its underwriting practices.

Last year, the Federal Housing Administration (FHA) updated its guidance for calculating student loan monthly payments when a borrower is using IDR, so these calculations would be more accurate of the borrowers’ actual monthly payment. It would also affect DTI ratios, making it easier for some borrowers to qualify for a mortgage.

Increased Savings

Student loan borrowers have already benefited from more than two years of paused federal loan payments, but now many of these borrowers would be able to continue to save what they would have otherwise spent on student loan payments once the payment pause ends. The additional saving could help more borrowers save for a down payment and buy higher priced homes.

Improved Credit History

When student loan payments resume in January, borrowers in default will have the opportunity to move to a current repayment status with the negative effects of defaulting removed from their credit histories.

Student loan default and the delinquencies leading up to a default can cause a drop in a borrower’s credit score of up to 90 points. Having these delinquencies and default erased from their credit histories could help student loan borrowers’ credit scores rebound enough to reach a score that would make them eligible for a mortgage.

Borrowers of color would most likely see the greatest benefits from the credit score boost, as they are more likely to default on their student loans than white borrowers, in part because of the discriminatory systemic barriers to building generational wealth.

Narrow Racial Homeownership Gap

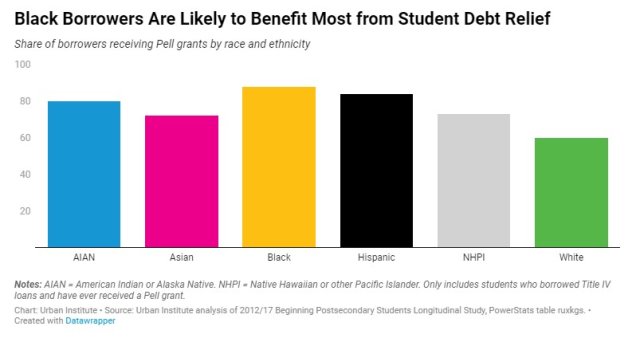

Biden’s proposal would allocate an extra $10,000 in student loan forgiveness for Pell grant recipients. Black student loan borrowers who first enrolled in the 2011-12 academic year, 88% received a Pell grant, compared with 60% of white borrowers. Student loan borrowers who identify as American Indian or Alaska Native, Asian, Hispanic or Latino, or Native Hawaiian/Pacific Islander are also more likely to have received a Pell Grant than white borrowers.

The extra loan forgiveness would further improve DTI ratios for borrowers of color, meaning they may be able to commit more to a monthly mortgage payment or save more quickly for a down payment. The additional benefit to Pell grant recipients would mean a small improvement in racial equity in homeownership.

In order to receive the loan forgiveness, student loan borrowers will need to fill out an application, and evidence suggests that this administrative burden will lead to fewer borrowers receiving debt relief. But real estate professionals, housing counselors, and mortgage loan officers could educate their clients on how to access these benefits and how the benefits could help them apply for a mortgage. In all, these policy changes can increase equity in homeownership.