Temporary Halt Requested On VA Foreclosure To Aid Military Families

Department of Veterans Affairs aims to bridge the gap between pandemic relief and successor program, garnering support from advocates while raising industry concerns.

A lot of military families may be breathing a sigh of relief this Thanksgiving. The Department of Veterans Affairs (VA) has issued a request to housing finance companies to temporarily halt foreclosures on VA-guaranteed loans until May 31, 2024.

This action, according to the consumer advocates at the National Consumer Law Center, aims to bridge the gap between the expiration of pandemic relief measures and the implementation of a successor program, the VA Servicing Purchase program (VASP).

"The foreclosure pause is badly needed as Veteran borrowers have had no meaningful alternatives to foreclosure for over a year,” said Steve Sharpe, senior attorney at the National Consumer Law Center. “We applaud VA and the Biden Administration for taking necessary steps to protect Veteran families, and we look forward to the release of VASP.”

The decision comes in response to concerns raised by recent media reports and a letter from Senate Democrats regarding the impact of the discontinuation of the partial claims program on borrowers. During the foreclosure pause, the VA will collaborate with mortgage servicers to develop viable home retention solutions for veterans.

Additionally, the VA is extending the COVID-19 Refund Modification program, which was set to expire at the end of the year, until May 31, 2024. This program allows borrowers to adjust their mortgage terms to make future payments more manageable and provides an option to obtain a separate loan to cover unpaid monthly obligations without incurring interest.

While these measures have garnered support from consumer advocates, industry experts have expressed concerns about their potential impact on servicing advance obligations.

The VA's request to halt foreclosures has raised questions about the voluntary nature of compliance. While the move is expected to assist some VA borrowers in foreclosure proceedings, it may create uncertainty for those further along in the process, as they may not qualify for the refund modification program or VASP.

Consumer groups have generally welcomed the foreclosure pause, highlighting its importance for veteran borrowers who lacked viable alternatives for over a year. The Center for Responsible Lending estimated that this measure could help tens of thousands of borrowers avoid foreclosure.

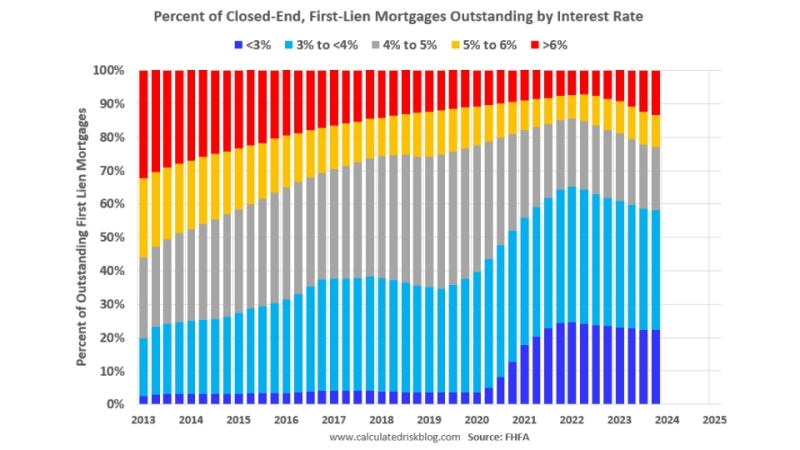

“The VA’s foreclosure pause is critically important for giving Veteran borrowers a path to avoid foreclosure. We now urge VA to ensure that VASP will be broadly available and provide relief that many VA borrowers need, especially in the current high interest rate environment,” said Kanav Bhagat, consultant to the Center for Responsible Lending. “The VASP program will give tens of thousands of active-duty servicemembers and Veterans the assistance they have earned through their service, allow them to remain in their homes, and avoid foreclosures.”

As both Democrats and Republicans have increasingly weighed in on mortgage policy in a partisan manner in anticipation of the next presidential election, industry groups have urged the VA to address the gap between the partial claims program and its successor. The discontinuation of the partial claims program stemmed from unique budgetary considerations.