Why Black, Latino Homeownership Grew Faster During The Pandemic

Analysis by The Urban Institute finds growth was driven by young, high-earning, highly educated borrowers.

- Black and Latino homeownership rates increased by 2 and 2.5 percentage points, respectively, from 2019 to 2021.

- White homeownership increased just 1 percentage point over the same period.

- Minority homeownership might have increased more if FHA borrowers had faced less resistance in the housing market.

Thanks to the Urban Institute, we already knew that low mortgage rates not only helped fuel a white-hot housing market during the COVID-19 pandemic, but also boosted homeownership rates more for Black and Latino homebuyers than for whites.

That was the finding of an Urban Institute study published last October. That study, however, left a big question unanswered: Why?

As the institute noted, Black and Latino homeownership rates increased by 2 and 2.5 percentage points, respectively, during the pandemic, while white homeownership increased just 1 percentage point.

The difference was surprising, as people of color disproportionately experienced higher rates of job loss and were more likely to miss rental and mortgage payments because of the pandemic.

But thanks to those historically low interest rates making homeownership much more affordable, a larger share of Black and Latino households — which in general are more likely to rent in their prime homebuying ages — took advantage.

In the institute’s new analysis, published earlier this month, it found that young, high-earning, highly educated borrowers across all racial and ethnic groups — but especially Black and Latino households — drove the increase in homeownership rates. It also found that Black and Latino homeownership might have increased more if Federal Housing Administration (FHA) borrowers had faced less resistance in the housing market compared to borrowers with more resources.

Capitalizing On Low Rates

According to the report, coming out of the Great Recession, millennials’ homeownership rate lagged behind that of the previous two generations at the same age. As millennials are both the largest and most diverse generation, the lag in part contributed to a widening of the racial homeownership gap, the institute said. But after years of delayed homeownership, millennials are finally starting to catch up, it said.

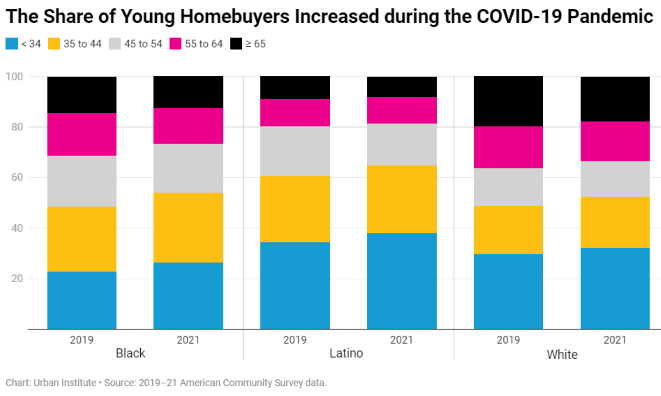

The institute’s analysis found a shift toward younger borrowers between 2019 and 2021, particularly among Black and Hispanic households.

“Across all racial and ethnic groups, homebuyers younger than 45 increased from 51% in 2019 to 55% in 2021,” the report states. “This change was largest for Black homebuyers younger than 45, whose share increased by 5.3 percentage points, compared with a 4-percentage-point increase for Latino homebuyers and a 3.5-percentage-point increase for white homebuyers.

“As the housing supply shortage became acute during the pandemic, the market became more competitive, with many homebuyers induced by low interest rates,” the report states. “In general, households with high incomes and high educational attainment were more likely to access homeownership, with the share of loans made to borrowers with annual incomes above $75,000 increasing by nearly 4 percentage points.”

The growth in the shares of Black and Latino borrowers with incomes above $75,000 outpaced that of white borrowers, the report found, but most high-income white households were already homeowners, which partially explained the smaller growth rate.

Black and Latino homebuyers also experienced larger income increases between 2019 and 2021 than did Black and Latino households as a whole, with the median among Black and Latino homebuyers increasing by about 9% and 7%, respectively, the report said. The shares of Black and Latino homebuyers with a bachelor’s degree or more education also increased more than any other racial or ethnic group between 2019 and 2021, increasing from 36% to 42% for Black homebuyers and from 30% to 37% for Latino homebuyers, the report states.

The upward shift in homebuyer incomes and education was coupled with an increase in property values. Specifically, the median property values for Black and Latino borrowers increased by 22.2% and 24.5%, respectively, the report states.

With more competition for homes, government loans — from the FHA and the U.S. Department of Veterans Affairs, or VA — were less attractive to sellers because they take longer to close than cash offers and have stricter property condition requirements than conventional loans, the report states.

Between 2019 and 2021, the share of FHA home purchase loans declined from 18.4% to 15.3%, and the share of VA loans declined from 9.5% to 8.3% across all racial and ethnic groups.

“Households with low incomes and (low) wealth, young households, and Black and Latino households are more likely to use FHA or VA loans, which indicates that if government loans were equally attractive to sellers, we could have observed a larger increase in Black and Latino homeownership,” the report states.

How To Keep Closing The Gap

Given the sharp increase in interest rates following the Federal Reserve’s rate hikes to battle inflation beginning in March 2022, some signs have emerged that the progress observed in Black and Latino homeownership from 2019 to 2021 has reversed, as homes have become significantly more unaffordable, the institute said.

Although 2022 American Community Survey and Home Mortgage Disclosure Act data are not yet available, recent surveys indicate that the growth in Black and Latino homeownership has not continued at the same pace now that interest rates have risen.

The first-time homebuyer share in 2022 dropped to 26% from 34% in 2021, and the median age of first-time homebuyers reached 36, an all-time high, the institute said.

In addition, the share of Black homebuyers declined by 3 percentage points, and the Latino share increased by 1 percentage point, both substantially lower than the 6-percentage-point increase in the share of white homebuyers.

From the preliminary data, it is clear that mitigating racial disparities in homeownership, especially in the current high-interest-rate environment, requires well-designed and well-implemented solutions, the institute said. Although the low-rate environment and other economic conditions during the pandemic unleashed some pent-up housing demand among households of color, the majority of these households are still renters and face barriers to homeownership, it said.

The institute suggested several policies that could continue the momentum despite a sharp increase in interest rates. These include:

- Targeting down payment assistance to first-generation homebuyers, which can lower mortgage costs, allowing homebuyers with fewer resources to be more competitive in the market.

- Implementing special purpose credit programs for borrowers or neighborhoods of color, which would play a similar role.

- Incorporating positive rental payment history in mortgage underwriting would disproportionately help borrowers of color, as they are more likely to be renters and are more likely to have no or low credit scores.

- Lastly, targeted mortgage rate buydowns geared toward low-income borrowers would bring back some of the benefits of historically low interest rates.

In the long term, policymakers can tackle systemic barriers that affect income, education, and other opportunity outlooks for people of color, the institute said.