Advertisement

Home Prices Are Still Rising

Two new data reports have reaffirmed the year’s most predictable housing news story: Home prices are going up.

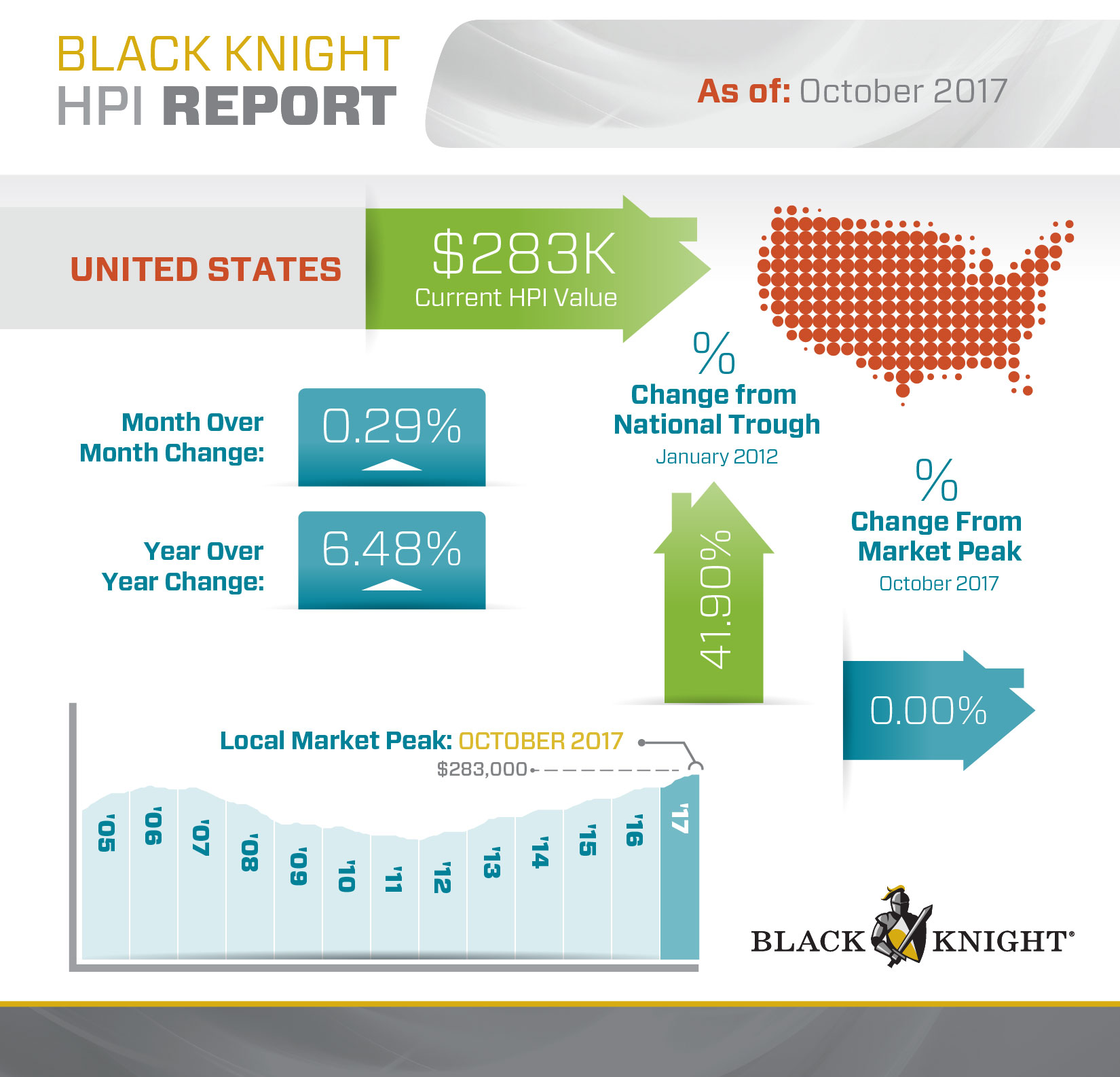

During October, Black Knight’s Home Price Index reached a new peak at $283,000, up 0.29 percent from September and up 6.48 percent from October 2016. Eleven of the nation’s 20 largest states and 12 or the largest 40 metros saw record-breaking home prices, but eight states recorded declining year-over-year home prices, with the greatest decline recording in Alaska at -0.47 percent.

For the fourth month in a row, New York was the state with the greatest monthly appreciation rate, with home prices rising 0.98 percent from September. San Jose had the greatest metro growth, with 1.86 percent monthly appreciation and a more than 17 percent year-over-year home price increase.

Separately, the latest S&P CoreLogic Case-Shiller Indices also confirmed home prices are still on the rise. The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index reported a 6.2 percent annual gain in October, up from 6.1 percent in the previous month. The 10-City Composite annual increase came in at 6.0 percent, up from 5.7 percent the previous month, while the 20-City Composite posted a 6.4 percent year-over-year gain, up from 6.2 percent the previous month. In this data report, Seattle was the leading metro for home price appreciation, with a 12.7 percent year-over-year price increase, followed by Las Vegas with a 10.2 percent spike.

“Home prices continue their climb supported by low inventories and increasing sales,” observed David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Underlying the rising prices for both new and existing homes are low interest rates, low unemployment and continuing economic growth. Some of these favorable factors may shift in 2018. The Fed is widely expected to raise the Fed funds rate three more times to reach two percent by the end of the New Year. Since home prices are rising faster than wages, salaries, and inflation, some areas could see potential home buyers compelled to look at renting. Data published by the Urban Institute suggests that in some West coast cities with rapidly rising home prices, renting is more attractive than buying.”

About the author