Advertisement

Rates Rise as Pandemic Forces Homebuyer Interest to Fall

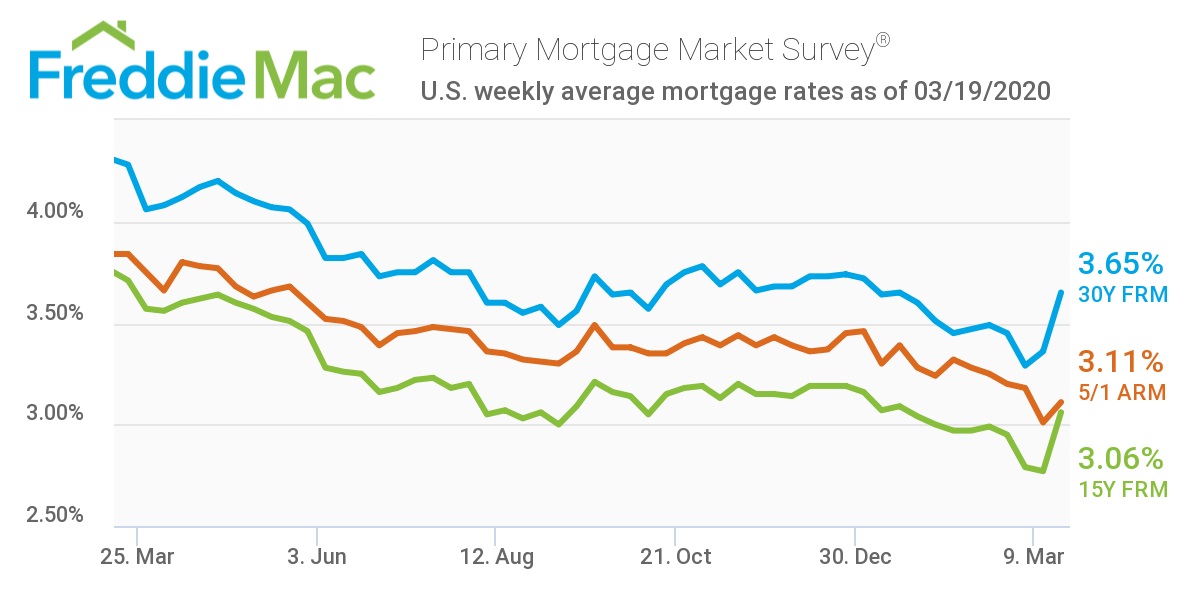

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage averaged 3.65 percent with an average 0.7 point for the week ending March 19, 2020, up from last week when it averaged 3.36 percent. A year ago at this time, the 30-year FRM averaged 4.28 percent.

“Mortgage rates rose again this week, as lenders increased prices to help manage skyrocketing refinance demand. This is expected to be a short-term phenomenon as lenders work through their backlog,” said Sam Khater, Freddie Mac’s chief economist. “On the purchase front, daily loan purchase applications were rising as of mid-February but started to decline last Friday.”

Mortgage rates, while at historically low levels, still are not enough to get potential homebuyers out there to purchase homes, as new data from the National Association of Realtors (NAR) has found that nearly half of Realtors (48 percent) said homebuyer interest has decreased due to the Coronavirus outbreak. That percentage tripled from just one week ago when it stood at 16 percent. Almost seven in 10 Realtors (69 percent) said there’s no change in the number of homes on the market due to the Coronavirus outbreak, down from 87 percent a week ago.

“The decline in confidence related to the direction of the economy coupled with the unprecedented measures taken to combat the spread of COVID-19, including major social distancing efforts nationwide, are naturally bringing an abundance of caution among buyers and sellers,” said NAR Chief Economist Lawrence Yun. “With fewer listings in what’s already a housing shortage environment, home prices are likely to hold steady. The temporary softening of the real estate market will likely be followed by a strong rebound once the economic ‘quarantine’ is lifted, and it’s critical that supply is sufficient to meet pent-up demand.”

After last week’s surge in applications, Coronavirus fears began to impact the housing market this week as the Mortgage Bankers Association found that mortgage apps decreased 8.4 percent from one week earlier for the week ending March 13, 2020.

Meanwhile, NAR’s latest Economic Pulse Flash Survey, conducted March 16-17, asked members questions about how the coronavirus outbreak, including the significant declines in stock market values and mortgage interest rates, has impacted homebuyer and seller interest and behavior, as well as new commercial clients who want to lease and purchase property. With respect to the coronavirus, several highlights of the member survey include:

►Forty-five percent of members said the stock market correction and lower mortgage rates roughly balanced out, noting no significant change in buyer behavior.

►The majority of those surveyed, 61 percent, reported no change in sellers removing homes from the market, down from 81 percent a week ago.

►Four in 10 members said home sellers have not changed how their home is viewed while it remains on the market. One week ago, nearly eight in 10 members (77 percent) said the same.

►More than half of commercial members (54 percent) have seen a decline in leasing clients, up from 18 percent of commercial members last week.

►Eighty-three percent of commercial buildings have changed practices, with the most common being offering more hand sanitizer, more frequent building cleanings, and increasing numbers of tenants working remotely.

►The majority of those surveyed, 61 percent, reported no change in sellers removing homes from the market, down from 81 percent a week ago.

►Four in 10 members said home sellers have not changed how their home is viewed while it remains on the market. One week ago, nearly eight in 10 members (77 percent) said the same.

►More than half of commercial members (54 percent) have seen a decline in leasing clients, up from 18 percent of commercial members last week.

►Eighty-three percent of commercial buildings have changed practices, with the most common being offering more hand sanitizer, more frequent building cleanings, and increasing numbers of tenants working remotely.

Efforts are underway nationally to curb any impending housing crisis, as yesterday, the U.S. Department of Housing & Urban Development (HUD) and the Federal Housing Finance Agency (FHFA) mandated that Fannie Mae and Freddie Mac suspend foreclosures and evictions for at least 60 days due to the Coronavirus.

About the author