Mortgage Rates Slightly Increase

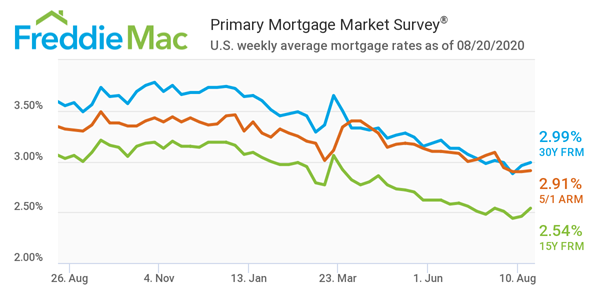

Mortgage interest rates continued on their slightly up-and-down track this week with a small increase that still keeps numbers a tick below 3%. The Primary Mortgage Market Survey released today by Freddie Mac shows that the 30-year fixed-rate mortgage averaged 2.99%.

That's an increase from the prior week's rate of 2.96%. The week before the number stood at 2.88%, a record low in the survey's history dating back to 1971.

“Purchase housing demand continues to accelerate, ultimately providing support to an economy that otherwise has stagnated,” said Sam Khater, chief economist for Freddie Mac. “The surge in sales led to a rapid increase in the demand for remodeling and home furnishings as consumers look to renovate while adjusting to home life during COVID.”

According to the Primary Mortgage Market Survey, the 15-year fixed-rate mortgage is up to 2.54% from last week's average of 2.46%. It remains significantly lower than last year's average of 3.03%. Additionally, the 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.91%, up slightly from last week's average of 2.90%.

Read the full Freddie Mac survey.