A Lesson In Symbiosis: Coral Reefs and The Mortgage Ecosystem

At ReadyPrice, we’ve created a successful digital ecosystem with our innovative mortgage technology. In this article, we explore the science behind why ReadyPrice helps drive the mortgage industry forward by comparing our mortgage ecosystem to a coral reef and the symbiotic relationship that exists between lenders and brokers that is an essential association in our industry. Much like that of coral and algae or sea anemones and clownfish, we rely on each other to thrive. These relationships between various business organisms can be strengthened through our ReadyPrice mortgage technology, by enhancing the symbiotic relationship between brokers and lenders during the mortgage process, improving this essential relationship in our business ecosystem.

At ReadyPrice, we are using innovation and technology to create a streamlined loan origination process. We are a technology-based company with mortgage expertise looking to strengthen the symbiotic relationship between lenders and brokers while keeping our customers at the forefront of changes in our industry.

Symbiosis

Symbiosis is generally understood as the interaction between two different organisms living in close association with one another. It often signifies a mutualism where both organisms can benefit from their relationship and rely on one another for success. Coral reef systems prosper as a direct result of mutualistic interactions between various organisms. Sea anemones and clownfish benefit from each other by protecting and feeding one another. These concepts of mutualism can be applied to our industry through our technology platform. We are bringing two business organisms closer together in symbiosis. Complimentary access is provided to mortgage brokers, and sponsored by the lenders, each organism mutually benefiting from the business connections that can be made in our mortgage ecosystem. Networking through ReadyPrice as organisms do in the ecosystem will propel our industry forward in a mutually beneficial way, supporting the co-evolution of lenders and brokers in the mortgage industry - the primary goal of ReadyPrice.

The association between coral and algae is another prime example of a mutualistic relationship. Together they keep the coral reef ecosystem healthy. Without algae, the coral would starve and without coral, algae would be vulnerable to destruction. The coral provides protection and contributes compounds to algae’s ability to photosynthesize, and as a result, the algae can pass nutrients back to the coral. Brokers and lenders rely on each other for success in this business much in the same way; together they create a healthy, thriving system. Our technology creates the foundational reef for “healthy” (accurate and efficient) mortgage transactions to take place in real-time.

Sponges are critical to the health and wellbeing of the coral reef, serving as a shelter, filter, and food for other reef species. Just like sponges on the reef, ReadyPrice makes life more efficient and sustainable for our mortgage ecosystem. We provide a platform for feeding the relationship between lenders and brokers and maximizing mutual benefits while keeping up with the changes in our industry. Take the recent MISMO 3.4 update as an example; ReadyPrice has taken the product development steps required to allow brokers and lenders to continue operating at a high speed despite major technology updates.

The ReadyPrice Ecosystem

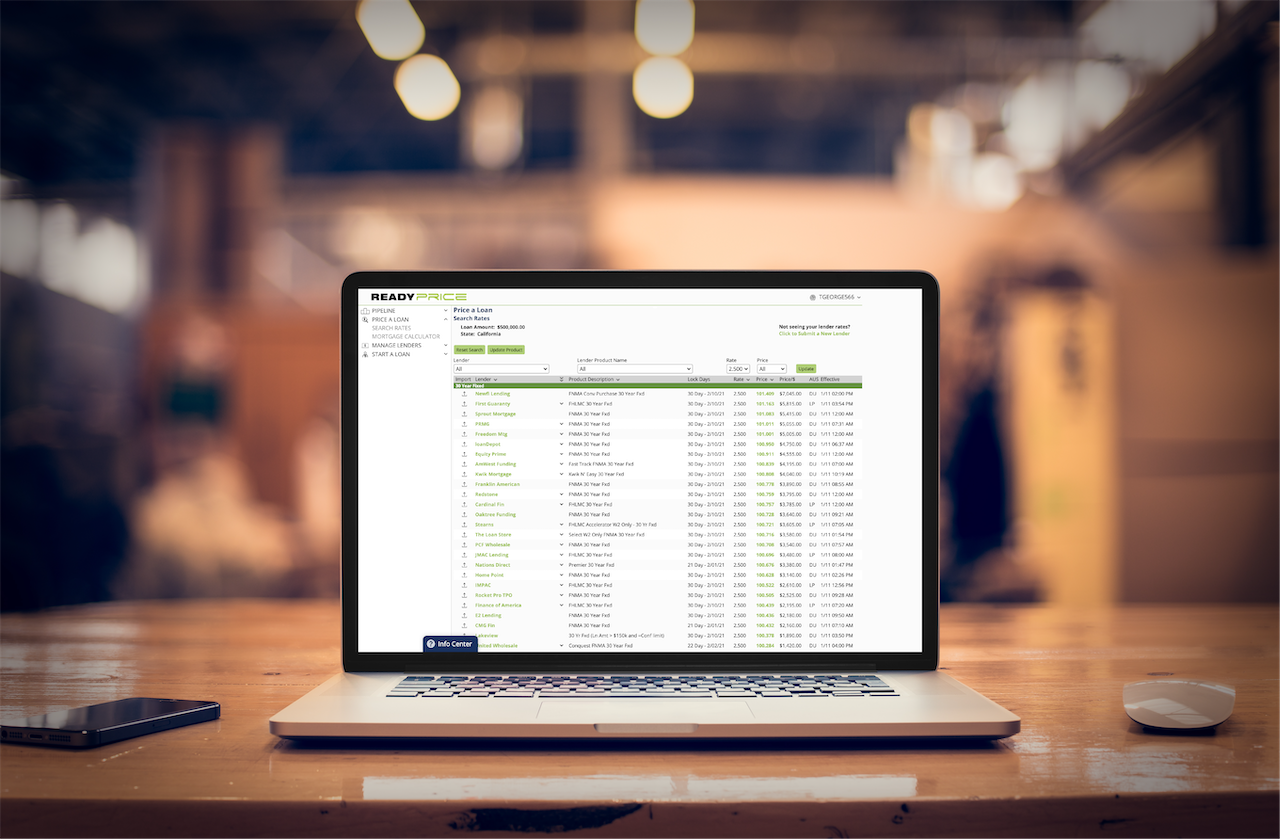

At ReadyPrice, our product pricing engine, automated underwriting, and loan delivery are all offered in a single digital platform, providing every broker with the opportunity to delight their customers. Similar to the reef life the Law of Reciprocity is clearly present throughout our ecosystem, ensuring that brokers and lenders alike are benefiting from it. Our lending partners sponsor that platform, giving brokers free access to information and technology that will allow them to make better decisions quicker.

ReadyPrice is paving the digital path for brokers to interact with multiple lenders, working together in symbiosis to stimulate our ecosystem. Brokers can find the best rates for their customers through our pricing engine, underwrite those loans without leaving the platform, and deliver approved loans to their lender of choice. Lenders are given a platform to market their rates and features, reaching brokers that they might not otherwise. It’s a win-win.

Evolution

Symbiosis and evolution go hand-in-hand, and at ReadyPrice, we want to see the continued evolution of our industry. As part of that evolution, we are excited to introduce a new series of interviews with leaders in the mortgage industry called The Wholesale Channel. In these interviews, we get a chance to talk with top industry leaders about what’s happening in the industry today. The goal of this channel is to start conversations and provide insight from some of the lenders that you do business with regularly, giving everyone a chance to better understand the way they think about our industry. These leaders are contributing to our ecosystem by sharing information and insight into their companies - doing their part to keep our coral reef alive and healthy. Check out The Wholesale Channel and learn something new today.

Our premiere interviews are short and sweet, sitting down with a few very well-known lending leaders from Stearns, PRMG, NEWFI, and more. The interviews all touch on different topics including industry news, cultivating relationships, and leadership to name a few. Their passion is palpable as they explain how their companies are growing and why they are attractive to brokers.

Sinking Into The Reef

As we wrap up this article, let this idea of the coral reef sink in. ReadyPrice is here to offer you this fresh take on our symbiotic relationships, the vast advantages of our mortgage technology, and its ability to transform our industry. It’s an exciting time and we are happy to connect brokers with lenders on our platform while providing seamless execution of the mortgage process. Sign up for your complimentary broker account today at www.readyprice.com/brokers.

About ReadyPrice

ReadyPrice is a leading mortgage technology connecting mortgage loan originators and lenders to support more efficient loan origination. The Product, Pricing, & Eligibility technology is free to use for individual mortgage brokers. For more information, visit www.readyprice.com.