According to the association’s website, the certification program provides mortgage professionals with the training to better serve clients who are ending marriages, as well as additional mentoring, coaching, and business development designed to help them reach their audience.

For Brun, background knowledge and a broader understanding of how those pieces intersect with real property issues is a key component to working in the divorce lending niche. Mortgage professionals who don’t see the difference between divorce lending and other less complicated channels fail their clients and risk doing them significant harm down the road, she said.

“They can provide value or chaos,” she said

Word Of Mouth And Relationship Building

Brian Sacks, a mortgage loan originator at Homebridge Financial, has been in the loan origination business since the 1980s and started working as a certified divorce lending professional in the last four years. Sacks, who calls Bruns’ course “outstanding,” said the niche fits into his philosophy that loan originators need to have a multipronged approach to stay in business.

As for the divorce niche, Sacks said the benefits are pretty simple: “These are people who have to sell,” he said. “It’s not rate sensitive.”

Another advantage, in Sacks’ view, is that he has developed relationships with mediators and divorce lawyers that enable him to participate in the niche without having to advertise, an act that he described as “cheesy.”

“You come blessed,” he said. “They bring us in while negotiations are going on.”

The key, for Sacks, is to come in early enough to make sure mistakes haven’t already been made, such as the case of a divorce in which the client who was keeping the home by virtue of the divorce agreement hadn’t applied for a mortgage. As it turned out, the person was not eligible for a mortgage, but no one had thought to ask.

In another case, Sacks said, the person keeping the home as a result of the settlement needed a year of alimony payments to build credit and income requirements to qualify for a mortgage.

“These are not quick loans generally speaking,” said Sacks, who estimated that he closes 15 to 20 divorce loans a year.

The key to working in the niche, Sacks said, is to realize that you are there to help mediators or divorce lawyers do a better job for their clients and get them through a very difficult time, albeit one that will result in the purchase of one home and sometimes two.

“The approach must be one of an educator not a beggar,” he said. “Too often LOs are just walking in with their hands held out,” he said.

Helping People

Cindy Tamsin, a senior mortgage advisor and certified divorce lending professional at House America Financial, has been involved in the divorce lending channel for about five years and said it represents about 5% to 10% of her business annually, although she believes it could be a full-time job.

“It’s slowly growing,” she said. “There will never be a shortage of people divorcing.”

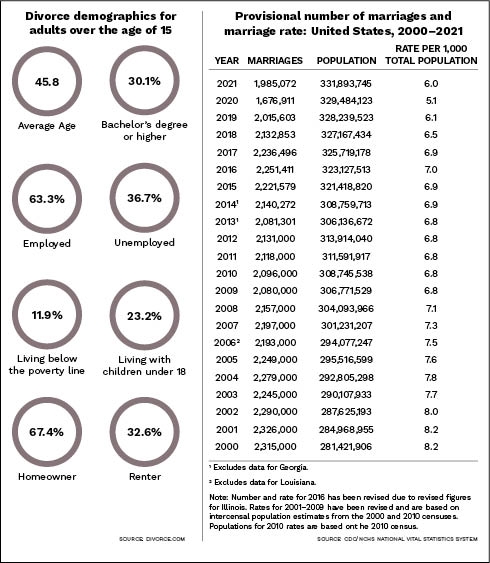

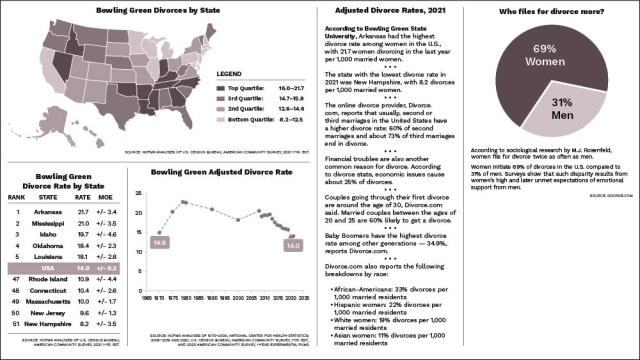

While there may not be a shortage, the Bowling Green research does indicate that the divorce rate is at its lowest in 40 years. But, still, almost a million people a year are calling it quits on their marriages.

Like Brun, she went through a divorce and realized that lenders could provide a much better experience for those going through a break up in which the only bigger issue than what happens to the house is what happens to the kids.

“My goal is to help people. When I went through it I didn’t know what to do,” Tamsin said. “I got it all wrong.”