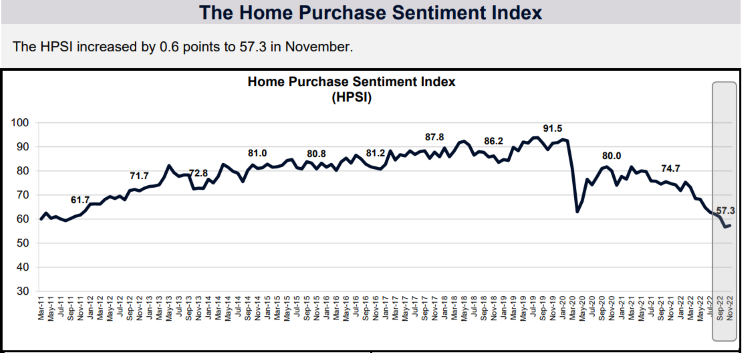

Fannie Mae Home Purchase Sentiment Index Rises For 1st Time In 9 Months

Index increased 0.6 points in November after hitting all-time low in October.

- The percentage of respondents who said it is a good time to buy a home remained unchanged at 16%.

- The percentage who said it is a bad time to buy decreased from 80% to 79%.

- The percentage of respondents who said it is a good time to sell a home increased to 54%, while the percentage who said it’s a bad time to sell decreased to 39%.

The Fannie Mae Home Purchase Sentiment Index (HPSI) increased 0.6 points in November to 57.3, its first increase in nine months, the government-sponsored enterprise said Wednesday.

The index set an all-time low in October, and remains significantly lower than its level at this time last year. Year over year, the full HPSI index is down 17.4 points, Fannie Mae said.

Four of the index’s six components increased modestly month over month, including those associated with the conditions for buying and selling a home, both of which also remain well below year-ago levels.

Higher mortgage rates continue to worsen affordability, and 62% of respondents expect mortgage rates to climb even higher over the next year, compared to only 10% who expect rates to decline.

“Both consumer homebuying and home-selling sentiment are significantly lower than they were last year, which, in our view, is unsurprising considering mortgage rates have more than doubled and home prices remain elevated,” said Doug Duncan, Fannie Mae senior vice president and chief economist. “Following eight months of consecutive declines, the HPSI did tick up slightly in November, but is essentially unchanged since hitting its all-time low last month.”

Duncan said that, with consumers continuing to expect mortgage rates to rise but home prices to decline, it has created “a situation that we believe will contribute to a further slowing of home sales in the coming months, as both homebuyers and home-sellers have reason for apprehension.”

While mortgage rates rose in November, they pulled back toward the end of the month and the beginning of December. The 30-year fixed mortgage was 6.37% on Wednesday, up 0.04% from Tuesday, according to Mortgage News Daily.

Duncan added that Fannie Mae expects mortgage demand to “continue to be curtailed by affordability constraints, while homeowners with significantly lower-than-current mortgage rates may be discouraged from listing their property and potentially taking on a new, much higher mortgage rate.”

HPSI Component Highlights:

- Good/Bad Time to Buy: The percentage of respondents who said it is a good time to buy a home remained unchanged at 16%, while the percentage who said it is a bad time to buy decreased from 80% to 79%. As a result, the net share of those who said it is a good time to buy increased 1 percentage point month over month.

- Good/Bad Time to Sell: The percentage of respondents who said it is a good time to sell a home increased from 51% to 54%, while the percentage who said it’s a bad time to sell decreased from 42% to 39%. As a result, the net share of those who said it is a good time to sell increased 6 percentage points month over month.

- Home Price Expectations: The percentage of respondents who said home prices will go up in the next 12 months remained unchanged at 30%, while the percentage who said home prices will go down decreased from 37% to 34%. The share who think home prices will stay the same increased from 26% to 30%. As a result, the net share of those who said home prices will go up increased 3 percentage points month over month.

- Mortgage Rate Expectations: The percentage of respondents who said mortgage rates will go down in the next 12 months increased from 6% to 10%, while the percentage who expect mortgage rates to go up decreased from 65% to 62%. The share who think mortgage rates will stay the same remained unchanged at 24%. As a result, the net share of those who said mortgage rates will go down over the next 12 months increased 7 percentage points month over month.

- Job Loss Concern: The percentage of respondents who said they are not concerned about losing their job in the next 12 months decreased from 85% to 78%, while the percentage who said they are concerned increased from 15% to 21%. As a result, the net share of those who said they are not concerned about losing their job decreased 13 percentage points month over month.

- Household Income: The percentage of respondents who said their household income is significantly higher than it was 12 months ago increased from 25% to 27%, while the percentage who said their household income is significantly lower increased from 15% to 17%. The percentage who said their household income is about the same decreased from 60% to 55%. As a result, the net share of those who said their household income is significantly higher than it was 12 months ago remained unchanged month over month.

The Home Purchase Sentiment Index distills information about consumers’ home purchase sentiment from Fannie Mae’s National Housing Survey (NHS) into a single number. The HPSI reflects consumers’ current views and forward-looking expectations of housing market conditions and complements existing data sources to inform housing-related analysis and decision making.

It is constructed from answers to six NHS questions that solicit consumers’ evaluations of housing market conditions and address topics that are related to their home purchase decisions. The questions ask consumers whether they think it is a good or bad time to buy or to sell a house, what direction they expect home prices and mortgage interest rates to move, how concerned they are about losing their jobs, and whether their incomes are higher than they were a year earlier.

Fannie Mae’s National Housing Survey (NHS) polled approximately 1,000 respondents via live telephone interview to assess their attitudes toward owning and renting a home, home and rental price changes, homeownership distress, the economy, household finances, and overall consumer confidence. Homeowners and renters are asked more than 100 questions used to track attitudinal shifts, six of which are used to construct the HPSI (findings are compared with the same survey conducted monthly beginning June 2010). The November 2022 survey was conducted between Nov. 1-19, 2022. Most of the data collection occurred during the first two weeks of this period. Interviews were conducted by ReconMR on behalf of PSB Insights and in coordination with Fannie Mae.