Millennial And Gen Z Borrowers Climb The Credit Tier Ladder

30% of millennials and Gen Zers moved up credit tiers within the past two years, more than older consumers.

Borrowing habits and credit outlook for millennials and Gen Zers is positively trending, according to a new study from Open Lending and TransUnion. Borrowers within this age group are deemed “thin-file borrowers” due to their lack of credit history, yet data shows that 30% of millennials and Gen Zers moved up credit tiers within the past two years compared to 22% of older consumers.

Despite these positive trends, Open Lending Senior Vice President of Marketing Kevin Filan said many financial institutions are hesitant to extend loans to borrowers with thinner credit files and lower credit scores.

“However, this strategic consumer segment shows immense potential for upward credit mobility compared to their older counterparts,” Filan said. “The financial institutions that intelligently address these ‘emerging prime’ borrowers through comprehensive data analysis and decisioning can generate higher-yielding loan opportunities and long-term customer loyalty.”

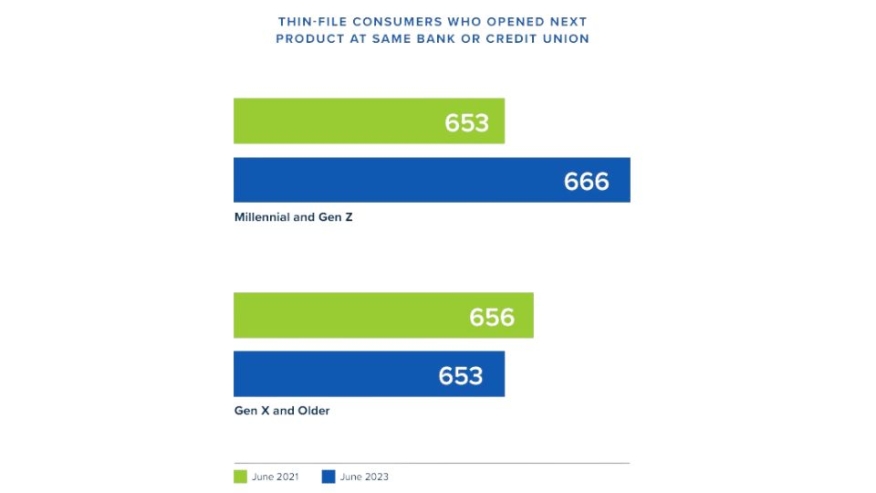

One of the major takeaways from the study found that younger consumers are also loyal consumers. Two out of every five millennial and Gen Z thin-file consumers who received an automotive loan at a bank or credit union returned to the same type of financial institution for their next product and often with a higher credit score. That happens more often than returning thin-file consumers from older generations.

“We are excited to collaborate with Open Lending to provide a broader and more accurate picture of younger borrowers’ financial health and credit potential despite only just starting their credit journey,” said Satyan Merchant, senior vice president of automotive and mortgage business at TransUnion. “We believe that the financial institutions that set these deserving borrowers on the path to financial wellness will be rewarded with long-term loyalty through subsequent credit products.”