Mortgage Prepayments Fell, Delinquencies Rose In November

Black Knight 'First Look' finds signs that more homeowners are struggling to make payments.

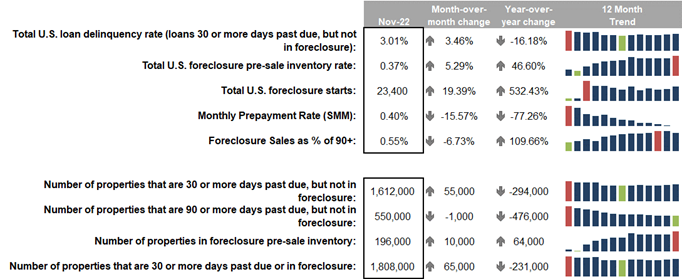

- Prepayment activity in November dropped 15.6% to the lowest rate on record since 2000.

- National delinquency rate rose in November to 3.01%.

- Foreclosure starts rose 19% on the heels of October’s increase.

Black Knight’s First Look at mortgage performance in November isn’t pretty, with signs that a growing number of homeowners are struggling with their mortgage payments.

Among the findings of Black Knight’s First Look at its monthly Mortgage Monitor, which is derived from its loan-level database representing the majority of the national mortgage market:

- Prepayment activity in November dropped 15.6% to a single month mortality (SMM) rate of 0.4% — once again marking the lowest rate on record since before 2000, when Black Knight started reporting the metric.

- The national delinquency rate, meanwhile, rose another 3.5% in November to 3.01%, up 10 basis points since October. The increase was driven by a 31,000 (+3.9%) increase in 30-day delinquencies, and a 25,000 (+11%) increase in 60-day delinquencies, and

- Foreclosure starts rose again (+19%) on the heels of October’s increase, but the month’s 23,400 starts are still below the recent high seen in June and remain 30% below pre-pandemic levels.

There were more indications that foreclosures are on the rise, though not to pre-pandemic levels. Foreclosure proceedings were started on 4.3% of serious delinquencies in November, up 7 basis points from October but still 44% less than the rate seen in the years before the pandemic.

In addition, the active foreclosure inventory rose 5.3%, though 2022 volumes remain subdued after the record lows of 2021 due to widespread moratoriums and forbearance protections.

By state, Mississippi had the worst percentage of non-current mortgages at 6.7%, followed by Louisiana at 6.08%, Oklahoma at 5.03%, Alabama at 4.7% and West Virginia at 4.66%.

Oregon, on the other hand, had the lowest percentage of non-current mortgages at 2.06%, followed by Colorado at 1.98%, California at 1.9%, Idaho at 1.79% and Washington at 1.69%.

The look at non-current mortgages combines foreclosures and delinquencies as a percentage of activer loans in the state, Black Knight said.

Black Knight also noted that the delinquency rate in Florida rose another 18 basis points in November to 3.6% as the impact of Hurricane Ian on homeowners’ ability to make mortgage payments continues.