NAHB: 49% Of U.S. Households Can’t Afford A $250K Home

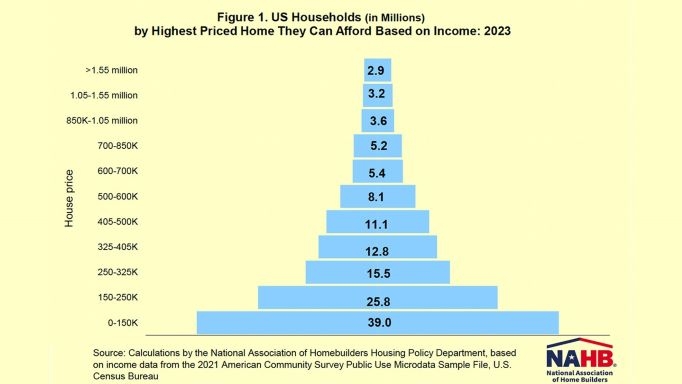

Organization updates its 2023 ‘housing affordability pyramid.’

- According to the NAHB, 64.8 million households (48.9%) nationwide are unable to afford a $250,000 home.

- It said 39 million U.S. households have insufficient income to afford a $150,000 home.

Of the 132.5 million households nationwide, nearly 49% are unable to afford a house priced at $250,000.

That’s according to the National Association of Home Builders (NAHB), which recently updated its "housing affordability pyramid" for 2023.

The pyramid is based on conventional underwriting standards that assume the combined cost of a mortgage, property taxes, and property insurance should not exceed 28% of household income. Based on that methodology, NAHB economists calculated how many households have enough income to afford a home at various price thresholds.

According to those calculations, 64.8 million households, or 48.9%, out of a total of 132.5 million nationwide, are unable to afford a $250,000 home.

At the base of the pyramid are 39 million U.S. households with insufficient incomes to afford a $150,000 home.

The pyramid's second step consists of 25.8 million with enough income to afford a top price somewhere between $150,000 and $250,000. Combining the bottom two rungs produces the 64.8 million households that can’t afford a $250,000 home.

The nationwide median price of a new single-family home is $425,786, meaning half of all new homes sold in the U.S. cost more and half cost less. A total of 96.5 million households — roughly 73% of all U.S. households — cannot afford this median-priced new home, the NAHB said.

“This helps put affordability concerns into perspective and goes a long way toward explaining why housing affordability now stands at a more than 10-year low,” the organization said in its report.

The top of the pyramid shows that 9.7 million households have enough income to buy an $850,000 home (adding up the top three rungs), and 2.9 million have enough for a home priced at $1.55 million.

“Market analysts should never focus on this to the exclusion of the wider steps that support the pyramid's base,” the NAHB said.

On March 2, NAHB released its new Priced-Out Estimates for 2023, which shows that a $1,000 increase in the price of a median-priced new home will exclude 140,436 U.S. households from the market for the home.

Prospective home buyers also are adversely affected when interest rates rise, the organization said.

NAHB's priced-out estimates show that 1.28 million households are priced out of the market for a new median-priced home at $425,786 when interest rates rise a quarter-point from 6.25% to 6.5%. An increase from 6.5% to 6.75% prices approximately 1.29 million households out of the market.

Freddie Mac said last week that the 30-year fixed mortgage rate had risen to 6.65%.