Pending Home Sales Slid 4% in November

Sixth-straight monthly decline occurred even as mortgage rates dipped.

- Pending home sales decreased for the sixth consecutive month, down 4% from October.

- Year-over-year, pending transactions dropped by 37.8%.

Despite a modest decline in mortgage rates in November, pending home sales slid for the sixth consecutive month, according to the National Association of Realtors (NAR).

All four U.S. regions recorded both month-over-month and year-over-year declines in transactions.

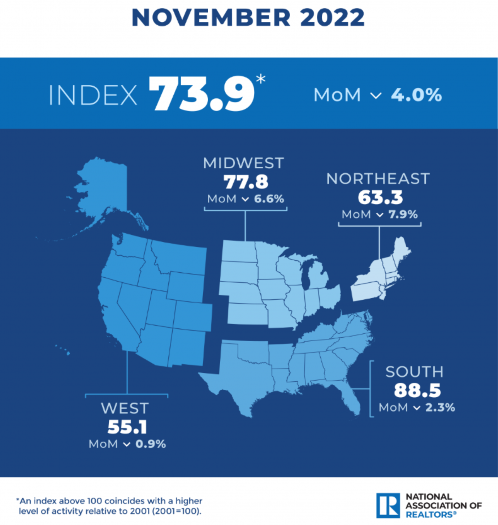

NAR’s Pending Home Sales Index (PHSI) — a forward-looking indicator of home sales based on contract signings — fell 4% to 73.9 in November 2022. Year-over-year, pending transactions dropped by 37.8%. An index of 100 is equal to the level of contract activity in 2001.

"Pending home sales recorded the second-lowest monthly reading in 20 years as interest rates, which climbed at one of the fastest paces on record this year, drastically cut into the number of contract signings to buy a home," said NAR Chief Economist Lawrence Yun. "Falling home sales and construction have hurt broader economic activity."

Yun noted that the residential investment component of GDP has fallen for six straight quarters. "There are approximately two months of lag time between mortgage rates and home sale,” he said. “With mortgage rates falling throughout December, home-buying activity should inevitably rebound in the coming months and help economic growth."

Mortgage rates continued to pull back in December 2022 from their early November peak, falling for five consecutive weeks, according to Freddie Mac. Rates fell for a sixth-straight week the following week, before rising at the end of the month, Freddie Mac said.

Odeta Kushi, deputy chief economist for First American Financial Corp., said that while mortgage rates dipped in November, they remained near 20-year highs. “However, rates dipped further in December and mortgage applications data in November and December point to buyers returning to the market,” she said.

“Pending-home sales in November reflect a freeze in the housing market, as buyers remain on the sideline and sellers are staying put,” Kushi said. “Yet, mortgage applications point to a thawing, but still cold, housing market as mortgage rates come down.”

By Region

- The Northeast PHSI slipped 7.9% from last month to 63.3, a drop of 34.9% from a year earlier.

- The Midwest index decreased 6.6% to 77.8 in November, a fall of 31.6% from one year ago.

- The South PHSI retracted 2.3% to 88.5 in November, fading 38.5% from the prior year.

- The West index dropped by 0.9% in November to 55.1, retreating 45.7% from November 2021.

"The Midwest region — with relatively affordable home prices — has held up better, while the unaffordable West region suffered the largest decline in activity," Yun said.

Methodology

The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

The index is based on a sample that covers about 40% of multiple listing service data each month. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing-home sales in 2001 fell within the range of 5.0 to 5.5 million, which is considered normal for the current U.S. population.

The National Association of Realtors is America's largest trade association, representing more than 1.5 million members in all aspects of the residential and commercial real estate industries.