Spring Surge: Optimal Blue Sees Record-High Credit Score Marks

Optimal Blue's March 2024 Originations Market Monitor report saw steady rate-lock volume growth.

Optimal Blue released its March 2024 Originations Market Monitor report, which reveals the average homebuyer credit score has reached 737 – an all-time high since it began tracking this data in January 2018.

In February and March 2024, FHA borrower credit scores reached six-year highs of 677 and 676, respectively. VA borrower credit scores reached their peak since February 2021, and conforming loan borrower credit scores achieved their highest mark since January 2021.

“Driven by rising interest rates and home prices, we’re witnessing the highest average homebuyer credit scores in years,” said Brennan O’Connell, director of data solutions at Optimal Blue. “This unprecedented level of creditworthiness among purchasers is largely a result of the affordability issues borrowers face in today’s housing market, with prospective buyers with lower credit scores waiting on the sidelines until conditions improve. However, it is encouraging to see a strong pool of qualified buyers still actively pursuing homeownership. This trend underscores the resilience of the market and the adaptability of consumers in navigating the current economic landscape.”

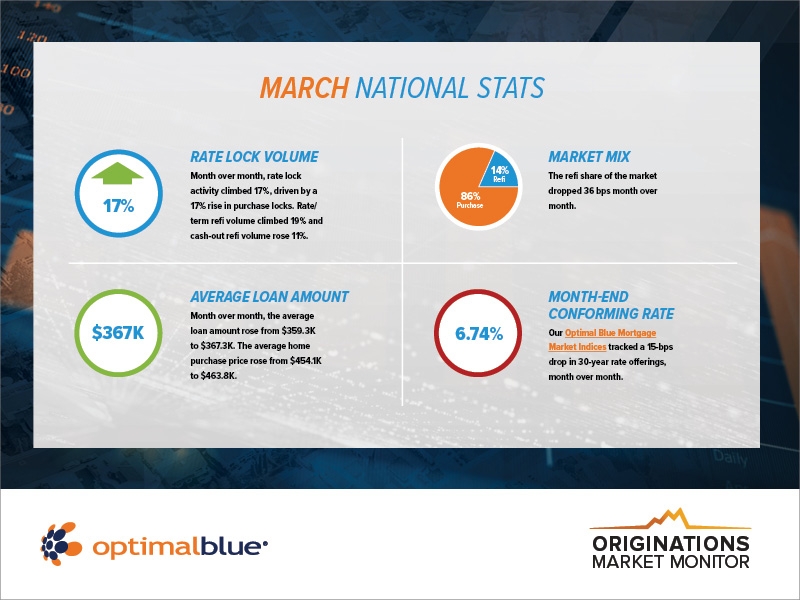

Rate lock volume showed steady month-over-month growth of 17% in March as the spring buying season got underway, despite the potential buyer pool being somewhat limited to borrowers with higher credit. While refinances comprised a small share of lock volume, rate/term activity rose 19% and cash-out activity rose 11%, aided by an improving rate environment.

The Optimal Blue Mortgage Market Indices (OBMMI) 30-year benchmark rate decreased by 15 bps to 6.74%, signaling an improving rate environment conducive to both purchase and refinance transactions. The OBMMI jumbo index saw the largest rally, dropping 27 bps to 7.07%.

Despite recording strong month-over-month gains, the number of purchase locks in March dropped by 24% compared to the same period in 2023. This decline in year-over-year figures is likely attributed to the timing of the Easter holiday weekend, which occurred in March this year and April last year. To gauge market trajectory more accurately, attention should be paid to April and May data.

In FHA lending, market share has experienced a fourth consecutive month-over-month decline, decreasing by 0.72% to encompass 19% of total lock volume. From 2021 to 2023, FHA volume exhibited steady growth, climbing from 9% to a peak of 23% in November 2023, before embarking on the current streak of declines.