A Third Of Homebuyers Paying In Cash

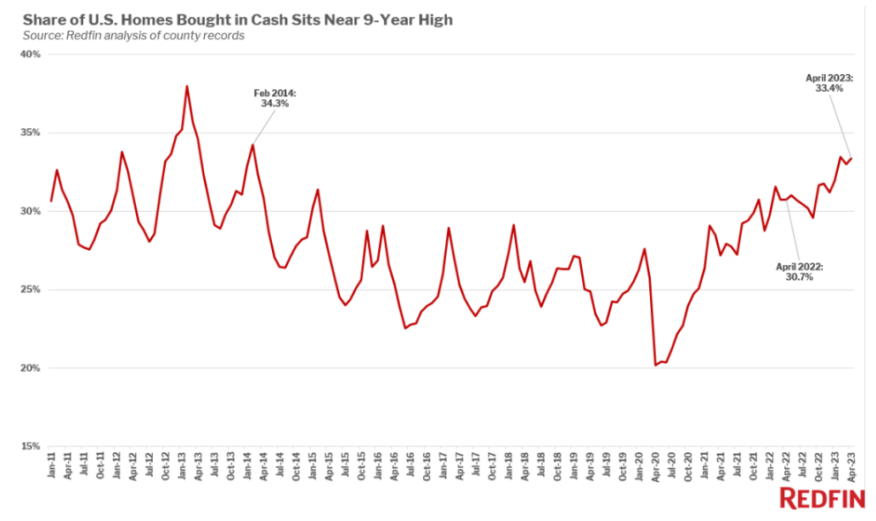

Redfin says all-cash home purchases in April hit highest level since 2014.

- Redfin said 33.4% of purchases in April were made in cash, up from 30.7% a year earlier and similar to February's 33.5% share.

- Overall home sales, though, were down 41% from a year earlier in April in the 40 most populous metros.

- The typical down payment in April was $52,500, down 18% YOY, the second-biggest drop since May 2020.

- About one in six mortgaged home sales used an FHA loan in April, the highest share since February 2020.

A third of U.S. home purchases were made entirely in cash in April, the highest share for April in nine years, according to a report from Redfin.

The technology-powered real estate brokerage said 33.4% of purchases in April were made in cash, up from 30.7% a year earlier and comparable with February’s 33.5% share.

Cash purchases made up a bigger portion of the homebuying pie for one major reason, Redfin said — elevated mortgage rates are deterring homebuyers who take out mortgages more than they’re deterring all-cash buyers.

Overall home sales were down 41% from a year earlier in April in the 40 most populous metros included in Redfin’s analysis, compared with a 35% decline for all-cash sales.

Mortgage rates are near their highest level in 15 years, deterring many potential homebuyers who would need a mortgage. High rates can also deter all-cash buyers, it said, because they may decide their money is better spent on investments that benefit from high rates, like bonds.

“A homebuyer who can afford to pay in all cash is weighing two potential paths,” said Redfin Senior Economist Sheharyar Bokhari. “They can use cash to pay for the home and avoid high monthly interest payments, or take out a loan and pay a high mortgage rate. In that case, they could use the money that would have gone toward an all-cash purchase to invest in other assets that offer bigger returns, which could partly cancel out their high mortgage rate.”

Bokhari added that buyers who can’t afford to pay in all cash also have two potential paths, though they are significantly different.

“They can avoid a high mortgage rate by dropping out of the housing market altogether, or they can take on a high rate,” he said. “That discrepancy is the reason the all-cash share is near a decade high, even though all-cash purchases have dropped: Affluent buyers have the choice to pay cash instead of dropping out of the market.”

While competition among homebuyers has fallen, it is still a noteworthy reason for the increase in all-cash sales, Redfin said. The lack of homes for sale prompts competition in some metros, motivating buyers to make all-cash offers to win homes.

[Cash doesn't have to be king: Even though cash may help those buyers swoop in with the big bucks, originators can still tap into cash buyers and help buyers compete against all-cash offers.]

Down Payments Fall

Redfin also noted that down payments fell in April to an average of $52,500, down 18% from a year earlier and the second-biggest drop since May 2020, when the housing market ground to a halt at the start of the pandemic. The biggest was a 22% drop in March 2023, it said.

Down payments have been falling on a year-over-year basis since November.

In percentage terms, the median down payment was equal to 13.1% of the purchase price, down from 16.5% a year earlier.

Even though the inventory shortage is causing more competition than one might expect given the current, relatively tepid demand, the bidding-war rate is much lower than it was a year ago, Redfin said.

Forty-six percent of home offers written by Redfin agents faced competition in April, down from roughly 59% a year earlier. Less competition means fewer buyers must offer a big down payment to prove their financial stability and stand out from the crowd. It also indicates that FHA loans, which require lower down payments, are becoming more prevalent.

The typical U.S. home sold for 4% less in April than a year earlier, and the drop is much bigger in some metro areas. Lower home prices mean lower down payments.

Share Of FHA Loans Rises

Roughly one in six (16.4%) U.S. mortgaged home sales used an FHA loan in April, the highest share since February 2020, just before the pandemic began. That’s up from 10.4% a year earlier; the largest year-over-year gain on record.

Just under 7% of mortgaged home sales used a VA loan, down from an eight-year high of 8% in February but up from 5.9% year over year.

Conventional loans are the most common type, making up 76.8% of mortgaged home sales. But the share of buyers using a conventional loan dropped from 83.7% a year earlier, the biggest year-over-year decline on record.

Redfin agents in pandemic homebuying boomtowns Boise, Idaho; Austin, Texas; and Orlando, Fla., report seeing an uptick in FHA loans in early spring. But Orlando Redfin agent Nicole Dege said she’s noticed a decline in buyers using FHA loans since then, as inventory has fallen and competition has ticked up.

High mortgage rates may also make buyers more likely to choose an FHA loan over a conventional loan, as FHA rates tend to be slightly lower; the average daily FHA rate was 6.54% on June 6, versus 6.89% for a conventional loan.

Even though FHA loans are becoming more common, the fact that one-third of home purchases are made in cash reflects the unequal nature of today’s housing market, Redfin said.

Affluent buyers who can afford to pay for a home in cash still have an advantage because offers are easier to get accepted and they don’t have to take on high mortgage rates.

Just 6.1% of mortgaged home sales used a jumbo loan in April, down from 10.6% a year earlier but up from the decade-low of 4.3% hit in January.

Jumbo loans have become less common over the last year as mortgage rates have risen. Elevated rates have pushed some buyers of expensive homes out of the market entirely and pushed some into lower price ranges. Banks are also more hesitant to take potential losses on jumbo loans after this year’s bank failures.