Zillow: 2M Homes No Longer Require A Jumbo Loan

This is the result of FHA's update to the baseline conforming loan limit in high-cost areas topping $1 million.

More than 2 million homes nationwide no longer require a jumbo loan, giving homebuyers additional inventory that is covered by a more accessible financing option, according to a new analysis by Zillow Home Loans.

The change is due to the Federal Housing Finance Agency's (FHFA) recent increase of conforming loan limits to $1,089,300 in some high-cost markets.

Zillow said the change may be welcome for buyers looking to purchase a home in the coming shopping season, as jumbo loans often come with additional fees and more stringent qualification standards, making them less affordable for many buyers.

Compared to conforming loans, jumbo loans typically require a higher credit score — 700 is the minimum score many lenders accept for such loans, versus a score of 620 that many require for a conforming loan.

Bigger down payments are also the norm with a jumbo loan:

- Jumbo loans often require 20% down, although some call for even higher down payments. Some jumbo loans also will require proof of larger cash reserves than conventional loans, up to 12 months-worth.

- For the majority of the country, the conforming loan requirement increased by $79,000 — going from $647,200 in 2022 to a baseline of $726,200 in 2023. In the most expensive parts of the country, equivalent to 103 counties, the conforming loan limit was raised to $1,089,300, topping the $1 million mark for the first time.

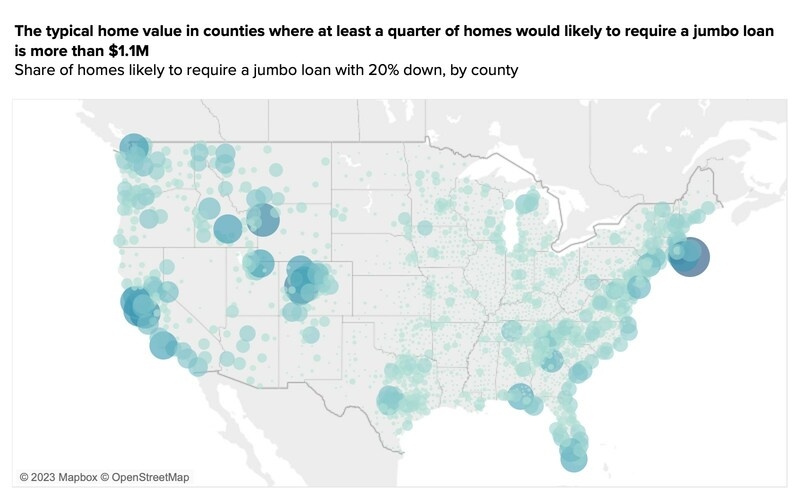

These high-cost counties are largely concentrated in the nation's most expensive metro areas, along the coasts and in the Mountain West.

While home price appreciation has begun to plateau, home prices are still significantly higher than a year ago. Affordability challenges weighed heavily on home sales in the second half of 2022 — the number of listings pending in November fell by 16.5% from October and are down 38% compared to last November.

"The addition of 2 million homes that now qualify for conforming loan options across the county is welcome news for homebuyers entering a shopping season with fewer homes on the market," said Nicole Bachaud, Zillow Home Loans senior economist. "Home price appreciation has slowed significantly, and this means that homes nearing jumbo loan territory will stay eligible for conforming loans longer than we have seen in the last few years."