Fed Projects A Single Rate Cut As Inflation Eases In May

“We welcome today’s reading and hope for more like that,” Fed Chair Powell said at the close of Wednesday's FOMC meeting.

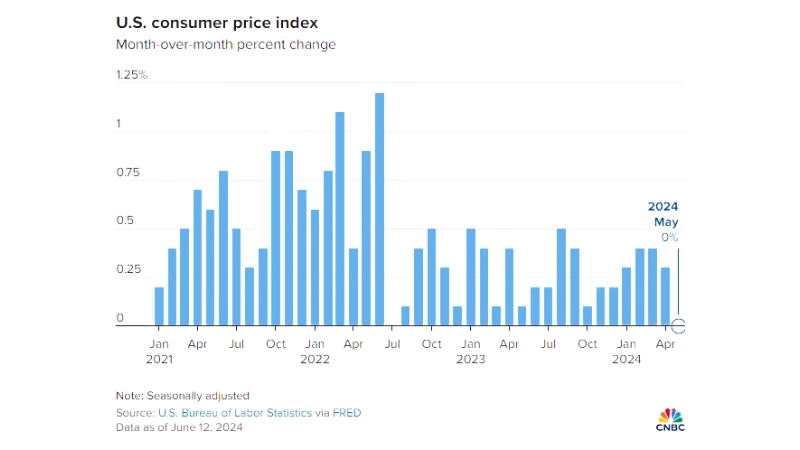

Inflation data published Wednesday morning by the U.S. Bureau of Labor Statistics indicate the core Consumer Price Index (CPI) registered 3.4% in May, a deceleration from the 3.6% annual pace logged in April. Headline inflation, which includes food and energy prices, also eased, rising 3.3% annually in May – a hair lower than April’s 3.4% annual pace of price growth.

Strong jobs data through the first half of the year, bolstered by a stronger-than-expected reading in May, have kept consumer spending high and allayed concerns of a weakening economy, though annual GDP growth shrunk by half in the first quarter and wage growth has moderated.

May’s inflation reading was “the second step in the right direction after a series of higher readings in the first quarter,” CoreLogic Chief Economist Dr. Selma Hepp told NMP. “If next months’ inflation readings continue in this direction, the Fed could have a case for cuts. Housing does remain a sticky point and continues to decelerate at a much slower pace but given the lagged shelter inflation response, that shouldn’t be a reason not to start the rate cut.”

While the energy index declined 2% from April, led by a 3.6% decrease in the gasoline index, the overall shelter index, which includes rent and owners’ equivalent rent, climbed 5.4% in May, driving more than two-thirds of the increase in core inflation and suggesting that the Fed’s rate-hiking campaign has yet to have a dampening effect on high housing costs.

Home prices near all-time highs and borrowing costs double their pandemic-era lows have many consumers pessimistic about the prospects of buying or selling homes right now. Purchase loan activity declined in the first quarter of 2024 to the lowest level since 2000 – down nearly 10% from the fourth quarter of 2023 and less than one-third of 2021’s quarterly highs.

On Wednesday afternoon, Federal Reserve Chair Jerome Powell addressed May’s inflation data and the central bank’s revised dot plot in a press conference following the Federal Open Market Committee’s (FOMC) two-day meeting.

“The labor market has come into better balance,” Powell announced, but inflation was “still too high,” undergirding the committee’s decision to leave the Fed funds rate unchanged in the 5.25%-5.5% range. FOMC participants expect labor market strength to continue, Powell added, saying longer-term inflation expectations remain well-anchored based on a broad set of consumer and market indicators.

“We welcome today’s reading and hope for more like that,” he said. When asked if two or three more inflation readings like May’s would result in a September rate cut, Powell declined to commit to September outcomes. Instead, he called today’s reading “encouraging.”

Powell also declined to say whether sticky shelter inflation would in-and-of-itself delay the Fed’s plans for rate cuts, insisting that the committee’s focus rests on reading the economic data in aggregate.

Eric Orenstein, senior director of nonbank financial institutions at Fitch Ratings, sees cause for optimism as the summer homebuying season progresses, despite the FOMC’s tipping toward only one rate cut in 2024. “Even with the Fed pumping the brakes on potential rate cuts,” Orenstein told NMP, “larger mortgage companies could be in line for better earnings in the coming months with homebuying picking up and less competition for originations compared to last year.”

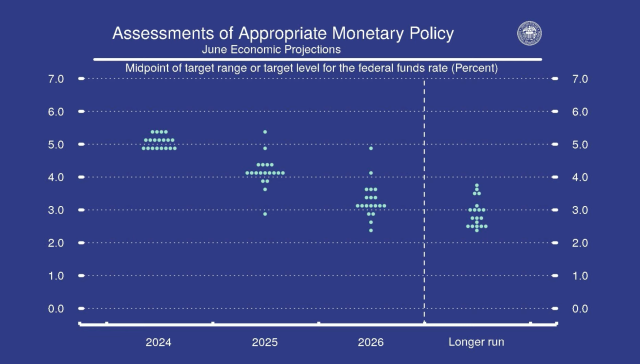

The Fed’s quarterly “dot plot” update provides a projection of where top Fed policymakers believe the benchmark federal funds rate is headed, to include future rate cuts or hikes. The dot plot updated in March signaled three Fed rate cuts through the end of 2024. In the lead-up to Powell’s remarks, investors had priced Fed funds futures at a 50% chance of a September cut.

Median projections following June's FOMC meeting placed the Fed funds rate at 5.1% at the end of 2024 and 4.1% by the end of 2025, Powell announced. Today’s updated dot plot showed 15 of the 19 policymakers predicting at least one rate cut in 2024. Eight officials estimated two cuts, seven officials estimated just one cut, and four officials predicted zero cuts.

No officials projected the three cuts that nine officials saw fit to in March.

"Hopefully this can start a trend in CPI to provide consistent data for more opportunities for the Fed to do cut rates later in the year," said Senior Director and Head of Trading at Mortgage Capital Trading (MCT), Andrew Rhodes.

As of March 2024, nearly 60% of borrowers held a mortgage under 4%, according to research on the "lock-in effect" published by the Federal Housing Finance Administration (FHFA). For that reason, "lower rates will help the market to a certain extent," Rhodes believes, "however there is a lot of room between current rates and rates to spur refi incentives for most borrowers."

While Powell noted on multiple occasions that the FOMC participants expect economic strength to continue, he also said “the economic outlook is uncertain.” If human nature factors at all into the central banks’ decision making, Powell warned those assembled – and by extension, investors watching and listening to his remarks – to check their optimism bias, and not allow a positive reading to out-signal the string of three negative readings at the beginning of the year.

“So far this year, the data have not given us that greater confidence,” Powell explained of the committee’s focus on the long-term rate path to 2%, not isolated incidents. “We’ll need to see more good data.” He cited as encouraging, though, the fact that the U.S. has (so far) avoided the recession that many analysts and agencies had predicted in 2022 and early 2023.

In contention with the FOMC’s announcement, CoreLogic’s Hepp said the Federal Reserve’s higher-for-longer stance on interest rates “is looking more untenable as more American households continue to pull back on spending. As more economic indicators begin to confirm this and unemployment begins to rise, the Fed will then look to cut rates.”

“What’s not clear yet,” Hepp added, “is when exactly the disinflation signs will be consistent enough for the first rate cut – we hope it’s still this year.”