The White House did not say whether Trump believes that low income housing causes crime. But in a statement, spokesman Judd Deere, said the repeal offered “long-overdue regulatory relief and cost savings to communities” and “eliminates D.C. control and strengthens local control on housing and development so communities can decide for themselves how to meet the unique housing needs of each community.”

New Opportunities

The White House does deserve some props for what Trump’s Council of Economic Advisors says is the success of Opportunity Zones, which are economically distressed communities, many of which have lacked any meaningful investment for years. In its latest progress report, the council estimates the country’s 8,764 zones have attracted $75 billion in capital investments and generated some 500,000 jobs in the two years since they were created in the Tax Cuts and Jobs Act of 2017.

Opportunity Zones offer tax benefits to business or individual investors who can elect to temporarily defer tax on capital gains if they timely invest those gain amounts in a Qualified Opportunity Fund. Investors can defer tax on the invested gain until the date they sell or exchange the QOF investment, or Dec. 31, 2026, whichever is earlier.

“This tremendous progress report shows the American people, especially the families who have felt forgotten for years, President Trump’s Great American Comeback is in fact underway,” Secretary Carson said in a press release.

The report, added Acting Domestic Policy Council Director Brooke Rollins in the same release, proves the focus on job growth, rewarding employment and removing bureaucratic middlemen is lifting millions out of poverty and revitalizing communities that haven’t seen investment in decades.”

A Declining HUD

At the same time, though, the Center for Economic and Policy Research, a D.C.-based group which promotes debate on economic and social issues, points out that Trump’s first three budgets have “generally recommended substantial reductions” in HUD’s overall budget, favoring instead to ask state and local governments to shoulder affordable housing activities.

The center pretty much gives the Administration low marks on rental housing and fair housing.

On the latter, it points out that the current White House has proposed regulations to make it more difficult for people who believe they have been discriminated against to sue under the Fair Housing Act. And on the former, Trump’s previous budgets have called for cuts in the Section 8 rental assistance voucher program.

Kick In The Fannie

In September 2019, the administration announced its plan to reform the housing finance system and privatize the government-backed mortgage entities, Fannie Mae and Freddie Mac. The Treasury Housing Reform Plan has three focal points: limit Uncle Sam’s role within the mortgage market, protect taxpayers from future bailouts and promote market competition in the housing finance system.

Proponents of the plan maintain it encourages sustainable home ownership and staves off a severe housing crisis like the one in 2008 that saw housing prices plummet nationally by, on average, almost 20%. But critics argue that a mortgage industry regulated by the free market is inherently biased against low-income families, therefore becoming a barrier to ownership for many.

Also worth a mention is Trump’s executive order supposedly extending the eviction moratorium during the pandemic. But it did nothing of the sort. The headlines might have said so, but a reading of the fine print shows that the President only instructed the Department of Health and Human Services and the Centers for Disease Control to study whether doing so is necessary.

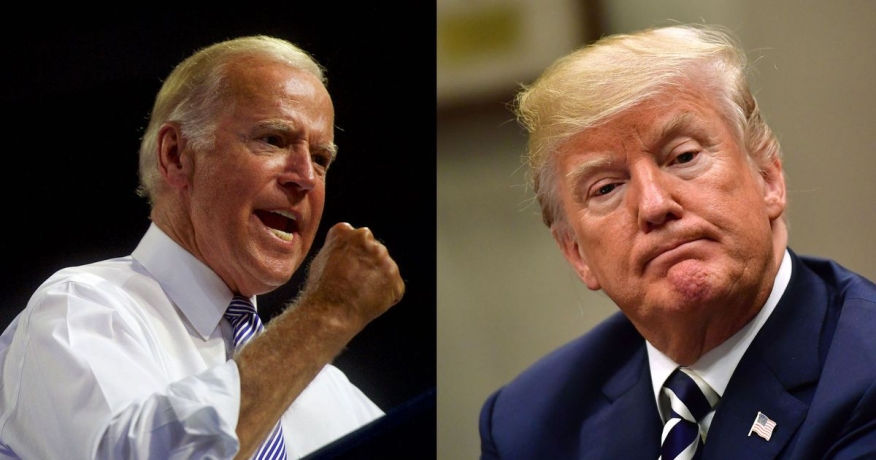

Biden Bulks Up

Meanwhile, the challenger, former Vice President and U.S. Sen. Joe Biden, has a host of ideas when it comes to housing, including ending discriminatory and unfair practices, providing down-payment assistance through a refundable and advanceable tax credit and fully funding federal rental assistance. He would also increase the supply, lower the cost and improve the quality of housing by, among other steps, investing in resilience, energy efficiency and accessibility of houses. And he wants to pursue a comprehensive approach to ending homelessness.

To accomplish all this, the Biden camp figures it will cost some $640 billion over a 10-year spread. But the candidate would pay for it by raising taxes on corporations and large financial institutions. About $300 billion of that amount is devoted to new construction as part of Biden’s $1.3 trillion infrastructure plan. The rest is paid for by instituting a financial fee on certain liabilities of firms with over $50 billion in assets.

Of particular interest to the lending community, the challenger wants to protect homeowners and renters from abusive lenders and landlords by enacting a Homeowner and Renter Bill of Rights modeled after California’s Homeowner Bill of Rights.

Getting Tougher

The proposed legislation is aimed at stopping mortgage brokers from leading borrowers into loans that cost more than appropriate, preventing servicers from moving forward with foreclosure when an owner is in the process of receiving a loan modification and requiring servicers to give borrowers timely status reports on their modification. Also, borrowers would have a private right of action to seek financial redress if these protections are violated, give borrowers the right to a timely notification on the status of their loan modifications, and to be able to appeal modification denials.

Biden’s Bill of Rights would expand protections for renters by prohibiting landlords from discriminating against tenants receiving federal housing benefits. And Biden promises to back legislation which would help tenants facing eviction gain access to legal assistance. Such bills have been introduced in the House and Senate by House Majority Whip James E. Clyburn, D-S.C., and U.S. Sen. Michael Bennet, D-Col.

Furthermore, a Biden Administration would reverse Trump’s attempts to “gut” the disparate impact standard, put into place during Barack Obama’s presidency, that holds that lending practices that have a discriminatory effect can be challenged even if discrimination was not explicit. Thus, financial institutions would once again be held accountable for serving all customers.

The Democratic standard bearer would also roll back policies that have gutted fair lending and fair housing protections for home buyers by requiring communities receiving certain federal funding to proactively examine housing patterns and identify and address policies that have a discriminatory effect. The Trump Administration suspended this Affirmatively Furthering Fair Housing rule in 2018.

Biden will ensure effective and rigorous enforcement of the Fair Housing Act and the Home Mortgage Disclosure Act. And he will reinstate the federal risk-sharing program which has helped secure financing for thousands of affordable rental housing units in partnership with housing finance agencies.

Because of space limitations, you’ll have to visit The Biden Plan for Investing in Our Communities Through Housing to see what else he has in mind. There’s plenty there.