August Housing Starts Stumble

Multiple challenges plague builders: soaring costs, labor shortage, and dearth of buildable land, even as permit data offers hope.

Mortgage rates averaging above 7% have curtailed single-family housing production for August, according to data from the U.S. Department of Housing and Urban Development (HUD) and the U.S. Census Bureau. Builders have been grappling with high mortgage rates and an array of supply-side constraints, including skyrocketing construction costs, a need for more skilled labor, and a shortage of buildable plots.

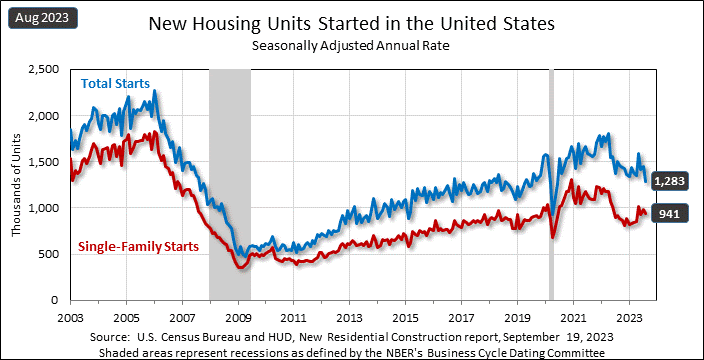

The report indicates an 11.3% decline in overall housing starts for August, bringing it down to a seasonally adjusted annual rate of 1.28 million units. This figure represents the housing units that would be initiated if the current pace were maintained for a subsequent 12 months. Within this aggregate, single-family starts dipped by 4.3% to 941,000 units on a seasonally adjusted annual rate, although this is still a 2.4% increase from the previous year. In stark contrast, the multifamily sector, encompassing apartment buildings and condos, plummeted by 26.3% to a 342,000 annualized pace.

“High mortgage rates above 7% combined with low resale inventory and higher home prices are slowing housing production, as many first-time home buyers and younger households are struggling to purchase an affordable home,” said Alicia Huey, chairman of the National Association of Home Builders (NAHB) and a custom home builder and developer from Birmingham, Ala. “With high mortgage rates sending buyers to the sidelines, and a nationwide shortage of 1.5 million units, we need to increase the housing supply to get this market back into balance to meet the pent-up demand for when market conditions improve.”

However, Danushka Nanayakkara-Skillington, NAHB’s assistant vice president for forecasting and analysis, said they don't expect things to improve anytime soon.

“Unfortunately, we expect mortgage rates to remain at higher levels as the Federal Reserve is likely to increase rates one more time later this quarter," Nanayakkara-Skillington said.

The report found that single-family units under construction have decreased 16.3% from last year, standing at 676,000. Conversely, apartment constructions have surged to 1.01 million. Region-wise data reveals declines in both single-family and multifamily starts: a 22.8% drop in the Northeast, 13.6% in the Midwest, 8.8% in the South, and a 16.5% fall in the West.

Permit data, however, paints a somewhat brighter picture. They witnessed a 6.9% increase in August, reaching an annualized rate of 1.54 million units. Single-family permits rose by 2% to a 949,000 unit rate, marking a 7.2% year-over-year increase. Meanwhile, multifamily permits jumped by a significant 15.8% to an annualized pace of 594,000. On a regional front, permits dropped 22.9% in the Northeast, 17.2% in the Midwest, 13.3% in the South, and 18.2% in the West.

First American Economist Ksenia Potapov says potential buyers are turning to new home construction due to low resale inventory. "A slowdown in construction would be concerning, especially as the housing market remains underbuilt relative to demand," Potapov said.

She added, “Despite the slowdown in single-family starts and completions, there is still an elevated number of single-family homes under construction and a near-record number of multi-family units are under construction – promising signs of more housing supply in the pipeline. When these units are completed, it should put downward pressure on prices and provide some affordability relief.”