Buyers Turn To New Construction As Inventory Lags

May's mortgage applications for new home purchases increased 13.8% from last year.

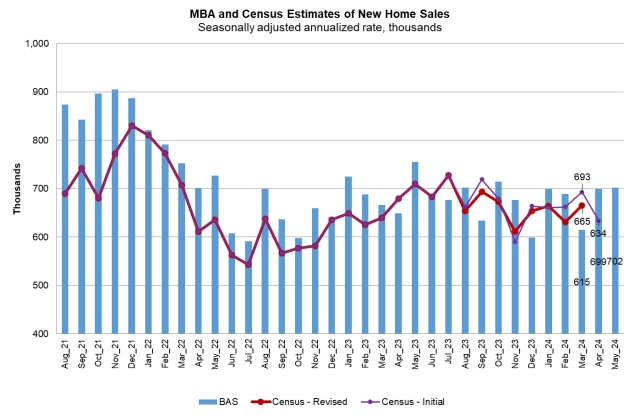

Newly-built homes are selling at their strongest pace since Oct. 2023 and purchase applications are also on the up-and-up.

Mortgage applications for new home purchases in May increased 13.8% year over year and 1% from April on an unadjusted basis, according to the Mortgage Bankers Association’s (MBA) Builder Application Survey.

“MBA’s estimate of new homes shows a slight increase to 702,000 units in May, the strongest pace since October 2023,” MBA’s Vice President and Deputy Chief Economist Joel Kan commented. “There continues to be strength in the new home purchase market, as purchase applications increased in May compared to both the prior month and from a year ago. With existing-home inventory still lagging in many markets, many homebuyers have turned their interest toward newly built homes, particularly FHA borrowers.”

May’s FHA share of purchase applications was 26.5%, the second-highest share in the survey’s history, since peaking at 27.1% in Nov. 2023. The average loan size was $400,150, a decline from April’s average of more than $405,000.

On an unadjusted basis, MBA estimates that there were 63,000 new home sales in May 2024, an increase of 1.6% from 62,000 transactions in April.

Conventional loans composed 63.4% of loan applications; FHA loans composed 26.5%; RHS/USDA loans composed 0.3, and VA loans composed 9.8%.